Reference no: EM131096984

1. The marginal propensity to consume is equal to:

A) the proportion of consumer spending as a function of aggregate disposable income.

B) the change in saving divided by the change in aggregate disposable income.

C) the ratio of the change in consumer spending to the change in aggregate disposable income.

D) the change in saving divided by the change in consumer spending.

2. The MPS plus the MPC must equal:

A) zero.

B) one.

C) income.

D) saving.

3. If the MPS = 0.1, then the value of the multiplier equals:

A) 1.

B) 5.

C) 9.

D) 10.

4. If the multiplier equals 4, then the marginal propensity to save must be equal to:

A) 1/4.

B) 1/2.

C) 3/4.

D) the marginal propensity to consume.

5. Suppose that the marginal propensity to consume is 0.8, and investment spending increases by $100 billion. The increase in aggregate demand is:

A) $100 billion, the same amount as investment spending.

B) $125 billion, composed of $100 billion in investment spending and $25 billion in consumption.

C) $80 billion, composed of $100 billion in investment spending and a decrease in consumption of $20 billion.

D) $500 billion, composed of $100 billion in investment spending and $400 billion in consumption.

6. The marginal propensity to save is:

A) savings divided by aggregate income.

B) the fraction of an additional dollar of disposable income that is saved.

C) 1 + MPC.

D) savings divided by aggregate income or 1 + MPC.

7. If disposable income increases by $5 billion and consumer spending increases by $4 billion, the marginal propensity to consume is equal to:

A) 20.

B) 0.8.

C) 1.25.

D) 9.

8. The spending multiplier is equal to:

A) MPC / MPS.

B) 1 / (1 - MPS).

C) MPC + MPS.

D) 1 / (1 - MPC).

9. Suppose that a financial crisis decreases investment spending by $100 billion and the marginal propensity to consume is 0.8. Assuming no taxes and no trade, by how much will real GDP change?

A) $500 billion decrease

B) $200 billion decrease

C) $800 billion decrease

D) $400 billion increase

10. Suppose the government increases spending by $100 billion as a stimulus package. If the MPC is 0.6, then equilibrium income will:

A) decrease by $250 billion.

B) increase by $250 billion.

C) increase by $600 billion.

D) decrease by $400 billion.

11. According to the National Bureau of Economic Research, the U.S. economy is going through a severe recession. Most households are trying to save more of their income than before. This increase in private spending will lead to:

A) an increase in aggregate income, as more saving means more funds for business investment.

B) a fall in aggregate income, as more saving means people will spend less.

C) no change in aggregate income, because there is no saving multiplier.

D) an increase in aggregate income, as an increase in saving will make people wealthier.

12. A key statistic to measure economic growth is:

A) the size of the government's budget.

B) real GDP per capita.

C) life expectancy.

D) the Dow Jones stock market index.

13. The standard of living in a country can be best measured by:

A) nominal GDP per capita.

B) real GDP per capita.

C) the productivity growth rate.

D) the business cycles.

14. To find the approximate number of years it takes the economy to double, one would:

A) divide its growth rate by 70.

B) divide 70 by its growth rate.

C) divide its growth rate by 100.

D) multiply its growth rate by 20.

15. Long-run economic growth depends almost entirely on:

A) labor productivity growth.

B) population growth.

C) agricultural production growth.

D) the number of hours worked.

16. Productivity is equal to:

A) real GDP divided by the number of workers.

B) real GDP divided by the population.

C) the number of workers per machine.

D) the total output produced.

17. The term human capital describes:

A) improvement made possible by better machines and the equipment available.

B) improvement in the technology available to the work force.

C) improvement in a worker's skills made possible by education, training and knowledge.

D) improvement in the robotics technology that can substitute for a human worker.

18. Which of the following will NOT increase the productivity of labor?

A) technological improvements

B) an increase in the capital stock

C) improvements in education

D) an increase in the size of the labor force

19. For developed countries, which of the following would be considered the most important driver in productivity growth?

A) the level of educational attainment

B) the amount of physical capital

C) technological progress

D) the abundance of natural resources

20. An example of physical capital would be:

A) a truck a company purchases for work.

B) a worker who physically learns to work on a truck his company buys.

C) a truck a worker buys for personal use like hunting, going to work, or going to the beach.

D) a truck a company purchases for work, a worker who physically learns to work on a truck his company buys, or a truck a worker buys for personal use like hunting, going to work, or going to the beach.

21. Workers now are more productive than in the past because workers today:

A) have more natural resources to use.

B) work four-day weeks.

