An analysis of the fluctuations of current assets and current liabilities that is working capital describes that how the working capital has decreased or increased. We want to identify where the raised working capital is applied if this has risen, and from where funds have been released if it has reduces. The profit and loss account offers several indications of the results of operations and its impact on the funds position. We attempt to integrate the impact of operations reported in the loss and profit account and balance sheet through preparing a statement of modifications in financial position. This describes the sources from that fluids were received and the uses to that funds were put. This statement of changes in financial position is generally referred to as fund flow statement or statement of application and sources funds.

Since the title indicates fund flow statement traces the flow of funds through the organization. Conversely, it shows the sources by where the funds were increased and the uses to that they were put.

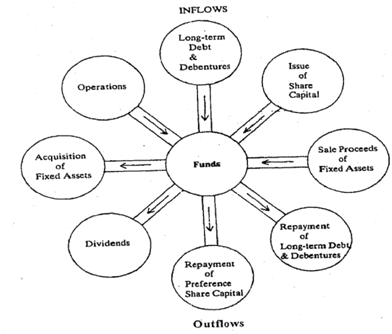

The statement of funds flow is generally bifurcated in two logical divisions as: sources of funds or inflows throughout the periods and uses of funds or applications of funds throughout the period. A division demonstrating sources of funds summarizes all those transactions that had the net effect of raising the working Capital. Uses of funds on the other hand deal along with all those transactions that had the effect of reducing the working capital. We shall demonstrate the primary structure of flows as given in the figure 1:

Figure1: Basic flow of funds

The flow of funds statement gives a summary of the impacts of managerial decisions. Hence it reflects the policies of acquisition, financing, retirement and investment of fixed assets, the success of operations and distribution of profits.

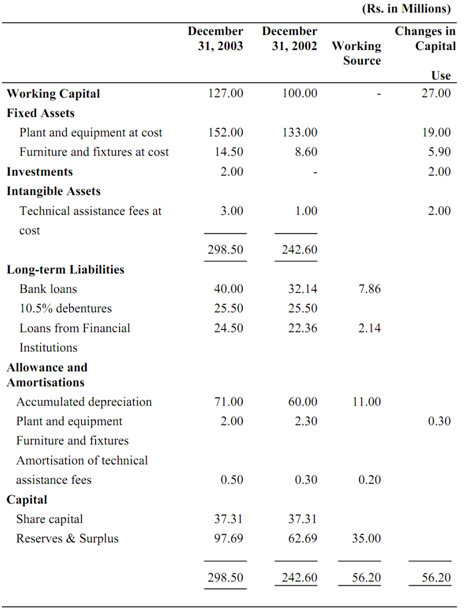

Then further we see illustration 2 so as to prepare a Fund Flow Statement. By a comparative balance sheet and profit and loss account we could acquire most of the information we need for the preparation of a fund flow statement. We have studied that modifications in net working capital amount are caused through the changes in non-working capital items. It could be easily seen by the summarized balance sheet of TIL as Table no.2.

We have seen that the net working capital amount increased through Rs. 27 million throughout 2003, January 1 to December 31. It is imply as the working capital from non-current sources must exceed non-current uses through Rs. 27 million.

The summarized balance sheet demonstrates the net change in each account. It does not demonstrate the decreases and increases separately. Fixtures and furniture value, for example: has increased through a net amount of Rs. 5.90 million. This increase demonstrates an application of funds. Actually, this account was both a source and an application of funds. We purchased modern furniture and fixtures worth Rs. 7.90 million as a utilization of funds and sold existing furniture and fixtures that had an original cost of Rs. 2 million and on that depreciation had accumulated to the tune of Rs. 1 million a source of funds. Because the purchase transaction was bigger in amount than the sale transaction, the net outcome was in the "use of funds".

Table 6.2

TOOLS INDIA LTD.

Summarized Balance Sheet

Notes:

1) Fixtures and furniture costing Rs. 2 million along with an accumulated depreciation of Rs. 1 million is sold for cash at Rs. 2 million.

2) Dividend paid throughout the year amounted to Rs. 2.25 million.

If we are to construct a statement demonstrating sources and uses of funds throughout the year, we require additional information. Several of this additional information is accessible from the profit and loss account and the appropriation of net income. Several other information as sales proceeds of asset will have to be acquired from other records of the company.

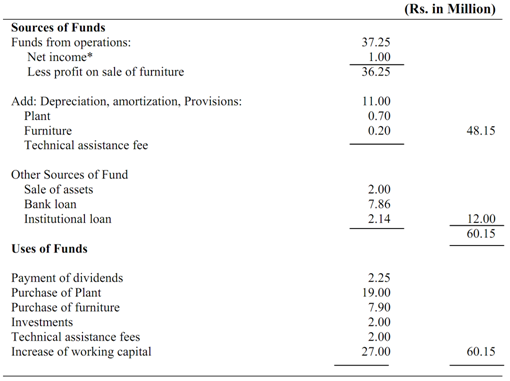

Funds Flow statement

* Net income has been acquired by deducting the last year's balance of Reserves and Surplus from the current year's balance that is: 97.69 minus 62.69=35 million. For this, the proposed dividend for the current year of Rs. 2.25 million has been added as this should have been taken in account whereas determining the net income to be transferred to Surplus and Reserves.

With the essential background on Profit and Loss Account and Fund Flow Statement having been prepared, you can here watch the Video programme "Understanding Financial Statement-Part II at your examination centre.