Reference no: EM131408121

Financial Management Assignment

OBJECTIVE - Demonstrate the ability to perform financial calculations and analysis related to the concepts covered in this course.

PURPOSE - The purpose of this project is to give you practical experience with financial computations and decision making in the Financial Management field. In this project, you'll calculate and analyze company balance sheets in the role of a financial manager. Your assignment is to analyze the financial position of the companies mentioned and make recommendations as to the most productive use of their assets and the ideal financial structures for their balance sheets. Show all calculations or calculator inputs for credit. Do all work using equations and a calculator? Do not submit or use an Excel spreadsheet to calculate.

Part 1: Financial Statements and Ratios

1A. You're the chief financial officer (CFO) of Worldwide Widget Manufacturing, Inc. The company manufactures and sells widgets at factories in the United States and internationally. Listed below are partial financial statements for Worldwide Widget Manufacturing, Inc. Fill in the missing information in each of the following financial statements. Answer spaces are given below.

a. Accounts receivable for 2015 _______

b. Accounts payable for 2014 _______

c. Gross plant and equipment for 2015 _______

d. Long-term debt for 2014 _______

e. Common stock and paid-in surplus (250 million shares) for 2014 _______

f. Total FA for 2015 _______

|

Worldwide Widget Manufacturing, Inc. Income Statement for Years Ending December 31, 2015 and 2014 (in millions of dollars)

|

|

2015

|

2014

|

|

Net sales

|

g. ?

|

$2,018

|

|

Less: Cost of goods sold

|

987

|

h. ?

|

|

Gross profits

|

$1,396

|

$1,189

|

|

Less: Other operating expenses

|

189

|

167

|

|

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

|

$1,207

|

$1,022

|

|

Less: Depreciation

|

121

|

114

|

|

Earnings before interest and taxes (EBIT)

|

$1,086

|

$ 908

|

|

Less: Interest

|

i. ?

|

128

|

|

Earnings before taxes (EBT)

|

$949

|

$ 780

|

|

Less: Taxes

|

j. ?

|

23

|

|

Net income

|

$664

|

$ 546

|

|

Less: Preferred stock dividends

|

98

|

98

|

|

Net income available to common stock holders

|

$566

|

$ 448

|

|

Less: Common stock dividends

|

219

|

199

|

|

Addition to retained earnings

|

$347

|

$ 249

|

|

Per (common) share data:

|

|

|

|

Earnings per share (EPS)

|

k.?

|

$1.79

|

|

Dividends per share (DPS)

|

$ 0.88

|

I. ?

|

|

Book value per share (BVPS)

|

m. ?

|

$ 5.77

|

|

Market value per share (MVPS)

|

$23.97

|

$22.47

|

g. Net sales for 2015 _______

h. Less: Cost of goods sold for 2014 _______

i. Less: Interest for 2015 _______

j. Less: Taxes for 2015 _______

k. Earnings per share (EPS) for 2015 _______

I. Dividends per share (DPS) for 2014 _______

m. Book value per share (BVPS) for 2015 _______

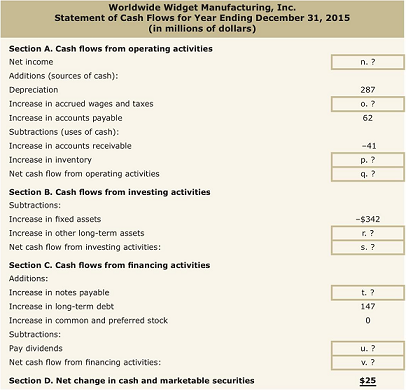

n. Net income _______

o. Increase in accrued wages and taxes _______

p. Increase in inventory _______

q. Net cash flow from operating activities _______

r. Increase in other long-term assets _______

s. Net cash flow from investing activities _______

t. Increase in notes payable _______

u. Pay dividends _______

v. Net cash flow from financing activities _______

|

Worldwide Widget Manufacturing, Inc. Statement of Retained Earnings as of December 31, 2015 (in millions of dollars)

|

|

Balance of retained earnings, December 31, 2014

|

|

$1,142

|

|

Plus: Net income for 2015

|

|

w. ?

|

|

Less: Cash dividends paid

|

0

|

0

|

|

Preferred stock

|

x. ?

|

|

|

Common stock

|

219

|

|

|

Total cash dividends paid

|

|

317

|

|

Balance of retained earnings, December 31, 2015

|

|

$1,489

|

w. Plus: Net income for 2015 _______

x. Preferred stock _______

1B. For each of the items listed below, indicate on which of the major statements they would be found (1, 2, 3 or 4) and the amount shown on the statements above:

