What was the business strategy underlying the merger? How was the acquisition financed? Was it a vertical, horizontal or conglomerate merger?

The strategy behind those mergers was to manage through economic cycles and volatile fuel prices, invest in fleet, improve services for the customers and achieve strategic objectives as the Delta airlines was strong in the south and the east and to Europe whereas Northwest was strong in the Midwest and across the pacific. They could have a more attractive product for their customers by putting both together. This merger was considered to give them benefits like more effective air craft utilization, a more comprehensive and diversified route system, diminished overhead and improved operational efficiency.

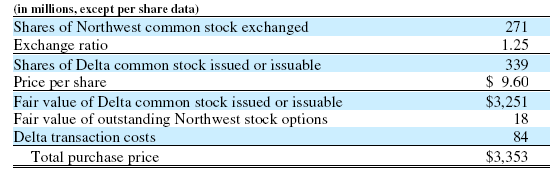

The merger was valued at $ 3.4 billion. This amount was derived from

i) By issuing 339 million shares of Delta common stock at a price of $9.60/share.

ii) Capitalized Merger-related transaction costs.

The purchase price also included the fair value of Delta stock options and other equity awards issued on the closing date in exchange for similar Northwest's securities. Northwest stock options & other equity awards vested on the closing date and were assumed by Delta and were modified to provide for the purchase of Delta common stock. The number of shares and, if applicable, the price of 1 share were maintained for the 1.25 exchange ratio. Earned stock options held by employees of northwest were considered part of purchase price.

Vertical, Horizontal or Conglomerate merger:

It was a vertical merger as both of the companies were engaged in same business of air carriage.