Reference no: EM131020811

Practice Final Exam-

1. Microeconomics focuses on the determination of issues like unemployment, inflation, and interest rate.

a. True

b. False

2. It is meaningful to make a comparison between Japanese GDP and German GDP.

a. True

b. False

3. Consider the market for tennis racquets (tennis racquets are a normal good). If the price of a can of tennis balls decreases due to improved technology in the manufacture of tennis balls, then the price of tennis racquets will decrease and the quantity of tennis racquets purchased will increase.

a. True

b. False

4. If the market price is below the equilibrium price, there will be an excess supply and the market price will rise.

a. True

b. False

5. Tom makes $20 an hour as a clerk. He must take 2 hours off work (without pay) to go to the dentist to have a tooth pulled. The dentist charges $100. What is the entire opportunity cost of Tom's visit to the dentist?

a. $20

b. $40

c. $100

d. $120

e. $140

Use the following information to answer the next TWO (2) questions.

The following table describes the production possibilities for some country:

|

PLAN

|

PCs (in millions)

|

Cars (in millions)

|

|

V

|

0

|

120

|

|

W

|

40

|

110

|

|

X

|

80

|

85

|

|

Y

|

120

|

50

|

|

Z

|

160

|

0

|

6. Which of the following statements is a FALSE statement given the above information?

a. Plan V, which requires no PCs to be produced, is an efficient plan of production.

b. The combination of production of 70 PCs and 70 Cars is a feasible plan.

c. The opportunity cost of moving from plan V to plan X is 80 PCs AND 35 Cars.

d. The opportunity cost of moving from plan Z to plan Y is 40 PCs.

e. This PPF satisfies the principle of increasing opportunity cost.

7. Given the above information, which of the following statements is the BEST description about the "movement" from plan X to plan Y?

a. A hail storm damages cars.

b. The GDP of this country has been increasing.

c. There is a new technology developed in producing PCs.

d. We are observing data from different years.

e. Since they are both feasible plans, this is not really a movement, but rather a comparison between different production plans.

8. The demand for doughnuts and the supply of doughnuts in Madison are given by the equations

Demand for Doughnuts: Q = 800 - 60P

Supply of Doughnuts: Q = 25P - 50

where Q is the quantity of doughnuts (measured in dozens) and P is the price per dozen doughnuts. Given this information, what is the equilibrium price for a dozen of donuts?

a. $8.00

b. $8.50

c. $10.00

d. $11.00

e. $12.00

9. Suppose the market for gasoline in Madison is initially in equilibrium. What will happen to the equilibrium price and quantity of gasoline as a result of an increase in the price of crude oil?

a. Price goes up, quantity goes down

b. Price goes down, quantity goes down

c. Price goes down, quantity goes up

d. Price goes up, quantity goes up

e. Price and quantity are both indeterminate

10. Suppose city officials decide rents are too high in Madison. They enact an ordinance placing a maximum rent of $500 on two-bedroom apartments (For simplicity's sake, let's assume all apartments are reasonably comparable in size, quality, location, etc.). This ordinance, if effective, will

a. Create a housing shortage.

b. Result in the creation of other rationing devices for the market in apartments since price will no longer be free to clear the market, i.e. to equate the quantity supplied to the quantity demanded.

c. Reduce landlords' investments in property maintenance over time.

d. Answers (a) and (b) are both true.

e. Answers (a), (b) and (c) are all true.

11. Madison liberals often talk about the Living Wage. Suppose the Living Wage is defined as a guaranteed hourly wage rate such that a recipient working full-time would earn an income above the US poverty standard. If this Living Wage is enacted, and is greater than the equilibrium wage rate, then

a. The market will adjust to this and find a new equilibrium.

b. There will be involuntary unemployment.

c. Everyone will benefit from this program.

d. It is possible that this program might actually negatively impact low wage earners.

e. Answers (b) and (d) are both true.

12. To find the market demand curve:

a. Add the quantities demanded by each individual at a particular price together to get a single point on the market demand curve. Continue this process selecting different prices to find the market demand curve.

b. Add the prices each individual is willing to pay for a particular quantity together to get a single point on the market demand curve. Continue this process selecting different quantities to find the market demand curve.

c. All demanders must demand zero units of the good at the same price.

d. Answers (a) and (c) are both true.

e. Answers (b) and (c) are both true.

13. The market for rice has a VERY INELASTIC demand while the price elasticity of supply is elastic. Suppose the government imposes an excise tax on the producers of this market. Which of the following statements is TRUE?

a. The economic burden of the tax falls on producers and consumers equally.

b. The consumers bear most of the economic burden of the tax.

c. No matter how inelastic the demand curve is, the seller must bear most of the economic burden of the tax.

d. The tax on this good results in relatively large tax revenues while simultaneously discouraging consumption of the good.

e. Answers (b) and (d) are both true.

14. The market for a specific brand of sugar is shown in the following figure. In this figure, the demand curve is a horizontal line and the supply curve is a straight line with a positive slope.

Pe is the equilibrium price BEFORE the tax and Qe is the equilibrium price BEFORE the tax.

Suppose the government wants to impose an excise tax of $1 per pound of sugar on the producers of this brand of sugar. Which of the following statements is TRUE given the above figure?

a. There must be a loss in consumer surplus after the excise tax is imposed.

b. The consumers bear an economic share of this excise tax even if the producers have the legal responsibility to pay the excise tax.

c. The producers bear the whole economic burden of this excise tax.

d. There is no deadweight loss; that is, this excise tax is efficient.