C) are better educated and so have more human capital.

D) are physically larger than their parents.

22. According to the text, productivity is driven by all of the following EXCEPT:

A) physical capital.

B) human capital.

C) technological progress.

D) natural resources.

23. Investment in human capital shifts the aggregate production function:

A) downward.

B) leftward.

C) upward.

D) rightward.

24. All of the following are sources of federal tax revenue EXCEPT:

A) the personal income tax.

B) sales taxes.

C) social insurance taxes.

D) the corporate profits tax.

25. The federal government's largest source of tax revenue is:

A) property taxes.

B) personal income and corporate profit taxes.

C) sales taxes.

D) social insurance taxes.

26 Government payments to households for which no good or service is provided in return are called:

A) transfer payments.

B) government purchases.

C) consumption expenditures.

D) investment expenditures.

27. In the basic equation of national income accounting, the government directly controls _____ and influences ______.

A) G;C and I

B) T; G and C

C) C; X and M

D) I; G and T

28. A change in taxes or a change in government transfers affects consumption through a change in:

A) autonomous consumption.

B) the marginal propensity to save.

C) disposable income.

D) government spending.

29. Which of the following is NOT a method of fiscal policy?

A) changing tax rates

B) government transfers

C) government purchases of goods and services

D) changes in the money supply

30. Suppose the economy is in a recessionary gap. To move equilibrium aggregate output closer to the level of potential output, the best fiscal policy option is to:

A) decrease government purchases.

B) decrease taxes.

C) decrease government transfers.

D) increase real interest rates.

31. If the current level of real GDP lies below potential GDP, then an appropriate fiscal policy would be to _____, which will shift the _____ curve to the _____.

A) increase government purchases; AD; left.

B) increase transfer payments; AS; right.

C) increase tax rates; AD; right.

D) increase government purchases; AD; right.

32. Suppose the economy is in an inflationary gap. To move equilibrium aggregate output closer to the level of potential output, the best fiscal policy option is to:

A) lower tax rates.

B) decrease government purchases.

C) increase the investment tax credit.

D) lower the real interest rate.

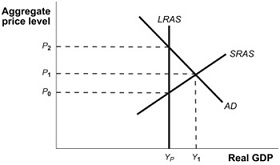

Use the following to answer questions 33-34:

Figure: Short-Run Equilibrium

33. (Figure: Short-Run Equilibrium) The accompanying graph shows the current short-run equilibrium in the economy. Appropriate fiscal policy action in this situation would be:

A) a decrease in transfer payments.

B) an increase in government purchases.

C) a decrease in tax rates.

D) an increase in the investment tax credit.

34. (Figure: Short-Run Equilibrium) The accompanying graph reflects a short-run inflationary gap. According to the labeling on the graph, the size of the inflationary gap is equal to:

A) P2 - P1.

B) Y1 - YP.

C) P2 - P0.

D) P1 - P0.

35. If the economy is at potential output and consumption spending suddenly decreases because of a fall in consumer confidence, the appropriate fiscal policy is:

A) a decrease in government transfers.

B) an increase in government spending.

C) a decrease in government spending.

D) an increase in the money supply to decrease interest rates.

36. Which of the following is an expansionary fiscal policy?

A) an increase in the money supply that decreases interest rates

B) an increase in taxes that reduces the budget deficit and decreases consumption

C) a decrease in government spending on the space program

D) an increase in unemployment benefits

37. A reduction in government transfers ________, therefore shifting the aggregate demand curve to the ________.

A) increases labor costs to companies, increasing investment; left

B) decreases government purchases of goods and services, decreasing consumption; right

C) increases the marginal propensity to save, decreasing consumption; right

D) decreases disposable income and consumption; left

38. A cut in taxes ________, therefore shifting the aggregate demand curve to the ________.

A) decreases government transfers and consumption; right

B) increases disposable income and consumption; right

C) decreases the marginal propensity to save, increasing consumption; left

D) increases corporate profits and investment; left

39. To close a recessionary gap by employing fiscal policy, the government could:

A) increase national savings so that the interest rate falls.

B) lower the annual income exempt from paying the personal income tax.

C) lower the corporate income tax rate.

D) lower the amount of unemployment insurance benefits.

40. To close an inflationary gap by employing fiscal policy, the government could:

A) reduce budget allocations to interstate highway maintenance.

B) increase federal subsidies to state universities.

C) lower the corporate income tax rate.

D) raise the average amount awarded for a disability pension.

41. Money is anything that:

A) serves as a medium of exchange for goods and services.

