Reference no: EM131212541

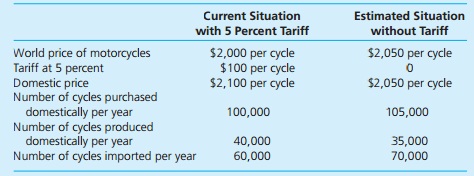

As in given question, you have been asked to quantify the effects of removing an import duty; somebody has already estimated the effects on the country's production, consumption, and imports. This time the facts are different. The import duty in question is a 5 percent tariff on imported motorcycles. You are given the information shown in the table.

Calculate the following:

a. The consumer gain from removing the duty.

b. The producer loss from removing the duty.

c. The government tariff revenue loss

d. The net effect on the country's well-being. Why does the net effect on the country as a whole differ from the result in given Question?

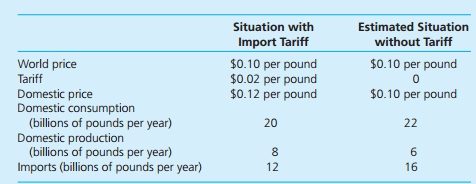

Question

You have been asked to quantify the effects of removing a country's tariff on sugar. The hard part of the work is already done: Somebody has estimated how many pounds of sugar would be produced, consumed, and imported by the country if there were no sugar duty. You are given the information shown in the table.

Calculate the following measures:

a. The domestic consumers' gain from removing the tariff.

b. The domestic producers' loss from removing the tariff.

c. The government tariff revenue loss.

d. The net effect on national well-being.

|

Why does this imply that the person is risk averse

: In a state-contingent income space, each person's indifference curves are generally bowed in toward the origin. Why does this imply that the person is risk averse?

|

|

Strengths and weakness of adaptive leadership

: What are the strengths and weakness of adaptive leadership? What particular challenges might an adaptive leader encounter in encouraging their followers to solve their own problems and challenges?

|

|

Compute the npv statistic for project

: Compute the NPV statistic for Project Y and tell [advise] whether the firm should accept or reject the project with the cash flows shown in the chart if the appropriate cost of capital is 12 percent.

|

|

Discuss the roles of social responsibilities in business

: Discuss the roles of ethics and social responsibilities in business. Use technology and information resources to research issues in business. Write clearly and concisely about business issues using proper writing mechanics.

|

|

Calculate the consumer gain from removing the duty

: Calculate The consumer gain from removing the duty. - Calculate The producer loss from removing the duty. - Calculate The government tariff revenue loss.

|

|

What is a charter

: What is a charter? Describe what an effective charter should accomplish. How is a charter like a contract? How is it different from a contract.

|

|

Strategic importance of forecasting

: Discuss the strategic importance of forecasting at your organization like healthcare. What strategic decisions does it need to make in terms of forecasting? Provide two recent examples. In your opinion, was this the best way? How could the process..

|

|

What is the equilibrium allocation for this economy

: Assume, instead, that the economy in exercise 19.10 lasts only for two periods. In the first period, there is only a young consumer. In the second period, there is one old consumer and a new young consumer. At the end of the second period, the eco..

|

|

How can a domestic market be protected

: How can a domestic market be protected

|