Reference no: EM131230038

Unit Seven Application Assignment (Capital Investment Decisions)

1. The director of capital budgeting for Big Sky Health Systems, Inc., has estimated the following cash flows in thousands of dollars for a proposed new service:

| Year |

Expected Net Cash Flow |

| 0 |

($100) |

| 1 |

70 |

| 2 |

50 |

| 3 |

20 |

The project's cost of capital is 10 percent.

a. What is the project's payback period?

b. What is the project's NPV?

c. What is the project's IRR? Its MIRR?

2. California Health Center, a for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated pretax salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day for 250 days a year for each year of the project's life. On average, each procedure is expected to generate $80 in collections, which is net of bad debt losses and contractual allowances, in its first year of use. Thus, net revenues for Year 1 are estimated at 15 x 250 x $80 = $300,000.

Labor and maintenance costs are expected to be $100,000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in Year 1. The cost for expendable supplies is expected to average $5 per procedure during the first year. All costs and revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year.

The equipment falls into the MACRS five-year class for tax depreciation and is subject to the following depreciation allowances:

Year Allowance

1 0.20

2 0.32

3 0.19

4 0.12

5 0.11

6 0.06

The hospitals tax rate is 40 percent, and its corporate cost of capital is 10 percent.

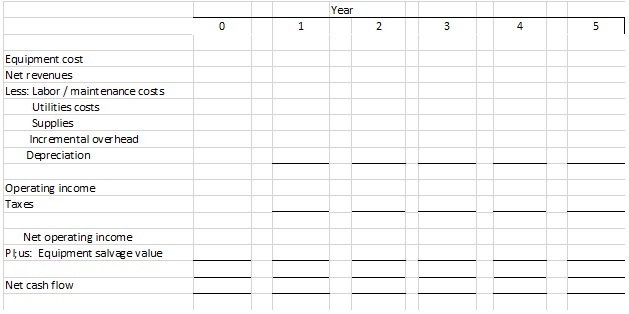

a. Estimate the project's net cash flows over its five-year estimated life. (Hint: Use the following format as a guide.)

b. What are the project's NPV and IRR? (Assume for now tht the project has average risk.)

3. Heywood Diagnostic Enterprises is evaluating a prject with the following net cash flows and probabilities (Prob.):

Year Prob. = 0.2 Prob. = 0.6 Prob. = 0.2

0 ($100,000) ($100,000) ($100,000)

1 20,000 30,000 40,000

2 20,000 30,000 40,000

3 20,000 30,000 40,000

4 20,000 30,000 40,000

5 30,000 40,000 50,000

The Year 5 values include salvage value. Heywood's corporate cost of capital is 10 percent.

a. What is the project's expected (i.e., base case) NPV assuming average risk? (Hint: The base case net cash flows are the expected cash flows in each year.)

b. What are the project's most likely, worst-case, and best-case NPVs

c. What is the project's expected NPV on the basis of the scenario analysis?

d. What is the project's standard deviation of NP?

e. Assume that Heywood's managers judge the project to have lower-than-average risk. Furthermore, the company's policy is to adjust the corporate cost of capital up or down by 3 percentage points to account for differential risk. Is the project financially attractive?

4. Fargo Memorial Hospital has annual net patient service revenues of $14,400,000. It has two major third-party payers, plus some of its patients are self-payers. The hospital's patient accounts manager estimates tht 10 percent of the hospital's paying patients (its self-payers) pay on Day 30, 60 percent pay on Day 60 (Payer A), and 30 percent pay on Day 90 (Payer B). (Five percent of total billings end up as bad debt losses, but tht is not relevant for the problem.)

a. What is Fargo's average collection period? (Assume 360 days per year throughout this problem.)

b. What is the firm's current receivables balance?

c. What would be the firm's new receivables balance if a newly proposed electronic claims system resulted in collecting from third-party payers in 45 and 75 days, instead of in 60 and 90 days?

d. Suppose the firm's annual cost of carrying receivables was 10 percent. If the electronic claims system costs $30,000 a year to lease and operate, should it be adopted? (Assume that the entire receivables balance has to be financed.)

Directions

The students are expected to carefully read the assignment instructions, then thoroughly and explicitly address each question for both problems.

Microsoft Excel will be used to setup and perform the financial computations; however, the questions and their corresponding responses should be written up in a Microsoft Word document. IMPORTANT: Make certain that there is a detailed description of how the calculations were performed. Students should create and label one tab in the Excel spreadsheet for each problem, but should prepare one Word document that contains the questions and responses for both problems. The amortization schedule should be developed in Excel.

While there is no minimum number of references that need to be utilized to support the completion of this assignment, it is generally understood that outside sources, including the text, will be necessary to complete the problems.

The document must adhere to the APA writing style in terms of using in-text citations and the listing of sources on the references page.

The Microsoft Word document and Excel spreadsheet are to be uploaded to Submit Assignment.

This assignment includes two parts. Use the APA style headings to separate major parts of the assignment.