Reference no:

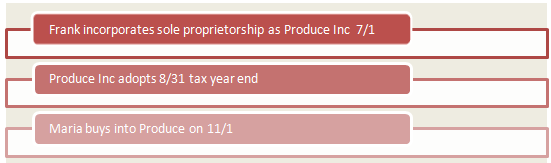

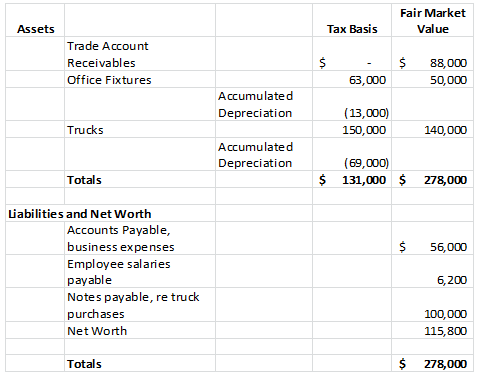

Your client, Frank Bearden, owns an Arkansas business that brokers high-quality fresh fruits and vegetables to restaurants and specialty grocery stores. Frank's business does not carry any inventories. Frank's attorney has urged Frank to incorporate the business, primarily because of the limited shareholder liability associated with corporate status, and to facilitate a business succession plan in the future. Frank has operated the business as a cash basis sole proprietorship since 1985, and anticipates incorporating the business on July 1 of the current year. Projected balance sheet and income statements for the business as of June 30 are attached.

PART I

Frank plans to transfer all existing business assets and liabilities to a newly incorporated entity, Bearden's Specialty Produce, Inc. (Produce), in exchange for 1,000 shares of voting common stock. He will serve as President of the corporation, and he will be a member of the Board of Directors. Frank wants to adopt an August 31 fiscal year end for Produce because August tends to be the slowest month of the year for the business, and accounts receivable typically are at their lowest level. Frank also intends for Produce to continue to use the cash method of accounting.

Frank's close friend, Maria Garcia, has for some time been interested in buying into Frank's business. Maria will not have access to the necessary cash until October, so Frank has agreed to proceed with the incorporation, and then sell 400 of his new Produce shares for $75,000 to Maria sometime before the end of the current year.

REQUIRED: In discussing the proposed incorporation with you, Frank specifically asks about the amount of any gain he must recognize, both upon the incorporation itself, and upon the subsequent stock sale. Naturally, he is eager to minimize any recognized gain to the extent possible. Frank also wants to structure the transaction to achieve the best tax outcome for Garcia, as Frank is eager to have her as a business associate.

In addition to addressing these specific concerns, identify any potential tax problems or planning ideas suggested by the facts. Be specific in describing the issues involved, give full citations to controlling law, and provide suggestions and/or alternatives to minimize risks and maximize opportunities.

PART II

Elsewhere in his portfolio, Frank is a limited partner in Build Arkansas, a real estate development partnership. Build has generated losses during the past two years. Frank holds a $27,000 suspended passive loss. Frank earns no passive activity income, and he anticipates that the partnership will continue to generate losses for several years into the future.

REQUIRED: He has asked you to explain the -469 tax consequences of transferring his interest in Build to Produce as part of the incorporation. The value of the partnership interest exceeds Frank's basis in the interest by approximately $50,000.

PART III

Assume for this section that the transfers involving Maria and Build Arkansas did not take place.

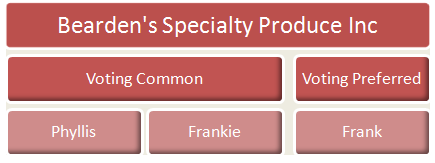

One of Frank's reasons for incorporating Produce is to put the business into a form to facilitate certain of his family tax planning goals. Frank is 60 years old, and he has an adult son (Frankie, now age 31) and daughter (Phyllis, now age 34) who are interested in participating in the family business.

Frank anticipates that Produce will hire Phyllis and Frankie as employees, so that they may familiarize themselves with all aspects of the corporate operation. If after several years his children's interest in the business continues, and if they demonstrate to their father that they are capable of managing Produce, Frank will consider recapitalizing the corporation. The originally issued voting common stock would be exchanged for new issues of (1) voting preferred stock (with a fixed liquidation value and a 9 percent noncumulative annual dividend) and (2) voting common stock.

At the date of recapitalization, the preferred stock would represent most of the value of Frank's equity in Produce, while the value of the common stock would be minimal. Frank would then make a gift to Phyllis and Frankie of the common stock, while retaining the preferred stock. Subsequent to the recapitalization, any increase in the value of the corporate business likely will cause a corresponding increase only in the value of the common stock; the value of Frank's preferred stock will be "frozen."

Frank anticipates structuring the recapitalization so that the value of the common stock transferred to each child will be no more thanthe current annual gift tax exclusion. Consequently, he assumes he can transfer the future appreciation in the value of the corporate business without making a taxable gift.

REQUIRED: Comment on this part of Frank's business plan. Would any realized gain relative to the recapitalization be deferred for him? Are his assumptions correct about the valuation of the shares and the use of the annual gift tax exclusion?

Bearden's Specialty Produce

Projected Balance Sheet

June 30

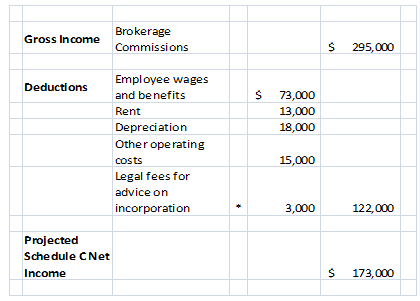

Bearden's Specialty Produce

Projected Income Statement

For January 1 - June 30

* Legal costs for drafting the corporate charter and by-laws and for filing the necessary legal papers with Arkansas will total $7,000. Frank estimates that Produce will incur accounting fees attributable to the incorporation of $5,200.

Keep these in mind as you work this case.

- Start by determining the Amount Realized for each of the three payments. How is the debt relief treated for this purpose?

- Now compute the Gain Realized with each payment received. What is Carole's interest basis at the end of Year One?

- For the total of the cash payments to Carole, how much is designated a -736(b) payment? A -736(a) payment?

- Remember that Neeley is classified as a service partnership - its asset holdings are not so capital-intensive as to find otherwise. Its greatest financial asset is its guaranteed cash flow from the service contracts.

- Now find the amounts of capital and ordinary income that Carole recognizes with each payment.