B) can be converted into silver with relatively little loss in value.

C) can be converted into gold with relatively little loss in value.

D) is traded in the stock market.

42. An economy that lacks a medium of exchange must use a(n):

A) anarchist system.

B) barter system.

C) communist system.

D) expanding system.

43. Which of the following assets is the MOST liquid?

A) a $50 bill

B) a $50 Amazon.com gift certificate

C) 100 shares of Microsoft stock

D) an economics textbook

44. Which of the following combination of assets is considered to be money?

A) currency in circulation, checkable bank deposits, and credit cards

B) currency in circulation, checkable bank deposits, and travelers' checks

C) currency in circulation and in bank vaults, checkable bank deposits, and travelers' checks

D) currency in circulation and in bank vaults, checkable bank deposits, and credit cards

45. Suppose a group of people decided to create their own economic system with cartons of milk serving as money. If we decided to use this "liquid asset" as our medium of exchange and all prices were measured in cartons of milk, milk would still not be a good form of money because it would not be a good:

A) medium of exchange.

B) unit of account.

C) store of value.

D) near-money.

46. "Tuition at State University this year is $8,000." Which function of money does this statement best illustrate?

A) as a store of value

B) as a medium of exchange

C) as a unit of account

D) as a means of deferred payment

47. The functions of money are:

A) expander of economic activity, medium of exchange, and store of value.

B) medium of exchange, store of value, and factor of production.

C) store of value, medium of exchange, and determinant of investment.

D) store of value, unit of account, and medium of exchange.

48. When a person makes price comparisons among products, money is being used as a(n):

A) unit of account.

B) expander of economic activity.

C) medium of exchange.

D) checkable deposit.

49. When you buy a ticket to the rodeo, you are using money as a(n):

A) expander of economic activity.

B) store of value.

C) factor of production.

D) medium of exchange.

50. When you discover money in your coat that you placed there last winter, you unexpectedly find you were using money as a(n):

A) medium of exchange.

B) expander of economic activity.

C) factor of production.

D) store of value.

51. When we keep part of our wealth in a savings account, money is playing the role of:

A) medium of exchange.

B) unit of account.

C) barter.

D) store of value.

52. When countries replaced gold and silver coins with paper money exchangeable for certain amounts of precious metals, the monetary system evolved from:

A) using commodity money to using fiat money.

B) using commodity-backed money to using fiat money.

C) using commodity money to using commodity-backed money.

D) using fiat money to using commodity-backed money.

53. Commodity money is:

A) whatever the government has decreed is money.

B) a good used as a medium of exchange that has other uses.

C) money used for commodity futures trading.

D) whatever people accept as money.

54. Money that has value apart from its use as money is:

A) fiat money.

B) currency.

C) convertible paper money.

D) commodity money.

55. Money that the government has ordered to be accepted as money is:

A) fiat money.

B) currency.

C) convertible paper money.

D) commodity money.

56. Money whose value derives entirely from its official status as a means of exchange is known as:

A) commodity money.

B) commodity-backed money.

C) fiat money.

D) bank reserves.

57. A share of stock is considered:

A) an asset for the owner of the stock.

B) part of M2.

C) a liability for the owner of the stock.

D) part of the money supply.

58. The primary difference between M1 and M2 is that:

A) the dollar amount of M1 is much larger than the dollar amount of M2.

B) M1 includes checkable deposits, but M2 does not.

C) M2 includes checkable deposits, but M1 does not.

D) M2 includes savings deposits and time deposits, but M1 does not.

59. Suppose you find a $50 bill that you put in a coat pocket last winter. If you deposit it in your checking account:

A) M1 increases by $50.

B) M2 increases by $50.

C) M1 and M2 both increase by $50.

D) there is no change in M1 or M2.

60. If you transfer $1,000 from your savings account to your checking account:

A) M1 decreases by $1,000, and M2 increases by $1,000.

B) M1 increases by $1,000, and M2 decreases by $1,000.

C) M1 and M2 don't change.

D) M1 increases by $1,000, but M2 doesn't change.

61. The Federal Reserve is able to have an impact on financial crises because it:

A) determines tax rates.

B) determines government spending.

C) conducts monetary policy.

D) is responsive to the people who elected its members to office.

62. Generally, the more liquid an asset is:

A) the lower its purchasing power.

B) the lower its rate of return.

C) the higher its capacity to store value over time.

D) the higher its rate of return.

63. The short-term interest rate is the interest rate on financial assets that mature within:

A) less than a year.

B) a year or more.

C) 2 years.

D) 5 years.

