Reference no: EM132501256

Question 1. What is the difference between the balance of payments (BOP) and the international investment position (or the balance of international indebtedness)?

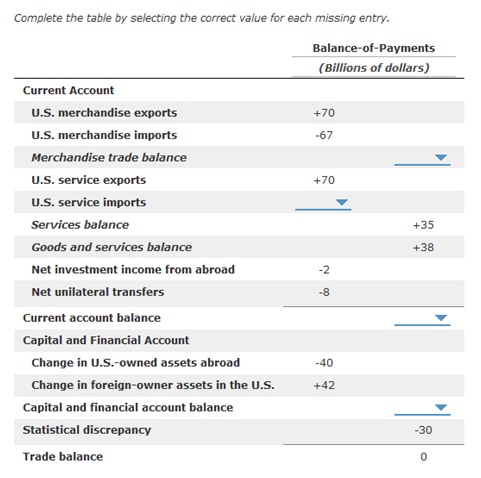

Question 2.

Question 3. Assume that a Japanese subsidiary in the U.S. buys office equipment from New York for $10,000. Would this transaction affect the U.S. and the Japanese BOP? If yes! Record it in the U.S. BOP.

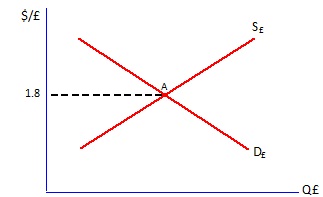

Question 4. Use the following demand and supply curves for British pounds. Starting from the equilibrium exchange rate $1.8/£, assume the following two changes occur simultaneously: (1) the U.K interest rate increases relative to the U.S. interest rate and (2) the U.S. real income increases while that of the U.K. remains unchanged. How would these changes affect the dollar price of pound (i.e., $/£)? Will the British pound appreciate or depreciate?

Note: Explain the direction of the shifts demand and supply and what the final outcome is. No need to graph the new demand/supply curve.

Answer:

The effect of higher interest rate in the U.K:

The effect of higher economic growth in the U.S:

Combined effect:

Question 5. List four differences between the futures and forward markets.

|

Comparison of the Forward and the Futures Markets

|

|

Feature

|

Forward Market

|

Futures Market

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

4.

|

|

|

Question 6. Traveling to Italy is much cheaper now than it was ten years ago, says a friend. "Ten years ago, a dollar bought 1,000 lire; this year, a dollar buys 1,500 lire." Is your friend right or wrong? Given that total inflation over this period was 25% in the United States and 100% in Italy, has it become more or less expensive to travel to Italy? Note that the exchange rate is lire/$.

Question 7. Suppose that at the end of 2014, the value of U.S.-owned assets abroad is $13,755 billion, and the value of foreign-owned assets in the United States (which are U.S. liabilities) is $16,295 billion. Calculate the U.S. net international investment position?

Question 8. Consider a bundle of consumer goods costs $90 in the United States. The same bundle of goods costs CNY 105 in China. Holding constant the cost of the bundle in each country, compute the real exchange rates that would result from the two nominal exchange rates. Put your numbers in the final column in the table below. Make sure to show your calculation in the answer section.

|

Cost of Bundle in U.S.

(Dollars)

|

Cost of Bundle in China

(Yuan)

|

Nominal Exchange Rate

(Yuan per dollar))

|

Real Exchange Rate

(Bundles of Chinese goods per bundle of U.S. goods)

|

|

90

|

105

|

7.00

|

|

|

90

|

105

|

10.50

|

|

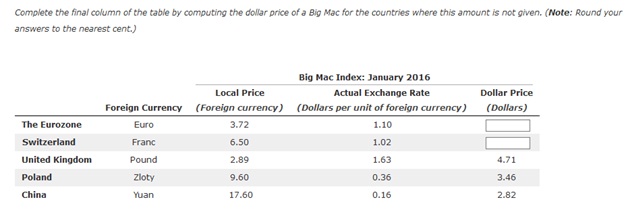

Question 9. a. Complete the final column in the table below by computing the dollar price of Big Mac for the countries where the amount is nor shown. Make sure to show your calculation in the answer section.

b. What is the exchange rate (i.e., U.S. dollar per euro) that would have equalized the dollar price of a Big Mac in the United States and the Eurozone, given that the price of a Bic Mac in the U.S. is $4.93? For this change to happen, should euro the euro appreciate or depreciate against the dollar. Make sure to show your calculation in the answer section.

Question 10. How does the J-curve effect relate to the time path of currency depreciation?

Question 11. Suppose a nation is running a trade deficit while the economy is at full employment. What policy action should the government take to improve the trade balance, according to the absorption approach?

Question 12. What happens to the exchange rate, according to the asset-market approach, when the U.K. inflation rates are expected to increase, ceteris paribus? Answer the question in terms of both short-run and long-run changes in the exchange rate ($/£). Make sure to explain the reason for the change in exchange rate.

Question 13. Suppose the velocity of money is V = 5 and nominal GDP of the nation is $500 billion. Suppose further that the domestic credit created by the nation's monetary authorities is $20 billion dollars and the nation's foreign reserves are $5 billion. Suppose also that the required reserve ratio is 20%. Find the size of the deficit or surplus in the BOP. How much capital inflow or outflow is required in order to eliminate the disequilibrium in the BOP? Assume a fixed exchange rate system.

Question 14. What led to the collapse of the Bretton Woods system?

Question 15. How is a currency board different from a central bank?

Currency Board Central Bank

1.

2.

3.

4.

Question 16. Why do some nations replace the domestic currency with a key currency such as the U.S. dollar? What are the benefits of dollarization?