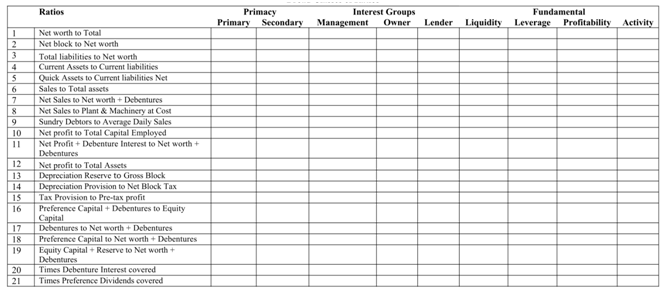

Table on subsequent page lists 21 ratios being calculated by the Bombay Stock Exchange. Tick the board class to that each of the 21 ratios belongs to the blank columns of the Table.

You should have begun grouping the ratios on the origin of what you have learnt regarding them. Though, we would assist you in this exercise. The extremely first ratio and for that issue the first three ratios are figured on net worth that is a parameter of vast interest to proprietors. However, the ratios do not reflect any of the four fundamental ratios that are: profitability, liquidity, leverage and activity. Also, they are not primary as they do not measure last profitability of capital or investment committed to the firm. Thus, ratios 1 to 3 are secondary and owner-oriented. Obviously, they do reveal one fundamental aspect that is: stability. The Bombay Stock Exchange categorizes such ratios under the board group of 'Stability ratios'.

This exercise of classification has specified you an idea about ratios, that are relevant for controlling business activities and the ratio wherein top management would be mainly interested. Clearly, they are activity ratios that we have classified as 'management-oriented' ratios. The initial ratio that is of universal relevance to top management will be particularly explained regarding its rationale and construction in this section.

You have noticed that the fundamental flow of activities of a business firm follows a specific sequence as:

Investment decision → financing of investment → acquisition of resources deployment of resources → disposal of output → reinvestment of surplus

This order needs several explanations. A classical business firm would get a decision to invest after an analysis of the projected outflows and inflows of the project. It will be followed through a plan to finance the project, which may be debt finance and / or proprietors' own funds. Finance will then be employed to build assists and commercial output will be acquired as per the project schedule as assuming there are no over-runs and delays Sales revenue will follow the disposal of the output and after meeting all expenses and costs as well as tax and finance charges, a decision will be acquired to compensate the owners dividend decision and reinvest the balance, whether any.

You will understand that the cycle of business activities commences along with the deployment of recourses and remove in the disposal of output. A business would as to have liked many these cycles as possible throughout a time period, as a year. Separately from raising the number of such cycles throughout a time period the management would be involved to decrease costs and expenses to the minimum at every stage of the cycle. Accounting ratios that belong to the category of "management-oriented activity ratios" facilitate business firms to exercise control over operations. The subsequent section of this section focuses attention on these ratios.

Table no.: Table listing 21 ratios being computed through the Bombay Stock Exchange Broad Classes of Ratios