Reference no: EM13373505

Complete Model of Exchange Rates

1. Derive a long-run model of exchange rate determination, if exchange rates are determined by Absolute PPP, and goods prices exibly adjust to bring about equilibrium in domestic money and �nancial markets.

Assume investors use the long-run model you derived in part (1) to form their forecasts of future exchange rates, Ee, but that in the short-run goods prices are �xed.

2. Refer back to the data on US and Mexican interest and exchange rates given in section 1, and assume foreign exchange and domestic money markets are initially in equilibrium. The Federal Reserve unexpectedly announces a new round of Quantitative Easing, a temporary expansion of the US money supply: for the next year the US money supply will be 50% higher, before returning to its initial level after 12 months. Other than this, no changes are expected in either the US or Mexican economies.

Graph (but do not calculate) the response of US interest rates and the $-peso exchange rate over the next year, assuming that Mexican mone tary policy does not change in response to the Fed's announcement and that investors believe the Fed's commitment to reverse this increase in the money supply in one year.

3. A year after the implementation of the Quantitative Easing program, the Fed announces that in fact it will not reverse its expansion of the money supply, which will be permanently 50% higher. Repeat your graph from part (2), extending it forward in time to show the expected response of US interest rates and the exchange rate over the year following the second announcement, assuming again that there is no change in Mexican policy, that the Fed is expected to abide by this new policy, and that US goods prices are able to gradually adjust.

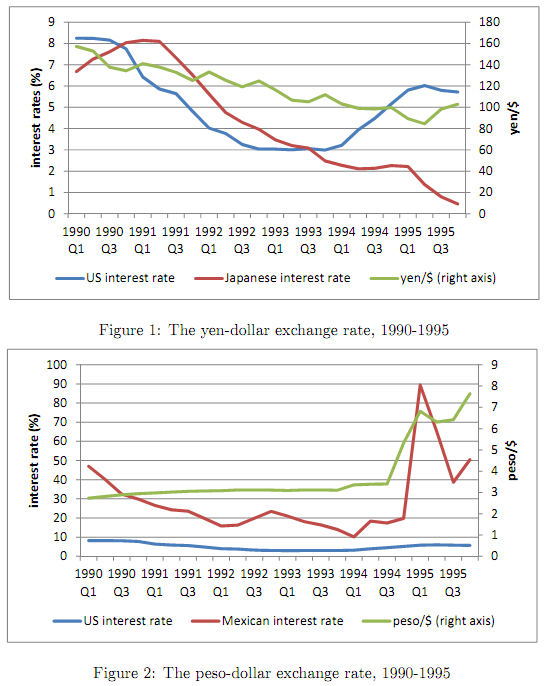

4. Figures 1 and 2 illustrate the prevailing interest rates in the US, Mexico and Japan from 1990-1995, along with the peso-dollar and yen-dollar exchange rates (measured on the right-hand axis of each graph). For which exchange rate does the theory of Uncovered Interest Parity appear to hold most consistently over this period? For that country, does the theory hold equally well throughout, or is there an episode which seems inconsistent with the theory?