Reference no: EM131401559

BANKING AND FINANCIAL INTERMEDIATION EXERCISE SET

PROBLEM 1 - A banker has just opened a bank. Because it is brand new, its balance sheet is empty (i.e., assume there is no equity). He can collect 1,000 dollars from depositors. The (net) interest rate on deposits will be 20% if he decides to collect. He has three investment opportunities: the first project yields 1.1 dollars next year for each dollar invested. The second project yields either nothing or 2 dollars with equal probability for each dollar invested. The third project yields nothing, 1 dollar, or 4 dollars with probabilities 3/5, 1/5, 1/5. Calculate NPV of each project. Will the banker collect deposits? If yes, in which project(s) will he invest?

PROBLEM 2 - Consider the game below. What should X be for (U, R) to be the unique equilibrium?

|

|

L

|

R

|

|

U

|

3, -2

|

5, 10

|

|

D

|

X, 6

|

-2, 4

|

PROBLEM 3 - Find all equilibria of the game below:

|

|

a

|

b

|

c

|

d

|

|

I

|

1, 1

|

2, 2

|

1, 0

|

3, 3

|

|

II

|

2, 2

|

5, 3

|

3, 4

|

2, 0

|

|

III

|

3, 4

|

1, 0

|

0, 2

|

1, 4

|

|

IV

|

4, 3

|

3, 5

|

2, 3

|

4, 2

|

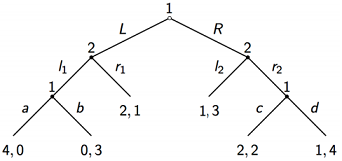

PROBLEM 4 - Consider the game below. Numbers at the top of each node represent player 1 and 2. First, player 1 moves and selects between L and R. Then, game continuous with player 2's move. Find the subgame perfect equilibrium of the game.

PROBLEM 5 - Suppose there are two investment opportunities. The first project yields 1 dollar next year for each dollar invested. The second project yields either nothing or 3 dollars with equal probability for each dollar invested. You have 100 dollars. You will invest all your wealth in these projects and then consume everything you will get (denote by X) next year. How will you allocate your wealth over these two investment opportunities if your utility function is ln X?

PROBLEM 6 - Solve the optimal effort for the course defined on slide 44 of lecture notes.

One day before the exam, each student decides how many hours to spend on preparing for the exam.

If a student studies x hours and if the average hours the rest of the class spends on studying is x¯, then the probability that the student will receive a good grade is x/x+x¯.

The cost of studying is x2/800 and if the student receives a good grade his utility increases by 1.

Who are players?

What is Θ (i.e., their strategy space)?

Hint: Assume that students are identical and their solutions at the end will be the same.

Attachment:- Lecture Notes.rar

|

Estimated in her original analysis

: Today, however, Kellie received new information that indicates the market risk premium, RPm is actually 1% higher than she estimated in her original analysis. Based on this new information, what should be the required rate of return for stock Q?

|

|

Four-stock portfolio with a beta coefficient

: Willis currently has $120,000 invested in a four-stock portfolio with a beta coefficient equal to 0.8. Willis plans to sell one of the stocks in his portfolio for $48,000, which will increase the portfolio's beta to 1.0. What is the beta coefficie..

|

|

Relationship among maturity of financial institutions assets

: Discuss the relationship among the maturity of financial institutions assets relative to its liabilities with respect to liquidity risk management.

|

|

Prepare the journal entries to record the transactions

: The bonds pay interest semiannually on July 1 and January 1. On January 1, 2016, after receipt of interest, Flynn Company sold 40 of the bonds for $38,500. Prepare the journal entries to record the transactions described above.

|

|

Calculate npv of each project

: BANKING AND FINANCIAL INTERMEDIATION EXERCISE SET. A banker has just opened a bank. Because it is brand new, its balance sheet is empty (i.e., assume there is no equity). He can collect 1,000 dollars from depositors. Calculate NPV of each project. ..

|

|

Write a summary of the case

: Elaborate on two key learnings from the case related to equal employment opportunity and managing diversity. Be sure to clearly state the two key learnings and defend them in well-organized, scholarly responses.

|

|

What did the instructor predict for her score on the final

: If Susan scored a 70 on the midterm, what did the instructor predict for her score on the final?- Susan got an 80 on the final. How big is her residual?

|

|

Describe what the unions can do to help labor

: You are a worker in a fast growing, large, non-union manufacturing organization. You notice persistent systematic labor violations in the plant. The company has multiple locations in the United States and plants in China and France. People are com..

|

|

What is the value of the correlation coefficient

: What is the value of the correlation coefficient between Speed and Density?- What percent of the variation in average Speed is explained by traffic Density?

|