Reference no: EM13493684

1.You bought a stock one year ago for $50 per share and sold it today for $55 per share. It paid a $1 per share dividend today.

a. What was your realized return?

b. How much of the return came from dividend yield and how much came from capital gain?

2.Repeat Problem 4 assuming that the stock fell $5 to $45 instead.

a. Is your capital gain different? Why or why not?

b. Is your dividend yield different? Why or why not?

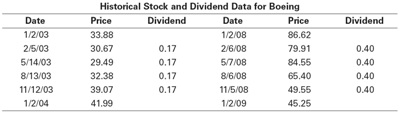

3.Using the data in the following table, calculate the return for investing in Boeing stock from January 2, 2003, to January 2, 2004, and also from January 2, 2008, to January 2, 2009,assuming all dividends are reinvested in the stock immediately.