Reference no: EM13327705

Part 1: Case study

Periwinkle Pty Ltd (Periwinkle) is a bathtub manufacturer which sells bathtubs directly to the public. On 1 May 2013, Periwinkle provided one of its employees, Emma, with a car as Emma does a lot of travelling for work purposes. However, Emma's usage of the car is not restricted to work only. Periwinkle purchased the car on that date for $33,000 (including GST).

For the period 1 May 2013 to 31 March 2014, Emma travelled 10,000 kilometres in the car and incurred expenses of $550 (including GST) on minor repairs that have been reimbursed by Periwinkle. The car was not used for 10 days when Emma was interstate and the car was parked at the airport and for another five days when the car was scheduled for annual repairs.

On 1 September 2013, Periwinkle provided Emma with a loan of $500,000 at an interest rate of 4.45%. Emma used $450,000 of the loan to purchase a holiday home and lent the remaining $50,000 to her husband (interest free) to purchase shares in Telstra. Interest on a loan to purchase private assets is not deductible while interest on a loan to purchase income-producing assets is deductible.

During the year, Emma purchased a bathtub manufactured by Periwinkle for $1300. The bathtub only cost Periwinkle $700 to manufacture and is sold to the general public for $2,600.

(a) Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014. You may assume that Periwinkle would be entitled to input tax credits in relation to any GST-inclusive acquisitions.

(b) How would your answer to (a) differ if Emma used the $50,000 to purchase the shares herself, instead of lending it to her husband?

Part 2: Question

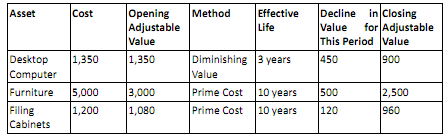

An extract of the asset register of Alpha Pty Ltd (‘Alpha') for the 2012-13 income year is as follows:

All depreciable assets are for 100% business use and Alpha uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2013 was $5,300.

Alpha purchased a printer on 5 June 2014 for $700.

Advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year.

|

Explain what makes the smooth cucumber

: A pickle is made by soaking a cucumber in brine, a saltwater solution. What makes the smooth cucumber become wrinkled like a prune

|

|

The key to success in social network marketing

: The key to success in social network marketing is to attract people to you. If you are fun, light-hearted, and aren't known as an mlm pusher then people will become curious about what you are all about. They will approach you and ask what you do.

|

|

Locate articles on accounting for multinational operations

: Locate two recent articles on accounting for multinational operations. You can use one that focuses on IFRS requirements and one that focuses on GAAP. Or you can use two articles that compare the two sets of requirements.

|

|

Determine what is the accounts receivables turnover rate

: Walther Enterprises has accounts receivable of $52,700, total assets of $269,250, cost of goods sold of $147,900 and a capital intensity ratio of 1.25. What is the accounts receivables turnover rate

|

|

Advise alpha of the income tax

: Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014 and how would your answer to (a) differ if Emma used the $50,000 to purchase the shares h..

|

|

What is the force which must be exerted on block

: The surface between a 12kg block , the 16kg wedge and between 16 kg wedge and the horizontal plane are smoothe, What is the force F which must be exerted on the 16 kg block in order that the 12 kg block

|

|

Roles they play in society or your life

: Explain ways in which you alter your communication according to context and or individuals and the roles they play in society or your life. Please use specific examples and demonstrate how they adequately explain your point.

|

|

Compute the duration for bond c and rank the bonds

: Compute the duration for bond C, and rank the bonds on the basis of their price volatility. The current rate of interest is 8 percent, so the prices of bonds A and B are $1,000 and $1,268 respectively.

|

|

Design and implement an application that reads an integer

: Design and implement an application that reads an integer value representing a birthdate from the user. First get the month, then get the day and then finally the year from the user.

|