|

Concept of Absorption costing

|

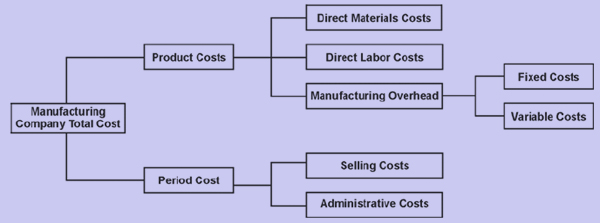

Cost is the base for ascertaining profit or fixing selling price or for valuing inventory. Different bases are used for classifying costs for different purposes. In this chapter, the terms, product cost and period cost are most important to understand the terms absorption costing and marginal costing.

Product costs are associated with unit of output. They are the costs 'absorbed by' or 'attached to' the units produced. These costs go into the determination of inventory valuation (finished goods and partly completed goods); hence are called inventoriable cost. They consist direct materials, direct labor and factory overheads (partly or fully). The extent of inclusion of factory costs depends on the type of costing system in force - absorption and marginal costing. Where the absorption costing method is adopted, factory overheads - both fixed and variable costs, are included as part of product cost. Where the marginal costing method is adopted only variable factory overheads are included as part of inventoriable cost.

Period costs are costs associated with time period rather than the unit of output or manufacturing activity. These costs are not treated as part of inventory and hence are treated as expenses during the period in which they are incurred. Administrative, selling and distribution costs are treated as period costs and are deducted as an expense for the determination of income and are not regarded as a part of inventory.

Absorption Costing

Absorption costing is a cost accounting method of charging all direct costs and all production costs of an organization to specific units of production. Absorption costing is also known as Total Cost method, Traditional method, Conventional method, and Cost Plus method. Absorption costing is an approach to product costing, wherein the total cost is considered. The production cost of product, process or operation consists manufacturing cost - both fixed and variable cost, as well as direct and indirect cost. In absorption costing, most of the fixed cost is treated as part of product cost, and inventory values are arrived at accordingly. It is the simpler and the oldest method in practice. Accounting Standards (AS-2) recommend the use of absorption costing for the valuation of stock and work-in-progress.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Absorption costing questions? Absorption costing topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Absorption costing related problems. We provide step by step Absorption costing question's answers with 100% plagiarism free content. We prepare quality content and notes for Absorption costing topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours