Reference no: EM131318390

EAT AT MY RESTAURANT - PROFITABILITY VIEW

With this case, we review the profitability of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows:

1. Yum Brands, Inc.

December 25, 2010; December 26, 2009 (52 weeks) "YUM consists of six operating segments: KFC - U.S., Pizza Hut - U.S., Taco Bell - U.S., Long John Silver's ("LJS") - U.S., and A&W All American Food Restaurants ("A&W") - U.S., YUM Restaurants International ("YRI" or "International Division") and YUM Restaurants China ("China Division")." 10-K

2. Panera Bread Company

December 28, 2010; December 29, 2009 (52 weeks) "Panera Bread Company and it subsidiaries, referred to as "Panera Bread," "Panera," the "Company," "we," "us," and "our," is a national bakery-café concept with 1,453 company-owned and franchise-operated bakery-café locations in 40 states, the District of Columbia, and Ontario, Canada." 10-K

3. Starbucks Corporation

October 3, 2010; September 27, 2009 (Fiscal year 2010 included 53 weeks, while fiscal year ended 2009 included 52 weeks) "Starbucks is the premier roaster and retailer of specialty coffee in the world, operating in more than 50 countries." 10-K

Required

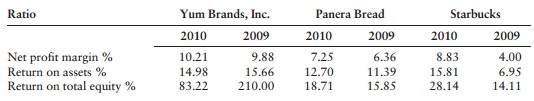

a. Comment on the net profit margin for these companies.

b. Comment on the return on assets for these companies.

c. Comment on the return on total equity for these companies.

d. Comment on the relative profitability of these companies.

|

Create research question on not-for-profit and governmental

: Create a Research Question on Not-for-profit and Governmental. you should have a much better understanding of the role that governmental accounting has in the One of the beginning steps in completing the dissertation is developing your research que..

|

|

Aggregate dollar terms do marketing signaling

: a. What do market signaling studies suggest will happen to FARDO stock price on the announcement date? Why? b. How large a gain or loss in aggregate dollar terms do marketing signaling studies suggest existing FARO shareholders will experience on t..

|

|

How the major southern countries has adapted towards the wto

: A undergraduate politics of the world economy coursework, mainly analysing and evaluating how the major southern countries has adapted towards the WTO (mainly focus on the growing role of Brazil, China and India)

|

|

Portfolio of japanese securities worth

: Consider a U.S. investor who owns a portfolio of Japanese securities worth 160 million japanese yen. In order to hedge to currency risk, he considers buying currency puts on yen instead of selling futures contracts. In Philadelphia, a yen put wit..

|

|

Comment on the net profit margin for the companies

: Comment on the net profit margin for these companies.- Comment on the return on assets for these companies.

|

|

What did you think of margret sanger article

: What are the benefits for women of a knowledge of contraception both now and in earlier years? What did you think of Margret Sanger's article and her activism

|

|

Bellamee after-tax cost of debt financing

: The bonds are currently priced at their face value. If the bonds have a coupon rate of 25 percent, then what is Bellamee's after-tax cost of debt financing (in percent) if the tax rate is 40 percent?

|

|

What did you learn about gmos in reading

: What did you learn about GMOs in reading through these posts? Anything surprising?Given what you've learned, would you personally purchase genetically modified foods for you and your family to consume? Explain why or why not.Do you think all gen..

|

|

What is the problem with specifying too stringent criteria

: SSS In seeking to establish comparable companies in relative valuation analysis, what is the problem with specifying too stringent criteria for companies to be included in the comparable group?

|