Reference no: EM13503415

Question 1

You have recently been appointed as an audit senior and have been assigned to the audit of TNO Limited (TNO) a listed public company. It is the beginning of January 2014 and you are gathering information in order to prepare the audit plan for the year ended 31 December 2013. The firm for which you work has been the auditor of TNO for a number of years. The following information has been gathered to date.

The principal activities of TNO are:

- research and development of technologies relating to medical equipment;

- manufacture and distribution of medical equipment;

- investment of surplus funds; and

- investment in the property market.

TNO was incorporated in 1990 and has operated successfully and profitably since that date. In the last few years it has branched out into the property market, acquiring a number of commercial properties which are let mainly to medical practitioners.

The directors of TNO are:

- Mr. John Stanton, Chairman

- Ms Jane Quade, Chief Executive Officer

- Mr. Joe Quade

- Dr Jim Xie

- Dr Jenny Yeo

Doctors X and Y are independent non-executive directors and have been directors since 2001. The other three executive directors have been employed by the company since its incorporation and have considerable experience in the industry. Mr Stanton controls a number of private companies.

In prior years, the audit firm placed reliance on internal controls based on satisfactory results of extensive tests of control. Recent discussions with the client have revealed no changes in the system of internal control since last year.

The company does not have an internal audit function.

In February 2013, research activities relating to a new laser surgery device commenced. Significant costs were incurred in relation to this research. In April 2013 a competitor announced that it had successfully developed and patented a similar device.

In order to finance the research activities noted above the company borrowed from its bankers an additional $5 million during the year. The loan agreement contains a covenant to the effect that should the company's debt to equity ratio (measured as total liabilities: shareholders' equity) increase above 1.2:1.0 at any time, the bankers have the right to demand immediate repayment.

Throughout 2013, the property market has been in decline. The interim audit is scheduled to take place in September 2013 for approximately two weeks. The final audit is scheduled to start on 1 February 2014 and should take about two weeks to complete. The client completed a stock count on 31 December 2013. The directors require the signed audited final financial report by 25 February 2014.

Your audit partner, John Richards, has approached you and advised that there are several account areas he is concerned about. Before you complete your audit program he wants you to report back to him about the following accounts:

- Accounts receivable.

- Current investments.

- Property assets.

- Intangible assets.

- Deferred development expenditure.

