Reference no: EM13492691

Question 1 -

The following is the unadjusted trial balance for James Trading Pty Ltd as at the close of the financial year ended 30 June 2011. In addition the following entries had not been applied to the general ledger.

1. Rent had been prepaid to the extent of 3 months on June 1st. The monthly rent is $1,000

2. Interest income on a loan made to J Harris had not been taken to account

3. Expenses of $20,000 for legal fees were estimated to be incurred but had not been invoiced by the solicitor

4. A stock take was undertaken as at the close of June and $8,500 was the value of stock on hand

5. The company received $20,000 for services which will be delivered over the next four months. The first services were provided in the current month of June.

On the attached worksheet

a. Complete the entries to adjust the trial balance for the closing entries

b. Prepare an statement of income and statement of financial position

Question2

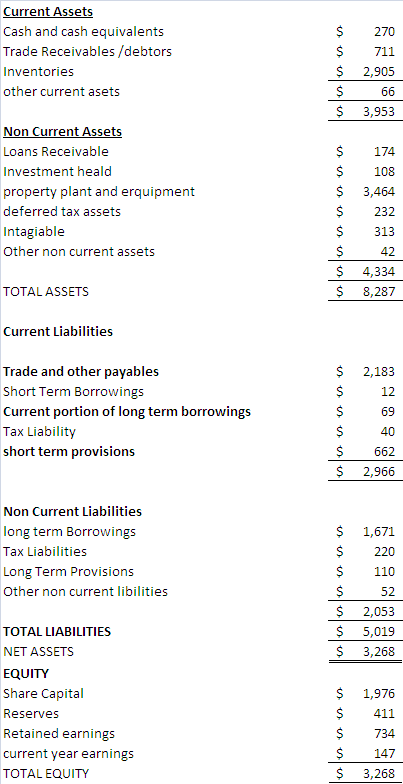

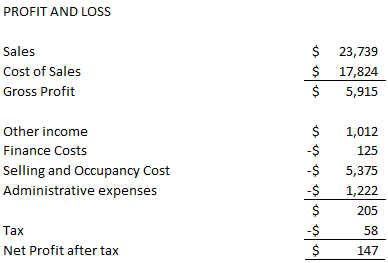

The following is the Statement of financial Position and Profit and Loss statement for Luke Incorporated Pty Ltd. You have been retained by your client to review the business and provide a financial analysis of the business for your client.

Undertake an analysis of the company and prepare a short report on your findings to a prospective purchaser.

Your analysis should cover the liquidity and performance of the company. Your report should clearly indicate the ratios and other methods used to evaluate the business for your client.

Your analysis must be in report format. With a suitable explanation of the specific ratios you have applied and why you used them.

Provide a recommendation to your client based on your analysis.

Question 3

Part a) -

Advanced Radio repairs make all sales on account. Cash receipts arrive by mail. James opens the envelopes and separates the cheques from the accompanying remittance advices. James forwards cheques to another employee, who makes the daily bank deposit but has no access to the accounting records. James sends the remittance advices, which show the cash received, to the accounting department for entry into the accounts. James' other duty is to grant sales allowances to customers ( a sales allowance decreases the amount receivable). When he receives a customer's cheque for less than the full amount of the invoice, he records the sales allowance and forwards the document to the accounting department.

Required

You are the new Financial Controller of Advanced Radio repairs. Write a memo to the company Chairperson identifying the internal Control weakness in this situation. State the steps to be taken to correct the weakness.

Part b)-

You are the Financial Controller for Lukes' Manufacturing and you have been approached by the Chief Executive Officer in relation to the purchase of a new item of equipment. Not having an accounting background, the owner Joe Logs, does not understand the concept of depreciation and is under the impression that depreciation is a process of creating a cash fund to replace an asset.

Write a note explaining the concept and using the information regarding the asset below illustrate the difference in various depreciation methods and the effect on the financial performance of the organisation if any.

Machine Cost $45,000

Delivery to site $500

Cost of set up ready for production $2,500

Salvage value estimated to be $3,000

Maximum units of production 5,000 in the first year

4,500 in the second year

And reducing by 500 units each until the end of its useful life

Effective Useful life 5 years

Show all calculations and a depreciation schedule in your report to demonstrate fully the impact to Joe Logs.

Question 4 -

Part a)

Alpha Ltd had the following equity balance at July 1, the beginning of the year

Share capital 10,000 $10 shares $100,000

Reserves $80,000

Retained Earnings $50,000

Alpha Ltd's profit for the year was $40,000. During the year the following events and transactions occurred;

Dec 30 Declared interim cash dividend of $1 per share

Jan 15 Paid interim cash dividend

Mar 31 4-for 1 share split

June 30 declared cash dividend o0f $1 per share

June 30 transferred $15,000 to general reserve

Required

a) Prepare journal entries to record the transactions affecting equity during the period

b) Prepare a statement showing the changes in retained earnings during the year

c) Prepare the equity section of the balance sheet

d) Calculate the dividend payout ratio and return on shareholders' equity

Part b)

Investors Ltd Shareholders equity is as follows

Share Capital $4,000,000

Retained earnings and reserves $1,000,000

Investor ltd plans to expand its operations by establishing a branch in Singapore. The new branch will cost $2.5million. Expected profits before tax and interest when the new branch is operational are $1.2 million. The tax rate is 30%. Investors Ltd is considering 2 financing options;

a) Borrow $2.5million at 8% interest

b) Issue 100,000 shares at $25

Required; Which funding alternative yields the higher return on equity. What other factors should be considered.

Question 5

CVP Analysis

Unique Manufacturing had a bad year in 2007. Having operated at a loss. The income statement showed the following results from selling 60,000: net sales $2,250,000, total costs and expenses $2,835,000; and loss $385,000. Costs and expenses consisted of the following

Total variable fixed

Cost of Goods sold 2,025,000 1,395,000 $630,000

Selling Expenses 630,000 110,000 520,000

Administrative expenses 180,000 70,000 110,000

Total 2,835,000 1,575,000 1,260,000

Management is considering the following independent alternatives for 2008

- Increase the unit selling price to $52.50 with no change in costs , expenses and sales volume

- Change in compensation of salespersons from fixed annual salaries totalling $300,000 to total salaries of $75,000 plus 5% commission on net sales

- Purchase new high tech factory that will change the proportion between variable and fixed cost of goods sold to 50:50

Required

a) Calculate the break -even point for the year 2007

b) Calculate the break -even point under each alternative course of action above.