Reference no: EM13960767

Patriot, Inc (a C corporation) filed for Chapter 11 bankruptcy protection during August, 2011 and has worked out a re-organization plan that was accepted by the Bankruptcy Court and the creditors’ committee. Under the plan, the note holder (which is a venture capital firm that financed the business) with a notes payable of $125,000,000 will receive new common stock; the old common stock will be cancelled. The new Patriot, Inc will emerge from bankruptcy on November 30, 2011.

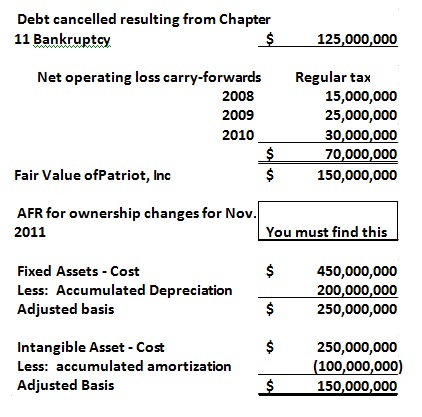

Ed Harris will continue as the CEO and will own 2% of the stock resulting from a conversion of liabilities the corporation owed him. He is concerned about the tax implications of debt forgiveness. The corporation has the following tax attributes and selected tax basis as follows:

He has heard that debt forgiveness results in taxable income which is called cancellation of debt income which, while not immediately recognized for tax purposes, reduces tax attributes. He believes the new corporation will be profitable with the burden of the debt repayment removed. His preference would be to preserve the tax carryovers to offset future taxable income.

He is also concerned about Section 382 which he heard about from a colleague at his country club. He is not sure how this will impact the future NOL utilization.

He has asked for your advice as to the best way from a tax perspective to treat the cancellation of debt to preserve the NOL carryovers and to describe how Section 382 will operate to limit the use of the NOLs. He anticipates the new corporation making an acquisition within six months which will increase revenue 15% and profits by 12%. Since this acquisition is planned, he wants your memo to cover electing out of IRC Code Section 382 (l) (5), which he has heard can be beneficial to the future utilization of NOLs.

Prepare a tax memo on these issues (no more than four pages), to the tax partner on this engagement, Robert Holder. You need to read Sections 382 and 108 and the related regulations to develop your solution. You must show how you plan to reduce the tax attributes resulting from the cancellation of debt income (see the ordering rules and elections that may be made). In addition to searching the primary tax sources, you should search the web as many accounting and law firms have written articles about this topic. You should also consult IRS form 982 and the instructions. You should discuss the Code, Regulations, Court Cases, Rulings, etc., that will support your strategy to advise and assist Mr. Harris accomplish his goals, if possible.

|

How do legal restrictions on practice for nurses

: How do legal restrictions on practice for nurses and physicians tend to affect the observed elasticity's of substitution? Would they tend to be higher if legal restrictions were removed? Would quality of care be affected?

|

|

Factor analysis project

: Factor analysis project, Prepare a report of the results of 2 and a half double-spaced pages along with tables associated with the results. Also include a log stating the steps used in the research, and any pertinent SPSS printouts.

|

|

Refer to the template spreadsheet provided

: Refer to the template spreadsheet provided. Stock A has an annualized volatility equal to 18% for which you have just written an out-of-the-money 26 week call option. The risk free rate is 2% per annum and the strike price is $100. There is anothe..

|

|

Revenue recognition

: Revenue Recognition - Suppose for purposes of this question that Cisco closes its books quarterly. What journal entry or entries did Cisco make on October 31, 2011?

|

|

Prepare a tax memo on these issues

: Prepare a tax memo on these issues (no more than four pages), to the tax partner on this engagement, Robert Holder. You need to read Sections 382 and 108 and the related regulations to develop your solution.

|

|

Outline the k-means clustering algorithm

: Outline the k-means clustering algorithm for a set of data defined as vectors xi. Include a diagram to support your algorithm description.

|

|

Explain the role of sensitivity analysis

: Explain the role of sensitivity analysis in terms of understanding the properties of a model. In particular, address the issue of how variation in model inputs can be assessed, and why this is important.

|

|

Venture capital and private equity

: Venture Capital and Private Equity. You have decided to begin a new venture and are armed with an understanding of the market for your products or services. How do you figure out what resources (financial and nonfinancial) you will need to bring that..

|

|

Principal technologies and standards for wireless networking

: What are the principal technologies and standards for wireless networking, communications, and Internet access? Define Bluetooth, wi-fi, WiMax, and 3G and 4G networks. Will these standards last until 2025? How often should they be updated?

|