Reference no: EM13380847

Bright Star Dance Company will be producing a modern dance show over a three-month period of time in October-December. It needs to employ designers and a construction crew to build a stage set for the show. The employees it will hire to construct the set are contract workers.

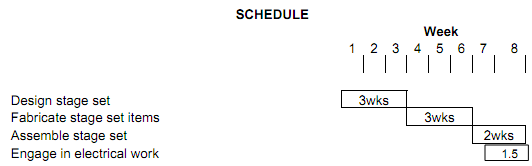

Shown below is the schedule for the construction effort, plus information on the costs of resources.

RESOURCES

Design stage set (10% chance 3 days delayed)

1 designer @ $1,000/wk (Weeks 1, 2, 3).

Fabricate stage set items (20% chance 3 days delayed)

2 carpenters @ $700/wk each (Weeks 4, 5, 6)

2 painters @ $600/wk each (Weeks 5, 6)

Assemble stage set (20% chance 3 days delayed)

2 carpenters @ 700/wk each (Weeks 7,8)

1 painter @ $600/wk (Week 7)

Engage in electrical work (10% chance half day delay)

2 electricians @ $1,000/wk each (Half week 7 plus full week 8)

Materials

Materials cost: $15,000

(Payments of $5,000 in weeks 1, 3, and 5)

Rental

Rent equipment (tools) @ $200/wk during weeks 4, 5, 6, 7, and 8

Assignment

1. Create a budget for the set design and construction project

2. Why don't you need to take into account fringe benefit costs for the workers?

3. Using the expected monetary value concept, calculate what contingency reserve should be set aside to deal with the prospects of cost overruns. (Hint: As a first step, you need to estimate the possible cost of the specified overruns, using the data in the table.)