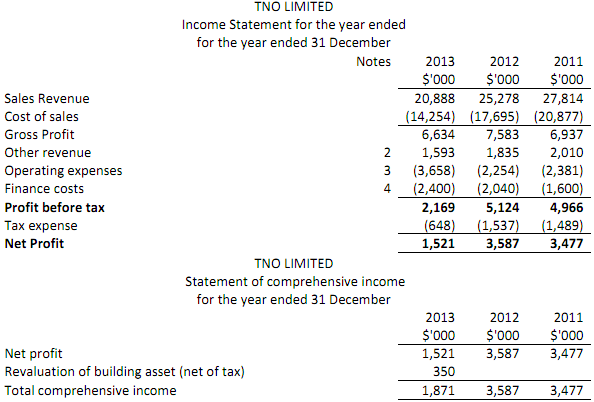

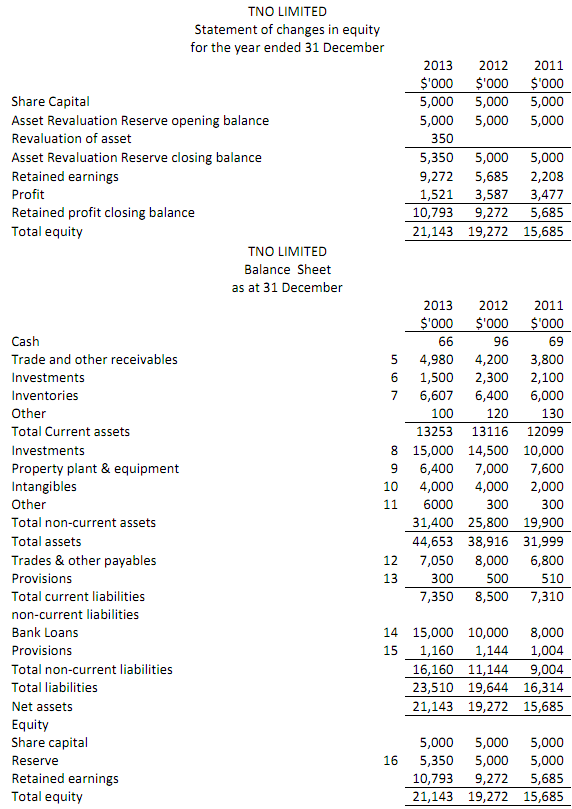

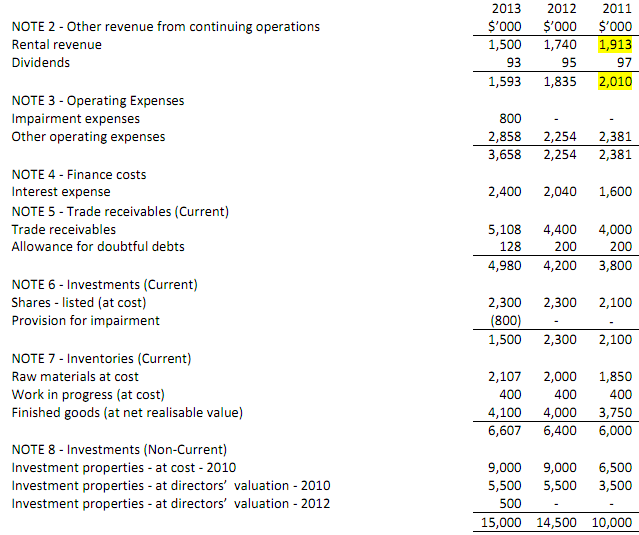

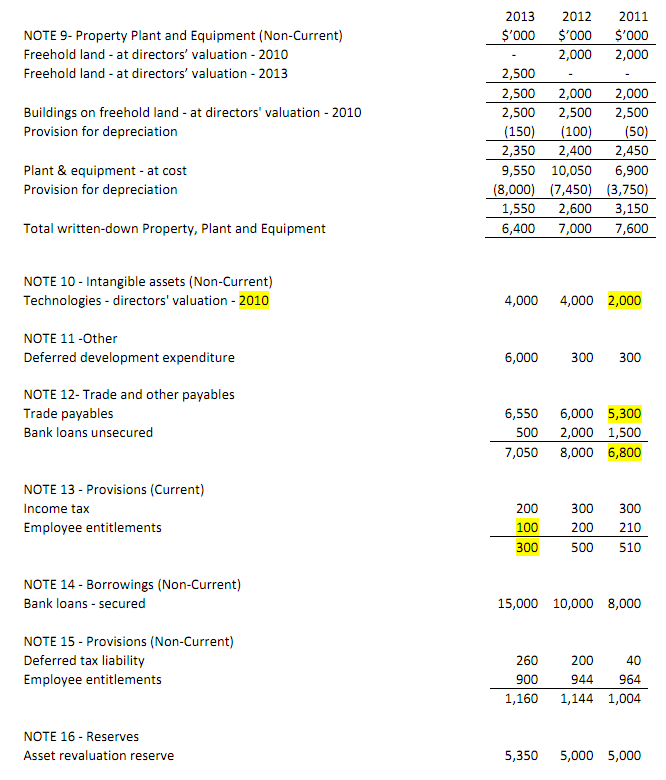

An unaudited set of financial reports at 31 December 2013 together with audited comparatives for the year ended 31 December 2012 and 2011 is set out below for your review.

Significant Account Policies

The accounting policy note states that the company complies with Accounting Standards and the Corporations Act 2001. It also reveals the following:

- commercial properties owned but not occupied by the company and which generate rental income are classified as non-current investments. These assets are not depreciated. Some of the investment properties are stated at cost and some are at directors' valuation

- technologies relating to modified equipment are included in the accounts as intangible assets. These assets stated at directors' valuation and are not amortised. The Director's believe that these assets do not have a limited useful life.

- deferred development expenditure is included in the accounts under 'other' non-current assets. This expenditure relates to the new laser surgery device.

REQUIRED:

1. Use Excel to undertake detailed analytical procedures covering all three years and comprising:

- a trend statement;

- a common size statement;

- a simple comparison between years on the Income Statement and Balance Sheet; and

- profitability, efficiency (activity), liquidity and solvency ratios where applicable.

