Prepare Cash Budget of a Company

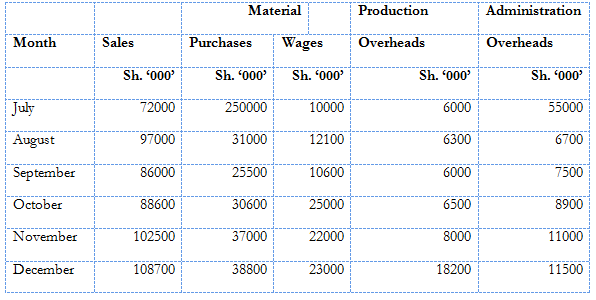

The given information concerned to the proposed budget for a company for the months ending on 31 December 1996.

Additional Information is given as:

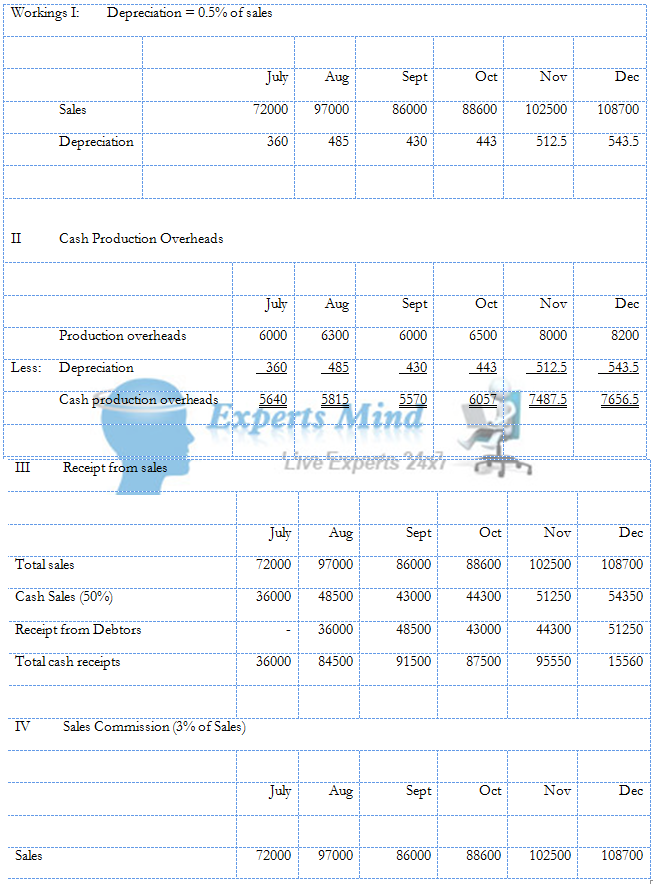

1. Depreciation expenses are expected to be 0.5 percent of sales.

2. Expected cash balance in hand on date 1 July 1996 is Sh. 72,500,000

3. 50 percent of net sales are cash sales

4. Assets are to be obtained in the months of August and October at Shs. 8,000,000 and Shs. 25,000,000 respectively

5. An application has been made to the bank for the grant of a loan of Shs. 30,000,00 and it is hoped like it will be acquired in the month of November

6. It is anticipated that a dividend of Shs. 35,000,000 will be paid in December

7. Debtors are permitted one month's credit

8. Sales commission at 3 percent on sales is paid to the salesmen every month

Required

A cash budget for the six months ending on date 31 December 2003

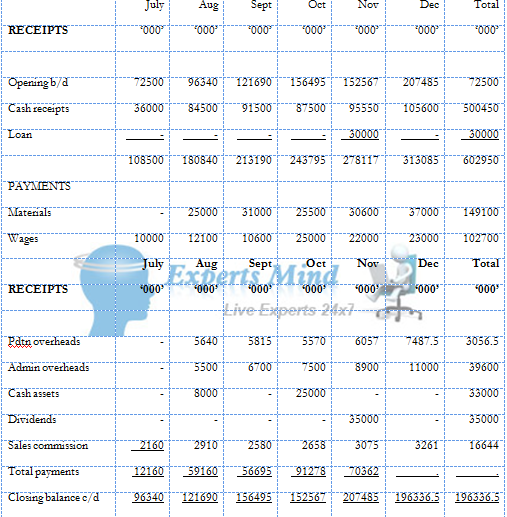

Cash Budget

Suggested Solution:

CASH BUDGET FOR SIX MONTHS ENDING ON 31 DECEMBER 1996