Q. Explain Economic Order Quantity?

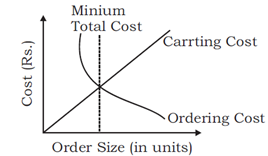

Economic Order Quantity (EOQ):- Economic order quantity (EOQ) is that quantity of material for which each order must be placed. Purchasing large quantities at one time as well as keeping the same as stock and increases carrying cost of inventories but reducing ordering cost of inventories. Alternatively small orders reduce the average inventory level thereby reducing the carrying cost of inventories however increasing the ordering costs because of increased number of purchase orders. Thus determination of economic order quantity is a trade-off between two types of inventory costs:

(i) Ordering costs: - Ordering costs comprises costs of placing orders as well as cost of receiving delivery of goods such as clerical expenses in preparing a receiving expenses, purchase order, transportation expenses, inspection expenses and recording expenses of goods received.

(ii) Carrying Cost: - Carrying cost comprises costs of maintaining or carrying inventory such as insurance expenses, godown rent etc. These costs vary with inventory size.

The sum of ordering costs as well as carrying costs represents the total costs of inventory. Economic order quantity is that order quantity at which the total of ordering as well as carrying cost is minimum. Economic order quantity is able to be explained with the help of following diagram:

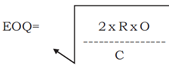

Formula: - EOQ can be resolved by the following formula:

EOQ = Economic Order Quantity

R = Annual purchase Requirements in units

O = Ordering cost per order

C = Carrying cot per unit.