The results of your analytical procedures are to be included as an appendix to the report you

complete for John. Note: A copy of your Excel file is to be separately lodged via EASTS.

2. Prepare a report (excluding an executive summary) for John that outlines:

a. Your analysis and other information provided, to make an assessment of the risk associated with the five accounts identified by John and the reasons for that assessment.

b. The key assertion common to all the identified account balances and, for each of the account balances, one substantive audit procedure that verifies the key assertion.

c. Details of other business risks identified from your analytical procedures and background details.

Question 2

You have been given another client, CTL Limited, to audit. CTL Limited (CTL) sells clay titles to the construction industry and has been in existence for the last four years. During this period, the financial controller has been refining the system of internal controls and informs you, at the planning stage of the current year's audit, that he has put together an internal control manual for the company. He has stated that this manual will create greater awareness of controls in the company, particularly with management which, in the past, has not been overly conscious of the need to implement and enforce effective internal controls.

Management staff receive bonuses based on certain agreed-upon target ratios which include measures such as targeted monthly sales volumes, variance of actual to budget departmental overheads and profit before interest and tax. The major shareholder takes an active interest in the performance of the company and is quick to request explanations on variances from the agreed-upon monthly budgets.

Two years ago, the company devoted significant time and resources to the development and implementation of a new IT system. All teething problems associated with the implementation phase have now been resolved, and the financial controller is satisfied that the automated controls in place are assisting in producing accurate and complete accounting records. The sales director also looks after the IT function as the position is not regarded by management as being a full-time job. Once application programs have been tested, strict password control exists over access to the programs. Passwords are not required for access to databases.

To assist in the planning for the current year's audit engagement, the audit manager has extracted the following information from a review of the systems notes in the permanent file and perusal of the new internal control manual:

I. Manual delivery notes for dispatch of tiles to customers are raised by the dispatch department from the sales order form. Where a delivery is only partially filled, the delivery note is marked 'hold for invoice' and placed on the incomplete deliveries file. At month end, the supervisor of the dispatch department is responsible for follow-up of the reasons why incomplete deliveries have been outstanding for greater than 30 days.

II. Returns of tiles by customers due to breakages, inferior quality, incorrect specifications or oversupply are received by the dispatch department where staff are required to check quantity and condition of the returned tiles. Details noted by the dispatch personnel, including the reason for the return, are recorded on a ‘goods returned' note. Once completed, this document is passed on to the trade receivables clerk who raises a credit note and sends it to the customer.

III. Once a delivery has occurred, the office copy manual delivery note is forwarded to the trade receivables clerk who is responsible for generating an invoice on the computer system. An invoice is raised by inputting the total quantity delivered (Note: this could be a number of partial deliveries) and the stock code which is also recorded on the delivery note. The computer then automatically retrieves the stock code price from the selling price master file. Posting to the debtors account occurs automatically once the trade receivables clerk has performed a screen check on the accuracy of the input of delivery details.

IV. For valued customers, discounts are applied in accordance with the company's volume rating system. The trade receivables clerk is responsible for updating the individual customer volume ratings every six months after preparing the 'sales volume analysis by customer' report. This report is authorised by the sales director prior to updating the customer discounts.

V. A sales journal summarising all sales invoices is prepared monthly by the computer system. This journal is then used by the trade receivables clerk for posting to the general ledger.

VI. Receipts from debtors are passed on to the trade receivables clerk after having been opened by the mail room. The trade receivables clerk lists all receipts from the debtors and then prepares a bank deposit slip. The list prepared by the trade receivables clerk is used to enter the debtors' payments on the computer system. The batch total of postings to the individual debtors' accounts is balanced to the bank deposit slip before processing occurs on the system. At each month end, the trade receivables clerk prepares a reconciliation of the trade receivables ledger to the debtors control account in the general ledger.

VII. The computer generates an aged analysis at month end based upon all invoices that have been processed onto the system for the period up until the last day of the month.

VIII. The financial controller obtains the latest trade receivables aged analysis at the end of each month and reviews all amounts out-standing for longer than 90 days. The trade receivables clerk is required to detail reasons for delays in payment by long outstanding debtors and the financial controller discusses items of concern with the clerk.

