Tests in Investments

There are many rules that specify how the past data of share prices can be used to obtain a clue regarding the future prices of shares. Such rules would be valuable to an investor because they could be used to determine which share prices are likely to rise. Hence the investor could buy such share and sell them in future at a higher price thereby earning a profit.

Statistical tests have been applied to examine whether such rules can deliver what they promise. Can investors using these rules earn higher profits than investors not using these rules? Do these rules really provide clues about the future prices of shares? Are short-term share price fluctuations not random in nature? Below are the results of two tests applied to past data of share prices to ascertain whether such data has any information relevant to future share price estimates.

Serial Correlation Tests

We have studied correlation applied to pairs of observations. For example, we can find out the correlation of one share price with another share's price, or the correlation of one company's share price with the company's profits.

In auto-correlation we ascertain the correlation of current observations in a set with past observations of the same set. As applied to investments, serial correlation has been used to find the correlation coefficient between current changes in a share's price and past changes in the same share's price. It was found that the correlation coefficient was very near to zero. If current share price changes are uncorrelated with past share price changes, how can the rules based on a study of past share prices have any predictive value?

Runs Tests

Correlation coefficients are unduly influenced by extreme observations. It was argued that a few unrepresentative extreme observations may have distorted the results of the above Serial Correlation Tests. So Runs Tests were devised. Here, only the directions of share price changes were considered. As the magnitudes of price changes were ignored, the excessive influence of extreme observations was removed.

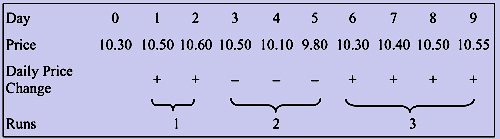

In a typical Runs Test the changes in share prices may be classified as '+' meaning an increase and '-' meaning a decrease. A run is said to last as long as the price changes do not change direction. For example, given the following daily price changes of a share, we can identify three runs.

So Runs Tests also appear to support the conclusion that share price changes are random.Runs Tests reveal that the number of runs are nearly equal to the runs that would be expected if share price changes were random.