Reference no: EM13180161

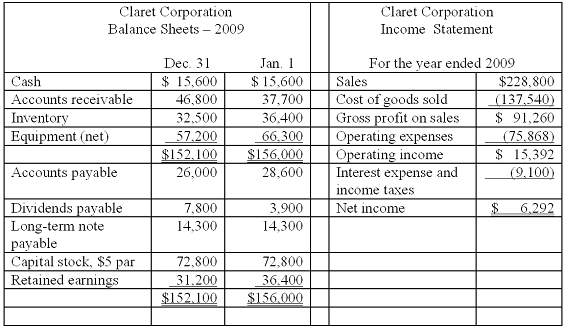

1. Below are comparative balance sheets and an income statement for Claret Corporation.

All sales were made on account. Cash dividends declared during the year totaled $11,492.

Answer the following ((a) through (e))based on the above information

a. Claret Corporation's accounts receivable turnover for 2009 is:

A. 4.6 times.

B. 2.9 times.

C. 5.4 times.

D. 68 days.

b. Claret Corporation's inventory turnover for 2009 is:

A. 6.6 times.

B. 3.9 times.

C. 4.2 times.

D. 94 days.

c. Claret Corporation's gross profit rate for 2009 is:

A. 60.1%.

B. 39.9%.

C. 33%.

D. 68%

d. Claret Corporation's return on assets for 2009 rounded to the nearest tenth of a percent is:

A. 9.9%.

B. 4.1%.

C. 5.9%.

D. 16.9%.

e. Claret Corporation's return on common stockholders' equity for 2009, rounded to the nearest tenth of a percent, is:

A. 5.9%.

B. 6.05%.

C. 14.4%.

D. 9.4%.

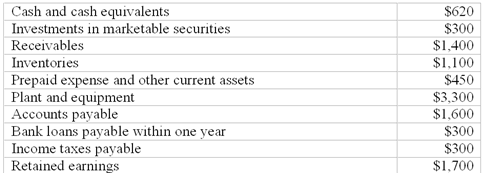

2. Measures of solvency and credit risk

Shown below are selected items appearing in a recent balance sheet of Grant Products. (Dollar amounts are in thousands.)

(a) Compute the following:

(1) Total quick assets $____________

(2) Total current assets $____________

(3) Total current liabilities $____________

(4) Quick ratio ______ to 1

(5) Current ratio ______ to 1

(b) Research indicates an industry average quick ratio is 1.3 to 1, and a current ratio of 2.3 to 1. Based upon this information, does Grant Products appear more or less solvent than the average company in its industry? Explain briefly.

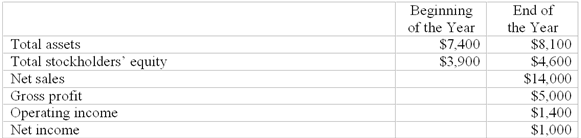

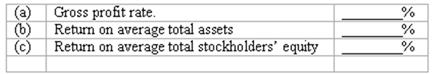

3. Computation of profitability ratios

Shown below are selected data from a recent annual report of Tall Oaks Co. (Dollar amounts are in thousands.)

Compute for the year the company's:

4. (a) Define (a) profitability, (b) liquidity and (c) solvency

(b) List (a) 3 profitability ratios, (b) 3 liquidity ratios, (c) 3 solvency ratios

(a) Describe the calculation of each ratio listed above for profitability, liquidity and solvency

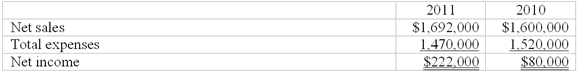

5. Percentage changes

Selected information from the financial statements of Perfectly Baked Cake Co. appears below:

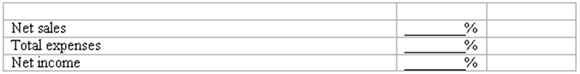

(a) Compute the percentage change in each of the above items from 2010 to 2011. Use a + or - to indicate increase or decrease.

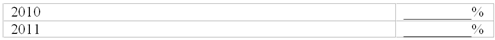

(b) Compute net income as a percentage of net sales in each year.

|

What is the probability that the other one is also a boy

: Mr X has two children. One of them is a boy born on tuesday.What is the probability that the other one is also a boy?

|

|

What restriction on federal employees are contained

: What restriction on federal employees are contained in the the Antideficiency Act and the Government Performance Results Act addresses performance plans and reports

|

|

How many rectangles can sam make

: Sam purchased 1000m2 of material and needed to cut it into rectangles of area 200cm2 for a patchwork quilt. This can be done with no waste. How many rectangles can Sam make.

|

|

What is the test value for their claim

: In 35 of their stores they sold on the average 430 suits per year with a population standard deviation of 40. What is the test value for their claim?

|

|

Compute net income as a percentage of net sales

: Compute net income as a percentage of net sales in each year and compute the percentage change in each of the above items from 2010 to 2011. Use a + or - to indicate increase or decrease.

|

|

Find the private marginal benefit

: Smartphones require superconductors, and the production of superconductors is heavily polluting due to the use of many chemicals in the process. The damages to society are given by Ds = 10x2.a) Find the private marginal benefit, the private margina..

|

|

What is the marginal abatement cost

: Plant B was constructed 2 months ago; it has a pollution abatement cost of 10c2. Assume that neither plant is initially engaging in pollution abatement. The per unit benefit to a unit of pollution abatement is constant at $1500. Unless told otherw..

|

|

Compute the coefficient of determination

: )TLC Lawn Care, Inc. provides fertilizer and weed control services to residential customers. Its seasonal services package, regularly priced at $250, includes several chemical spray treatments. As part of an effort to expand its customer base, TLC..

|

|

Complete and balance the equation for a reaction

: MnO2 is oxidized to MnO4 and Cu2 is reduced to Cu . Complete and balance the equation for this reaction in acidic solution. Phases are optional.

|