1. Balance sheet

2. Income statement

3. Statement of cash flows

4. Statement of retained earnings

1. Earnings before taxes for 2015 _______ ; $ _______

2. Gross plant and equipment for 2015 _______ ; $ _______

3. Increase in fixed assets, December 31, 2015 _______ ; $ _______

4. Net sales for 2015 _______ ; $ _______

5. Balance of retained earnings, December 31, 2015 _______ ; $ _______

6. Common stock and paid-in surplus for 2014 _______ ; $ _______

7. Net cash flow from investing activities, December 31, 2015 _______ ; $ _______

8. Increase in inventory, December 31, 2015 _______ ; $ _______

9. Accrued wages and taxes for 2014 _______ ; $ _______

10. Book value per share (BVPS) for 2015 _______ ; $ _______

2. You'll need to compare your company's ratios with the industry's standards.

|

Worldwide Widget Manufacturing, Inc.

|

|

Company

|

Industry

|

Comparison

|

|

Current ratio

|

|

2.2 times

|

|

|

Quick ratio

|

|

1.1 times

|

|

|

Cash ratio

|

|

0.35 times

|

|

|

Inventory turnover

|

|

2 times or 1 time

|

|

|

Days' sales In Inventory

|

|

135 days or 335 days

|

|

|

Average payment period

|

|

110 days

|

|

|

Sales to working capital

|

|

3 times

|

|

|

Total asset turnover

|

|

0.6 times

|

|

|

Debt-to-equity

|

|

1.1 times

|

|

|

Profit margin

|

|

16.5%

|

|

|

Gross profit margin

|

|

48.13%

|

|

|

ROA

|

|

8.78%

|

|

|

ROE

|

|

19.45%

|

|

|

Dividend payout

|

|

32%

|

|

A. Use the information found in Worldwide Widget Manufacturing's financial statements to calculate all of the listed financial ratios in the above table for your company. Then, for each ratio, provide a comparison of the company's result with the industry standards, indicating if your company's results are lower than, higher than, slower than, or faster than the industry standards.

B. Calculate your company's internal and sustainable growth rates.

Part 2: The Value of Money, Bonds and Stocks

3. The company you work for is looking to expand. As the CFO, you're tasked with comparing the cost of buying manufacturing equipment now, at a $250,000 discount from its original price of $1,650,000 and storing it for a year, or waiting one year to buy it. The cost of buying the equipment includes the supplier's bill and the cost to store the item, for a total of $1,464,000. What interest rate is implied by a $1,464,000 cash flow today, versus $1,650.000 in a year? When it comes to obtaining the cash for the purchase of the equipment, what is your recommendation on whether the company should purchase the equipment now or wait a year?

4. Worldwide Widget Manufacturing, Inc., decided to go ahead with its plan to. It issued $30 million in debt due in 30 years to finance the expansion at an 8 percent coupon rate. The company makes interest-only, semiannual pay¬ments of $1,200,000 on this debt. Debt issued today would cost only 7 percent interest. You have been asked to determine whether the company should issue new debt (for 25 years) to pay off the old debt. If the company does so, it will have to pay $1.7 million as a 'call premium" to the existing debt holders, and also $1.4 million to its investment bankers to float the issue. If the new debt was issued, what would be the semiannual interest payment savings or cost? What is the cost to refinance the debt? What would be the present value of the semiannual savings in interest payments over the life of the debt? Should you advise the company to replace the old debt with new debt? Why?

5. Worldwide Widget Manufacturing, inc., is doing so well it decides it's time to become an international company. As the chief financial officer (CFO), you're tasked with raising $340 million of new capital to open offices around the world. In researching the matter, you learn that if bonds due in 20 years are used for raising the capital, they'll be rated AA and will need to offer a yield of 6.5 percent. Flow many bonds will it be necessary to issue to raise the needed capital? What will Worldwide Widget Manufacturing have to make as a semiannual interest rate payment?

Part 3: Stock Returns

6. Worldwide Widget Manufacturing, Inc., has decided to invest in some stock. As CFO, you've been asked to review the portfolio. First, you'll need to measure the past performance of the investments. Then, measure the past return's risk of the investment. Lastly, calculate the average return and risk of the portfolio.

The following table shows the annual returns for Company A and Company B, which are part of the investment portfolio you're interested in.

|

|

Company A

|

Company B

|

|

Year 1

|

5.23%

|

13.51%

|

|

Year 2

|

8.91

|

-9.35

|

|

Year 3

|

7.32

|

2.44

|

|

Year 4

|

-15.81

|

3.12

|

|

Year 5

|

-8.32

|

14.81

|

|

Year 6

|

25.98

|

18.36

|

What is the return and standard deviation of returns for these two companies?

What is the return and standard deviation of returns for the portfolio? What's the average return of a portfolio consisting of 60 percent of Company A and 40 percent of Company B?