IX. Usually an action plan is agreed for follow-up; this may include involvement of debt collectors or the issuing of writs. Where necessary the financial controller records details of amounts that should be provided for as doubtful debtors. Whilst performing this re- view, the financial controller notes the level of individual debtors' balances and, in instances where he is uncomfortable with the level of this balance, he instructs the dispatch area to withhold any shipments until a minimum prescribed payment is received.

John your partner on the audit has mentioned to you that, in the past, a substantive approach had been adopted for the audit of CTL. He now feels that, with the improvements that the client claims to have made to the systems of internal control, an opportunity exists to place reliance on the internal controls and therefore reduce the extent of substantive work.

REQUIRED:

Prepare an additional report (excluding an executive summary) for John that outlines:

1. The internal controls in the system that are potentially effective, the risk that the control could mitigate and one ‘test of control' for each of the identified potentially effective controls.

2. The weaknesses in internal control for sales and trade receivables that you would bring to CTL management's notice in your management letter.

3. Your assessment of the reliance that can be placed on the internal controls covering the sales and accounts receivable cycles and the reasons for that assessment.

Question 3

The final report that John wants you to prepare for him is for the audit client Malos Ojos Limited (MO), who imports and distributes sunglasses. The sunglasses industry in Australia is extremely seasonal.

Background

MO is a well established company in a very competitive market. The company competes with a number of established manufacturers and distributors with well recognised brand names. MO's main competitors in the Australian sunglasses market are Reflecta and Zest.

MO has a handful of suppliers for its products, all of which are based in Australia. The company distributes to retail stores where stock is held on consignment within the stores. Major customers in this segment include Myer, David Jones and Sunglass Hut. This segment comprises 70% of MO's total sales.

The company has a high volume of casual employees who work during the peak seasonal periods. Casual staff are needed during the busy times to support the increase in workload in the areas of administration on (data operators and clerical staff), distribution (warehouse), delivery (truck drivers), sales and marketing.

It is currently 30 May 2013. You are in the process of finalising the planning for MO audit engagement for the financial year ending 31 December 2013. Your team has identified sales, payroll expense, trade receivables and inventory as the significant risks.

Sales

In respect of sales, the specific audit concern is the timing of the recognition of the consignment stock sales as there is a lag of up to two weeks in the sales information being transferred to MO by the retail stores.

You are also concerned about the high level of credit notes historically processed in the first two weeks of January each year. This is due to incorrect information supplied by retailers' stores as to mid to late December sales attributed to MO, but actually belonging to Reflecta and Zest. These errors are a result of the large number of pre-Christmas transactions that the retailers' computer systems have difficulty capturing correctly.

Trade receivables

You have now turned your attention to trade receivables balance. Given the issues identified with consignment sales, you are particularly concerned about the existence assertion with respect to the retail debtors at year end. You are considering using alternative procedures to debtor confirmations as the retail stores have a policy of not responding to audit confirmation requests.

Payroll

The company has a high volume of casual employees who work during the peak seasonal periods. Casual staff are needed during the busy times to support the increase in workload in the areas of administration on (data operators and clerical staff), distribution (warehouse), delivery (truck drivers), sales and marketing.

REQUIRED:

Prepare a brief report for John that covers the following areas:

1. For MO's sales account at year end:

a. Identify the key assertion at risk (as per ASA 315.A111) with respect to the timing of the consignment stock sales (other that cut-off) and briefly explain why it is at risk.

b. Identify the key assertion at risk (as per ASA 315.111) in relation to the credit notes processed in early January and briefly explanation why it is at risk.

2. Design two practical, relevant substantive tests of detail to substantiate the existence of trade receivables balance at year end.

3. You are also concerned about the impact of the issues in relation to consignment sales on the audit of the inventory balance.

a. Explain the impact of the timing of the recognition of the consignment sales and credit notes issued in January on the inventory account balance at year end.

b. Identify the key assertion at risk (as per ASA 315.A111) for each of these issues.

4. Identify the two (2) key assertions at risk (as per ASA 315. A111) at risk with respect to casual employees, briefly explain why they are at risk and outline a specific practical test of detail that would address the risk.