64. If a checking account has an interest rate of 1% and a Treasury bill has an interest rate of 3%, the opportunity cost of holding cash in a checking account is:

A) zero.

B) 0.02%.

C) 1%.

D) 2%.

65. The money demand curve shows the relationship between the:

A) money supply and the quantity of money demanded.

B) aggregate price level and the nominal quantity of money demanded.

C) interest rate and the nominal quantity of money demanded.

D) real GDP and the nominal quantity of money demanded.

66. The money demand curve is:

A) downward-sloping because the opportunity cost of holding money is inversely related to the interest rate.

B) downward-sloping because the opportunity cost of holding money rises as the interest rate rises.

C) downward-sloping because the opportunity cost of holding money rises as the interest rate falls.

D) upward-sloping because the opportunity cost of holding money rises with the interest rate.

67. A 20% increase in the aggregate price level will increase the quantity of money demanded by:

A) 20%.

B) the money multiplier.

C) 10%.

D) half the money multiplier.

68. An increase in interest rates causes the demand for money to:

A) increase.

B) decrease.

C) stay the same.

D) shift to the right.

69. Workers in country A have cost-of-living adjustments (COLAs), which adjust wages to offset the effect of inflation, in their wage contracts, and workers in country B do NOT. When the central banks of countries A and B increase the money supply:

A) prices in country A increase faster than prices in country B.

B) prices in country B increase faster than prices in country A.

C) prices in countries A and B will change at the same rate.

D) COLAs have no effect on the speed of price changes.

70. Inflation doesn't reduce purchasing power if:

A) prices of essential products, such as food and gasoline, don't increase too much.

B) nominal wages rise at the same rate as prices.

C) it remains under 10% per year.

D) the Federal Reserve increases the money supply enough to offset it.

71. In the classical model, it is thought that the long-run:

A) and short-run aggregate supply curves are both upward sloping.

B) aggregate supply curve is vertical and the short-run aggregate supply curve is upward sloping.

C) and short-run aggregate supply curves are both vertical.

D) aggregate supply curve is upward sloping and the short-run aggregate supply curve is vertical.

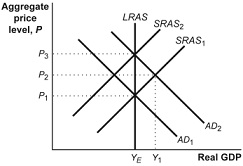

Use the following to answer question 72:

Figure: AD-AS Model

72. (Figure: AD-AS Model) Refer to the information in the figure. Suppose the economy is at YEwith a price level of P1. Which of the following would represent the new long-run equilibrium position if the aggregate demand curve shifted to the right from AD1 to AD2 as a result of an increase in the money supply?

A) YE and P2

B) YEand P1

C) Y1 and P2

D) YE and P3

73. In the short run in periods of low inflation, an increase in aggregate demand from a position of full employment leads to:

A) higher prices and higher unemployment.

B) higher prices and higher output.

C) lower prices and higher output.

D) lower prices and higher unemployment.

74. In the long run, an increase in aggregate demand from a position of full employment leads to:

A) higher prices and higher output.

B) higher prices and the same output.

C) higher output and lower prices.

D) higher output and higher unemployment.

75. In the long run, any given percentage increase in the money supply:

A) decreases real GDP.

B) leads to an equal percentage increase in the overall price level.

C) increases real GDP.

D) leads to an equal percentage decrease in the unemployment rate.

76. Investment banks differ from commercial banks because:

A) commercial banks are allowed to advertise, but investment banks are prohibited from advertising.

B) commercial banks can have offices only in one state, but investment banks can have offices in many countries.

C) commercial banks do not sell foreign currencies, but investment banks do.

D) commercial banks accept deposits from customers, but investment banks do not.

77. Without banks, people would:

A) hold more of their wealth as cash.

B) hold less of their wealth as cash.

C) invest most of their wealth in real estate.

D) earn higher rates of return and enjoy more liquidity.

78. The first bankers were:

A) farmers.

B) merchants who engaged in foreign trade.

C) insurance companies.

D) goldsmiths.

79. One of the first forms of paper money developed when:

A) the Federal Reserve was formed in the early 1900s.

B) the government of Rome printed money to pay Roman soldiers.

C) customers who had deposited gold and silver with medieval goldsmiths began to use their receipts to pay for purchases.

D) Europe adopted the euro.

80. Depository banks:

A) borrow on a short-term basis from depositors and lend on a long-term basis to others.

B) borrow on a long-term basis from depositors and lend on a long-term basis to others.

C) borrow on a short-term basis from depositors and lend on a short-term basis to others.

