Selling Agents vs. Sales Force

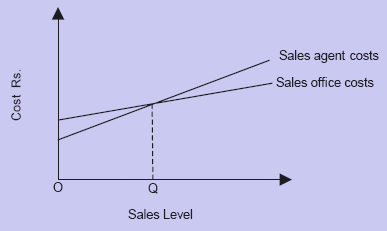

This is one of the most important decisions for the marketing managers. The economic criteria can be evaluated by means of a break-even chart for choosing a channel of distribution (i.e., selling agents or sales force). In the following figure, the choice between a sales agents and establishing a branch sales office is depicted. If selling agents are employed, the level of fixed costs is less but the variable cost (i.e., commission) is higher. If branch is established, the level of fixed cost is more (i.e., rent salaries etc.) and the variable cost is less compared to the other option. If the level of sales is expected to be below the point Q on the horizontal scale, then selling through sales agents is preferable; otherwise a branch office is to be preferred.

Figure : Break-even Chart for Sales Agents vs. Sales Force

Illustration

ABC Ltd., manufactures a range of products, which it sells through the manufacturer's agents to whom it pays commission of 20% of the selling price of the products. Its budgeted profit and loss statement for 2005 is as follows:

|

Particulars

|

Rs.

|

Rs.

|

|

Sales

|

|

11,25,000

|

|

Less: Prime costs and variable overhead

|

3,93,750

|

|

|

Fixed overhead

|

1,81,250

|

5,75,000

|

|

|

|

5,50,000

|

|

Selling Costs:

|

|

|

|

Commission to manufacturer's agents

|

2,25,000

|

|

|

Sales office expenses (fixed)

|

10,000

|

2,35,000

|

|

|

|

3,15,000

|

|

Administrative costs (fixed)

|

|

1,50,000

|

|

Profits

|

|

1,65,000

|

Subsequent to the preparation of the above budgeted profit and loss statement, the company is faced with a demand from its agents for an increase in their commission to 22% of selling price. As a result, the company is considering whether it might achieve more favourable results if it were to discontinue the use of manufacture's agents and instead employ its own sales force. The costs this could involve are budgeted as follows:

|

Particulars

|

Amount

(Rs.)

|

|

Sales manager

|

(Salary and expenses)

|

37,500

|

|

Salesmen expenses

|

(Including traveling costs)

|

10,000

|

|

Sales office costs

|

(Additional to present costs)

|

25,000

|

|

Interest and depreciation on sales department cars

|

17,500

|

In addition to the above, it will be necessary to hire four salesmen at a salary of Rs.20,000 per annum each plus commission of 5% on sale plus car allowance of Re. 1 per kilometer to cover all costs except interest and depreciation.

On the assumption that the company decides to employ its own sales force on the above terms, you are required to ascertain the maximum average kilometer per annum that salesman could travel if the company is to achieve the same budgeted profit as it would have obtained by retaining the manufacturer's agents and granting them the increased commission they had requested. Assume that sales in each case would be as budgeted.

Solution

Calculation of Economies of Employing Company's Own Sales Force

|

Particulars

|

Rs.

|

Rs.

|

|

Savings in existing commission

|

(20% of Sales)

|

2,25,000

|

|

Saving in proposed increase in commission

|

(2% of Sales)

|

22,500

|

|

Total Savings in Commission (i)

|

|

2,47,500

|

|

Additional Costs: (excluding car allowance)

|

|

|

|

Commission

|

(5% of Sales)

|

56,250

|

|

Sales manager

|

(Salary and expenses)

|

37,500

|

|

Salesmen's expenses

|

|

10,000

|

|

Sales office costs

|

|

25,000

|

|

Interest and depreciation on sales department cars

|

|

17,500

|

|

Salesmen's salary

|

(4 × Rs. 20,000)

|

80,000

|

Total Costs (ii)

|

|

2,26,250

|

Net savings prior to paying car allowance

|

|

21,250

|

The above calculations show that there would be net saving (excluding salesmen's car allowance) to achieve the same budgeted profit as company would have obtained by retaining the manufacturer's agents and granting them increased commission. Since the car allowance of salesmen is Re.1 per km., the maximum total kilometers to be traveled by all the salesmen would amount to Rs.21,250. The number of salesmen being 4 the maximum average kilometers per salesman would amount to Rs.5,312 (i.e., 21,250/4).

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Selling Agents vs. Sales Force questions? Selling Agents vs. Sales Force topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Selling Agents vs. Sales Force related problems. We provide step by step Selling Agents vs. Sales Force question's answers with 100% plagiarism free content. We prepare quality content and notes for Selling Agents vs. Sales Force topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours