Reference no: EM13491896

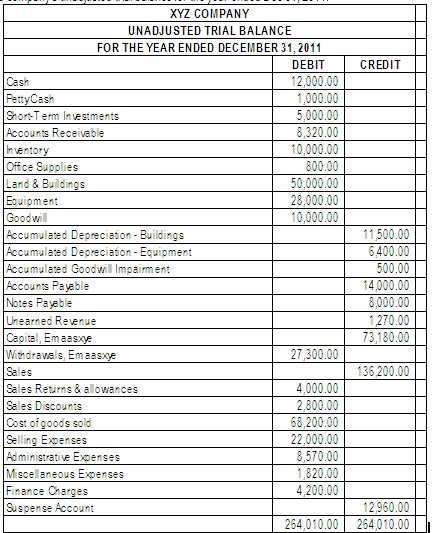

1. Emaasxye has been operating as a sole proprietorship under the name XYZ Company for the last five years. The following is the company's unadjusted trial balance for the year ended Dec 31, 2011.

ADDITIONAL INFORMATION:

i. On December 31, 2011, the actual petty cash balance is $350. The Petty Cashier has receipts for the following items; Selling Expenses $320, Administrative Expenses $100, and Miscellaneous Expenses $75.

ii. Plant assets are depreciated using the following variables.

|

|

Land

|

Buildings

|

Equipment

|

Goodwill

|

|

Useful Life

|

NA

|

20

|

10

|

NA

|

|

Salvage Value

|

NA

|

$2,000

|

$0

|

NA

|

|

Method

|

NA

|

Straight-line

|

200% Declining Balance

|

NA

|

Goodwill is assed for impairment annually; as at Dec 31 2011, it is determined that $750 worth of goodwill is impaired. Land costing $20,000 was purchased at the start of the business; no other land transactions have taken place. A building costing $5,000 was added during the year 2011 - this entry was correctly recorded. Equipment that had cost $20,000 on Jan 1, 2009 was sold for $22,960 on June 30th, 2011. The accountant debited cash with $22,960, credited equipment $20,000, and credited the suspense account with the balance. Another equipment costing $25,000 was purchased during the year - the entry for this equipment has correctly been recorded.

iii. As at December 31, 2011, only $230 of office supplies is on hand.

iv. On December 28, 2011, the company purchased inventory worth $12,600 FOB shipping point on credit with an invoice date of December 28, 2011. No entry has been made since the inventory has not yet been received by the company.

v. On December 31, 2011, the company received cash of $10,000 from a customer, for goods that will be supplied in January 2012. The accountant debited cash and credited the suspense account.

vi. Wages of $21,000 have not been paid - 1/3 of which comprise selling expenses and 2/3 relates to administrative expenses.

vii. Insurance of $3,000 for the office building has not expired.

viii. The unearned revenue relates to cash that was received in advance for goods that were delivered on December 25th 2011. The original entry, as well as the cost of goods sold entry, was entered correctly. However, upon delivery of the goods, the accountant credited the correct account but debited accounts receivable.

Required:

A. Prepare a classified income statement for the period ended December 31, 2011

B. Prepare a classified balance sheet as at December 31, 2011

C. Prepare the closing entries for the company

D. Calculate the profit margin, current ratio, and acid test ratio for the company

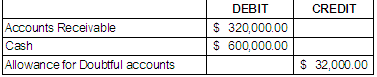

1. Eraesi Company, which uses the perpetual inventory system, began operations on January 1, 2010. At January 1, 2011, the Company reports the following balances.

During the year, the company completed the following transactions involving sales on credit, accounts receivable collections, and bad debts.

a. Sold goods worth $3,475,000 on credit. The cost of these goods was $2,800,000

b. Received $3,150,000 cash from customers for the goods sold on credit.

c. Wrote off $62,000 of uncollectible accounts receivable.

d. The company estimates that 10% of its accounts receivable will be uncollectible.

Required:

A. Record the journal entries for the above select transactions

B. Show how the accounts receivable and the allowance for doubtful accounts appear on the Dec 31, 2011 balance sheet.

2. On November 29th 2012, a fire broke out in the warehouse of Leansot Company and destroyed most of the inventory at hand as well as the inventory records. The only inventory salvaged and in good condition is worth $36,000. Luckily, some backup data was found and the company maintains fire insurance. From the data recovered, the following information was derived.

|

|

|

|

January 1 beginning inventory

|

$275,000

|

|

January 1 beginning cash balance

|

$ 300,000

|

|

Cost of goods purchased during the period

|

$ 3,600,000

|

|

Cash Sales during the period

|

$ 1,800,000

|

|

Credit Sales during the period

|

$ 4,400,000

|

|

Sales returns & allowances

|

$ 300,000

|

|

Sales discounts

|

$ 100,000

|

|

Purchase returns & allowances

|

$ 125,000

|

|

Purchase discounts

|

$ 50,000

|

|

Inventory on consignment on 11/29/2012

|

$ 90,000

|

|

Inventory on transit from suppliers as at 11/30/2012

|

$ 50,000

|

|

Inventory on transit to customers on 11/29/2012 FOB Shipping point, invoice date 11/29/2012

|

$ 60,000

|

The company uses the perpetual inventory system and all purchase returns, allowances, and discounts are debited or credited to the inventory account. Historical data indicates that the company's gross profit rate averages 30%.

Required: Use the gross profit method to estimate the amount of inventory destroyed by the fire, and thus, the amount to be claimed from the insurance company.