1. Shares were certified at a premium of Rs. 1.50' per share.

2. Throughout the year Taxation liability regarding of 2002 was Rs, 20,000 and paid.

3. Throughout the year, Rs. 11,000 was provided for depreciation on Machinery and Plant.

4. An item of the plant the written down value Rs. 20,000 was sold on Rs. 25,000.

5. Throughout the year, a dividend @ 7.5 percent was paid.

6. Part of the investment costing Rs. 30,000 was sold at Rs. 35,000 and the profit was considered in Profit and Loss account.

Depends on the above information, we initially set ourselves to ascertain the cash inflow and outflow regarding Investment, Machineries and Plant and Tax, that cannot be determined through a mere inspection of their balances in two balance sheets. The duty is accomplished through preparing the respective accounts and examining the effects of the additional information on each of such. It is followed through preparation of an "Adjusted the Profit and Loss a/c" to determine the actual net profit earned throughout the period, in the light of the additional information now obtainable. In the last stage, the "Cash flow statement" is prepared as in Table 3.

Investment Account

|

To Opening balance

|

75,000

|

By Sale

|

|

35,000

|

|

To P & L a/c (profit on sale)

|

5,000

|

By Closing balance

|

|

1,30,000

|

|

To Bank (Purchases)

|

85,000

|

|

|

|

|

|

1,65, 000

|

|

|

1,65, 000

|

Plant & Machinery Account

To Opening balance 1,10,000 By Sale 25,000

To P & L a/c (profit on sale) 5,000 By P & L a/c- depreciation 11,000

To Bank 91,000 By Closing balance 1,70,000

2,06,000 2,06,000

Provision for taxation

|

To Bank

|

20,000

|

By Opening Balance

|

20,000

|

|

By Closing balance

|

35,000

|

By P & L a/c

|

35,000

|

55,000 55,000

Adjusted Profit and Loss Account

|

To General Reserve 15,000 By Opening balance

|

40,000

|

|

To Dividend 30,000 By Dividend Equalisn. Reserve

|

10,000

|

|

To Provision for tax 35,000 By Plant and Machineries profit on sale

|

5,000

|

|

To Depreciation 11,000 By Investment-profit on sale.

|

5,000

|

|

By profit for the year

|

|

|

(balancing figure)

|

1,01,000

|

|

To Goodwill 10,000

|

|

|

To Preliminary expenses 5,000

|

|

|

To Closing balance 55,000

|

|

|

1,61,000

|

1,61,000

|

|

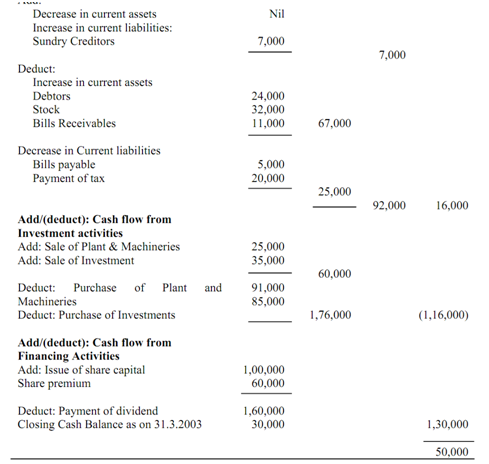

Table 3

|

|

|

Statement of Cash flow

|

|

|

for the period 1.4 2002 to 31.3.2003

|

|

|

|

Rs.

|

|

Opening Cash balance as on 1.4.2002

Add/(deduct): Cash flow from

Operating Activities

Net profit (Ref: P&L Adjustment a/c) 1,01,000

Add:

|

20,000

|