Reference no: EM131928350

The interest n may be either fixed or variable. If an installment loan has a fixed interest rate on an installment loa rate, that rate will not change over the life of the loan.

The payments on a fixed-interest loan usually remain the same throughout the term of the loan.

By contrast, if an installment loan has a variable interest rate, the interest fluctuates over time. With a variable-rate loan also called an adjustable-rate loan the monthly payments will go up or down, allowing the loan to be paid off by the same date as originally established in the loan contract.

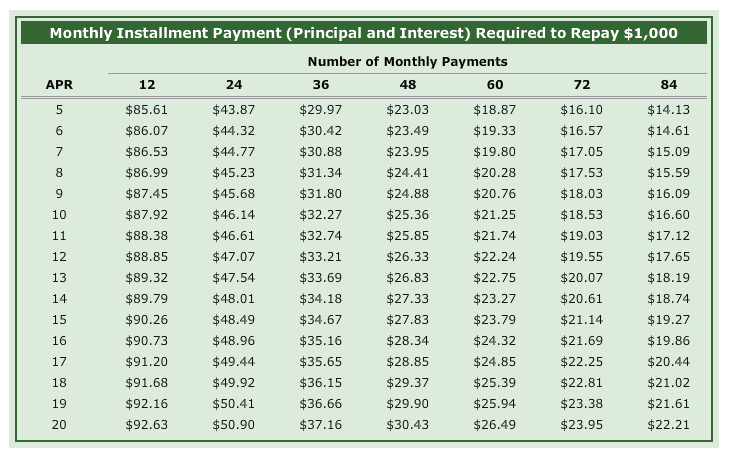

The following table lists the monthly installment payment amounts required to repay $1,000 over various time frames and at various fixed interest rates:

To estimate the required monthly payment amount for a fixed-rate loan, divide the borrowed amount by 1,000 and multiply the result by the appropriate figure from the table.

Suppose that you are repaying a personal loan in the amount of $15,000. The APR (annual percentage rate) on the loan is 9%, and you have agreed to pay back the loan in 24 monthly payments.

Using the values in the preceding table, complete the following steps to calculate the required monthly payment amount for this loan.

Step 1: Divide the amount of the loan by 1,000. Dividing $1 I (loan amount) by 1,000 gives you a value of

Step 2 : Use the APR and the number of monthly payments to identify the appropriate figure to use from the table. In this case, the APR is 9%, and the loan requires 24 monthly payments. Therefore, the relevant amount from the table is $

Step 3: Multiply your answer from step 1 by the appropriate value from the table cell (from step 2). This gives you a required monthly payment amount of $

|

What is that cash price of the house now

: What is that cash price of the house now with a 30 yr mortgage?

|

|

What does this problem tell you about the interest rate risk

: Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds?

|

|

What position will you need to hedge your portfolio

: You have a $6,000,000 portfolio that has a beta of 2.4 to the S&P 500. You have decided you want to hedge this portfolio over the next 12 months.

|

|

What is the total current cash price of house

: A modest home was purchased for $30,000 down payment and $1,000 a month for 5 yrs with a 12% interest rate compounded monthly.

|

|

Calculate the required monthly payment amount

: Using the values in the preceding table, complete the following steps to calculate the required monthly payment amount for this loan.

|

|

How much he will need to put into an account every

: In order to retire as a "Millionaire" at a young age of 50, Joe needs to figure out how much he will need to put into an account every quarter (3 months).

|

|

What was the beginning retained earnings for the period

: If net income for the period was $139,950, dividends distributed were $79,000. What was the beginning retained earnings for the period?

|

|

What percent of annual life-cycle cost is related to fuel

: A 50-kilowatt gas turbine has an investment cost of $45,000. It costs another $11,000 for shipping, insurance, site preparation, fuel lines, and fuel storage.

|

|

Find the amount of an annuity deposited

: Find the amount of a $500 annuity deposited every 6 months for a 10 year period if annual interest rate is 12% and interest is compounded semiannually?

|