Q. Determine Interest coverage ratio?

Current interest coverage ratio = 7000/500 = 14 times

Increased profit before interest and tax = 7000 × 1.12 = $7.84m

Increased interest payment = (10m × 0.09) + 0.5m = $1.4m

Interest coverage ratio after one year = 7.84/ 1.4 = 5.6 times

The current interest coverage of Droxfol Co is elevated than the sector average and can be regarded as quiet safe. Subsequent the new loan note issue however interest coverage is less than half of the sector average, perhaps indicating that Droxfol Co mayn't find it easy to meet its interest payments.

(ii) Financial gearing

This ratio is defined here as previous charge capital/equity share capital on a book value basis

Current financial gearing = 100 × (5000 + 2500)/ (5000 + 22500) = 27%

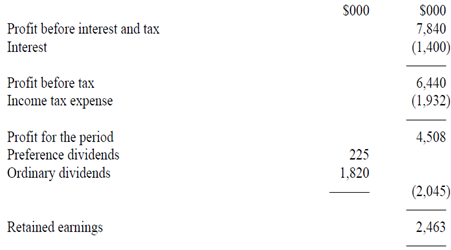

Ordinary dividend after one year = 0.35 × 5m × 1.04 = $1.82 million

Total preference dividend = 2500 × 0.09 = $225000

Income statement after one year

Financial gearing after one year = 100 * (15000 + 2500)/ (5000 + 22500 + 2463) = 58%

The current monetary gearing of Droxfol Co is 40% less in relative terms than the sector average and after the new loan note issue it is 29% more (in relative terms). This stage of financial gearing may be a reason of concern for investors and the stock market. Continued annual growth of 12% nevertheless will decrease financial gearing over time.