D) borrow on a long-term basis from depositors and lend on a short-term basis to others.

81. Most of a bank's short-term liabilities are:

A) loans from the Federal Reserve.

B) loans from the U.S. Treasury.

C) loans to its customers.

D) deposits of customers' savings.

82. Most of a bank's assets are:

A) loans from the Federal Reserve.

B) loans to the Federal Reserve.

C) loans to its customers.

D) deposits of savings from its customers.

83. Which of the following is an example of maturity transformation?

A) Anne sells her house for $200,000 and uses the money to open a bakery.

B) Matthew sells his car and uses the money to pay college tuition.

C) Justin takes $10,000 from his savings account and uses it to buy some Apple stock.

D) Michael closes his checking account at Bank of America and opens a checking account at a local credit union.

84. Which of the following are regulations intended to prevent bank runs?

A) the Sherman Anti-Trust law

B) regulation Q, which prohibits banks from paying interest on demand deposits

C) deposit insurance

D) maturity transformation

85. Which of the following is a characteristic of the classical school of economics?

A) It emphasizes the short run.

B) It emphasizes the flexibility of wages and prices.

C) Potential output is a problem, since it cannot be achieved without active policy.

D) It advocates the use of discretionary fiscal policy.

86. The beginning of a recession is declared by the:

A) National Bureau of Economic Research.

B) Treasury Department.

C) Fed.

D) president.

87. The General Theory of Employment, Interest, and Money was written by:

A) Adam Smith. C) Joseph Schumpeter.

B) Paul Samuelson. D) John Maynard Keynes.

88. According to Keynesian theory:

A) the long-run and short-run aggregate supply curves are identical.

B) a decrease in aggregate demand leads to decreases in output and prices.

C) a decrease in aggregate demand will decrease prices but not output.

D) the short run is relatively unimportant.

89. The main ideas of Keynesian economics are:

A) the importance of the long run over the short run, and an emphasis on a vertical SRAS curve.

B) the importance of the long run over the short run, and an equal emphasis on the AD curve and the SRAS curve.

C) the importance of the short run over the long run, and an emphasis on the AD curve and a rising SRAS curve.

D) the importance of the free market with no government intervention, and an emphasis on monetary policy in the long run.

90. Macroeconomic policy activism:

A) involves the use of political activism made popular by liberal economists.

B) mandates a balanced government budget.

C) involves the use of monetary and fiscal policy to smooth out the business cycle.

D) was the tool used by classical economists.

91. The main reason that the Great Depression ended was:

A) effective monetary policy by the Fed under the leadership of Paul Volcker.

B) the defeat of Adolf Hitler in Germany in the 1930s.

C) Winston Churchill's foreign policy.

D) deficit spending in the United States to finance World War II.

92. Open-economy macroeconomics is the branch of economics that deals with:

A) reducing regulations on business.

B) the relationships between economies of different nations.

C) reducing employment discrimination.

D) the provision of financial information to investors.

93. If the United States imports more goods from Japan than it exports to Japan, how can the difference be financed?

A) U.S. consumers would simply borrow money from domestic banks.

B) The United States could buy more Japanese assets.

C) The United States could sell assets and create a liability obligating Americans to pay for those imports in the future.

D) The United States could sell assets to the Japanese, which would reduce its liabilities.

94. Economists summarize a country's transactions with other countries with a(n) _____ account.

A) circular flow

B) balance of payments

C) exchange rate

D) purchasing power parity

95. When the United States gives foreign aid to developing nations in Africa, which of the following balance of payments account is affected?

A) current account

B) financial account

C) reserve account

D) foreign exchange account

96. The difference between a country's exports and imports of goods alone-not including services-is the:

A) merchandise trade balance.

B) balance of payments on good and services.

C) balance of payments on current account.

D) current account.

97. If a country has a current account deficit, it must have a:

A) financial account surplus.

B) balance of payment surplus.

C) financial account deficit.

D) balance of payments deficit.

98. A current account surplus exists when:

A) the balance on the current account is positive.

B) net exports are negative.

C) spending flowing out of the country for goods and services exceeds spending flowing into the country for its goods and services.

D) imports exceed exports.

99. A current account deficit exists when:

A) the balance on current account is negative.

B) spending flowing out of the country for goods and services is less than spending flowing into the country for its goods and services.

C) net exports are positive.

D) an economy buys less from foreigners than it sells to them.

100. The difference between a country's exports and its imports of goods and services is known as the:

A) trade balance.

B) balance of payments on goods and services.

C) balance of payments on current account.

D) balance of exchange.