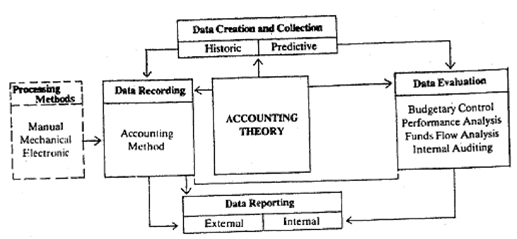

Data evaluation is observed as the most significant activity in accounting recently. Evaluation of data comprises controlling the activities of business along with the assist of budgets and standard costs for budgetary control, estimating the performance of business, the flow of funds analyzing and analyzing the accounting information for decision making reasons through choosing among option courses of action.

The interpretative and analytical work of counting may be for external or internal utilizes and may range from snap responds to elaborate reports created through extensive research. Capital project analysis, budgetary projections, financial forecast and analysis for reorganization, takeover or merger frequently produce research-based reports.

Data evaluation has the other dimension and this can be termed as the auditive work that focuses on verification of transactions as entered in the account books and authentication of financial statements. This work is complete through public professional accountants. Conversely, it has turn to be ordinary in these days for still medium-sized organizations to engage internal auditors to maintain a continuous watch above financial flows and review the operation of financial system.

Data reporting comprises two parts as external and internal. External reporting consider to the communication of financial information that are: earnings, funds and financial position, about the business to outside parties, for example: shareholders, government agencies and regulatory bodies of the government. Internal reporting is concerned along with the communication of results of financial analysis and evaluation to management for decision-making reasons.

You will identify that accounting theory has been demonstrated in the centre of the diagram. We will turn to the task of accounting theory in the subsequent section.

The central reason of accounting is to initiate the periodic matching of costs or efforts and revenues or accomplishments. This idea is the nucleus of accounting theory. Though, accounting is moving away by its traditional procedure based record maintaining function to the adoption of a role that emphasizes its social significance.