Reference no: EM13379034

Alternative methods of joint-cost allocation, product-mix decisions. The Southern Oil Company buys crude vegetable oil. Refining this oil results in four products at the splitoff point: A, B, C, and D. Product C is fully processed by the splitoff point. Products A, B, and D can individually be further refined into Super A, Super B, and Super D. In the most recent month (December), the output at the splitoff point was as follows:

Product A, 322,400 gallons

Product B, 119,600 gallons

Product C, 52,000 gallons

Product D, 26,000 gallons

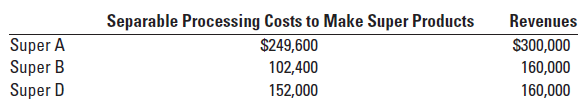

The joint costs of purchasing and processing the crude vegetable oil were $96,000. Southern had no beginning or ending inventories. Sales of product C in December were $24,000. Products A, B, and D were further refined and then sold. Data related to December are as follows:

�

Southern had the option of selling products A, B, and D at the splitoff point. This alternative would have yielded the following revenues for the December production:

Product A, $84,000

Product B, $72,000

Product D, $60,000

Required

1. Compute the gross-margin percentage for each product sold in December, using the following methods for allocating the $96,000 joint costs:

a. Sales value at splitoff

b. Physical-measure

c. NRV

2. Could Southern have increased its December operating income by making different decisions about the further processing of products A, B, or D? Show the effect on operating income of any changes yourecommend.