7. After coming to a final decision, Worldwide Widget Manufacturing, Inc., has a stock portfolio that consists of the following positions, with betas shown for each stock. You've been asked to calculate and evaluate the risk of the portfolio beta and the required return for your portfolio. The market return is expected to be 11 percent, and the risk-free rate is 6 percent.

|

|

Shares

|

Price

|

Position

|

Weight

|

Beta

|

W x Beta

|

|

Merck & Co., Inc.

|

150

|

61

|

?

|

?

|

1.62

|

?

|

|

Domino's Pizza

|

200

|

152

|

?

|

?

|

1.8

|

?

|

|

Macy's, Inc.

|

300

|

36

|

?

|

?

|

1.42

|

?

|

|

Tesla

|

150

|

202

|

?

|

?

|

2.51

|

?

|

|

Totals

|

|

|

?

|

1

|

?

|

?

|

What's the beta of the portfolio? Is this a high- or low-risk portfolio? What's the required return of the portfolio? Fill in the position, weight, and portfolio beta columns for each company in the table above. Show calculation.

A. Merck & Co., Inc.

1. Position:

2. Weight:

3. W x Beta:

B. Domino's Pizza

1. Position:

2. Weight:

3. W x Beta:

C. Macy's, Inc.

1. Position:

2. Weight:

3. W x Beta:

D. Tesla

1. Position:

2. Weight:

3. W x Beta:

Total Position:

Total W x Beta:

Expected Return:

The risk of the portfolio:

Part 4: Capital Budgeting

8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufactur¬ing facility in a new location. The company has a capital structure that consists of debt and common and preferred stock. The company is considering changing this capital structure in conjunction with the launch of the new manufacturing facility. The manufacturing facility project is slated to be funded with 30 per¬cent debt, 30 percent preferred stock, and 40 percent common stock. Worldwide Widget Manufacturing has 15 million shares of common stock outstanding. The shares sell at $24.63 per share. The company expects to pay an annual dividend of $ 1. 0 one year from now, after which future dividends are expected to grow at a constant 7 percent rate. Worldwide Widget Manufacturing's debt consists of 30-year, 9-percent annual coupon bonds with a face value of $180 million and a market value of $185 million. The company's capital mix also includes 200,000 shares of 12-percent preferred stock trading at par. If Worldwide Widget Manufacturing has a marginal tax rate of 32 percent, what weighted average cost of capital (WA CO) should it use as it evaluates this project?

9. Worldwide Widget Manufacturing, Inc., wants to add two new production lines of widgets. You're asked to analyze whether to go forward with two mutually exclusive projects. The cash flows of both projects are displayed below. Your company uses a cost of capital of 9 percent to evaluate projects such as the two you're now analyzing. Show all calculations.

|

Year:

|

0

|

1

|

2

|

3

|

4

|

5

|

|

Project A Cash Flow

|

-$1,000

|

$150

|

$300

|

$500

|

$300

|

$250

|

|

Project B Cash Flow

|

-$1,400

|

$300

|

$470

|

$200

|

$600

|

$350

|

Calculate the payback of Project A:

Calculate the payback of Project B:

Calculate the IRR of Project A:

Calculate the IRR of Project B:

Using the NPV method and assuming a cost of capital of 6 percent, calculate the NPV of these two projects. Which of these mutually exclusive projects should the company accept?

Part 5: Forecasting and Capital Structure

10. You've been asked to use the following historical sales information to forecast next year's sales for Worldwide Widget Manufacturing, Inc. The actual sales for 2016 were $1,950,000.

|

Year:

|

2011

|

2012

|

2013

|

2014

|

2015

|

|

Sales

|

$1,750,000

|

$2,000,000

|

$1,350,000

|

$2,250,000

|

$1,800,000

|

What would be next year's forecast using the naïve approach and the average sales approach? What would be the MAPE using the naïve approach and the average sales approach?

11. After adding a new line of widgets, Worldwide Widget Manufacturing, Inc., expects all assets and current liabilities to shrink with sales. The company has sales for the year just ended of $20 million. The company also has a profit margin of 20 percent, a return ratio of 25 percent, and expected sales of $18 million next year. Worldwide Widget Manufacturing, Inc., shows the following on its balance sheet.

|

Assets

|

|

Liabilities and Equity

|

|

|

Current assets

|

$2,500,000

|

Current Liabilities

|

$1,250,000

|

|

Fixed assets

|

$3,500,000

|

Long-term debt

|

$1,500,000

|

|

|

|

Equity

|

$3,250,000

|

|

Total assets

|

$6,000,000

|

Total Liabilities and equity

|

$6,000,000

|

What amount of additional funds (AFN) will Worldwide Widget Manufacturing, Inc., need from external sources to fund the expected growth? What does the AFN show?