Reference no: EM131212485

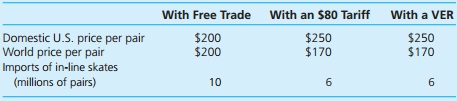

Suppose that the U.S. government is under heavy pressure from the Rollerblade and K2 companies to put the brakes on imports of Bauer in-line skates from Canada. The protectionists demand that the price of a $200 pair of in-line skates must be raised to 250 if their incomes are to be safe. The U.S. government has three choices:

(1) free trade with no protection,

(2) a special tariff on in-line skates backed by vague claims that Canada is using unfair trade practices (citing Section 301 of the Trade Act of 1974), and

(3) forcing Bauer to agree to a voluntary export restraint. The three choices would lead to these prices and annual quantities:

Note that the $80 tariff reduces imports by 4 million pairs a year, the same reduction that the VER arrangement would enforce.

a. Calculate the U.S. net national gains or losses from the tariff, and the U.S. gains or losses from the VER, relative to free trade. Which of the three choices looks best for the United States as a whole? Which looks worst?

b. Calculate the net national gains or losses for Canada, the exporting country, from the tariff and the VER. Which of the three U.S. choices harms Canada most? Which harms Canada least?

c. Which of the three choices is best for the world as a whole?

|

A quota and an equivalent tariff that permit

: If the tariff rate is unchanged, and if the quota quantity is unchanged, are the two still equivalent? Show this using a graph.

|

|

International business and the world economy

: It has been suggested that the existence of the World Wide Web has impacted international business and the world economy. Explain your answer with a well-constructed and cogent response.

|

|

Proportion to the level of production

: Explain the concept under the variable cost which stipulates that the variable costs change in direct proportion to the level of production.

|

|

Relevant compliance issues

: 1) Do outside research on what are the relevant compliance issues associated with the Disability Laws, especially the regulations, for employers in general. This is from the perspective as it relates to Title IIV in relation to employee/employeer ..

|

|

Calculate us net national gains or losses from the tariff

: Calculate the U.S. net national gains or losses from the tariff, and the U.S. gains or losses from the VER, relative to free trade.

|

|

Draw a diagram of the marginal cost and marginal revenue

: Draw a diagram of the marginal cost and marginal revenue curves with the number of mills on the horizontal axis. Assume that government regulation restricts lake access to the profit-maximizing number of firms. Show the resource rent earned by the ..

|

|

History of healthcare compliance

: How has the history of healthcare compliance changed since its inception? Hint: Look at the ways in which penalties have increased in various ways. Describe your responsibilities as a healthcare manager as it applies to fraud and abuse.

|

|

How does this firm make money

: Prepare a two page (double-spaced) essay presenting the investment consulting firm and answer the following question: Dimensional Fund Advisors "How does this firm make money by taking advantage of the Efficient Market Hypothesis?"

|

|

Meyers-briggs type indicator personality inventory

: What is the Meyers-Briggs Type Indicator personality inventory, and why is it a useful tool for healthcare executives? Describe why human resources management is comprised of strategic and administrative actions. If you are responsible for resea..

|