15. Using the information in the table below, which of the following statements is TRUE?

Year CPI Nominal Wage

1980 100 $6/hour

1990 200 $10/hour

2000 300 $12/hour

a. The real wage is increasing from 1980 to 2000.

b. The real wage is decreasing from 1980 to 2000.

c. The real wage in 1990 is $8/hour.

d. The real wage in 2000 is greater than the nominal wage in 2000.

e. Answers (a) and (d) are both true.

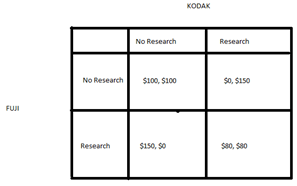

16. Consider two rival producers of camera film, Kodak and Fuji. Each firm canunder take one of two strategies, Research or No Research. The film producers have the following matrix of profits, depending on each firm's actions. Profits are given in millions of dollars. The first entry in each box corresponds to Fuji's profits while the second entry corresponds to Kodak's profits.

Given the above information, which of the following statements is TRUE?

a. Fuji's dominant strategy is No Research.

b. Kodak's dominant strategy is No Research.

c. Fuji and Kodak will maximize joint profits if both play their dominant strategies.

d. All of the above statements are true.

e. None of the above statements are true.

17. The graph depicts a market for a particular good such that the production of the good imposes an externality. MSC refers to marginal social cost, MPC refers to marginal private cost, MPB refers to marginal private benefit, and MSB refers to marginal social benefit.

Given the above graph, which of the following statements is TRUE?

a. There is an external cost in this industry.

b. There is an external benefit in this industry.

c. If we let the market determine how much of the good to produce, too little will be produced, relative to the output that is socially efficient.

d. The market allocation is socially efficient.

e. Answers (a) and (c) are both true.

18. Suppose that good X is a public good. Then

a. If one individual consumes X, then this will decrease how much of X another individual can consume.

b. It is impossible, or very costly, to prevent an individual from consuming X.

c. If we let the market decide how much X is produced, then in general we will have an allocatively efficient amount of X produced.

d. Answers (b) and (c) are both true.

e. Answers (a), (b) and (c) are all true.

19. Economists believe that there is a tradeoff between current consumption and future consumption. Which of the following statements is true?

a. Forgoing current consumption means that people consume and enjoy less "stuff" during the current period and that means that they are worse off and will never be able to recover from the losses they suffer by forgoing consumption.

b. Forgoing current consumption means that there are fewer resources devoted to future consumption: this means that in the future the level of feasible production will be enhanced compared to what that level would be if current consumption was higher.

c. There is an expression that states "a bird in the hand is better than two birds in a bush": this expression encourages people to maximize their current consumption since one never knows what will happen in the future. This expression does not completely consider the tradeoff between current and future consumption.

d. It does not matter whether an economy chooses current consumption or future consumption: neither choice affects a country's production possibility frontier.

20. Wheelan argues that

a. Only rich countries benefit from globalization.

b. Poor countries can benefit from trade.

c. World trade is imposed by rich countries on poor countries and this world trade is harmful to those poor countries.

d. Answers (a) and (c) are both true.

21. International economics

a. Is a zero-sum game where it is only possible for a country to gain economically from trade if another country loses economically from that trade?

b. Is not a zero-sum game: through trade it is possible for all countries to "become richer over time".

22. In 1991 Argentina

a. Gave up control of its monetary policy as a necessary step to eliminating high levels of inflation.

b. Adopted a strict policy where the Argentine peso would be worth one U.S. dollar.

c. Adopted policy that resulted in Argentina having no control over their exchange rate or their money supply.

d. Answers (a), (b) and (c) are all true.

23. Wheelan discusses the relationship between China and the U.S. and refers to it as "an unhealthy symbiotic relationship that has the potential to come unglued at any time". Which of the following statements does Wheelan make to support his position?

a. "China has created a very successful development strategy built upon 'export-led growth'."

b. "China's export-oriented development strategy depends on keeping the renmimbi relatively cheap."

c. "The Chineses government has used exports to generate jobs and growth."

d. "America has funded its dissavings with enormous loans from China."

e. Answers (a), (b), (c), and (d) are all true.

24. The U.S. has accumulated a high level of debt in their trade with China. One option for handling this debt burden

a. Is for the U.S. to reduce the level of this debt by inflating its currency.

b. Is for China to dump its holdings of dollar-denominated assets quickly so that China does not lose financially.

c. Is for China to increase the level of its exports to the U.S.

d. Answers (a) and (b) are both true.

25. Government often pursue policies that lead to higher inflation. This is because

a. If the government has a large amount of debt, inflation will erode the cost of repaying that debt.

b. Inflation rates are controlled by the government.

c. Answers (a) and (b) are both true.

26. Holding everything else constant, countries with independent central banks

a. Have higher inflation rates over time.

b. Have lower inflation rates over time.

c. Are more responsive to political pressure to alter the money supply or the interest rate.

d. Answers (a) and (c) are both true.

e. Answers (b) and (c) are both true.

27. Money serves many functions in an economy including

a. A means of exchange to make it easier for people to make transactions.

b. A unit of account so that we have a single scale to compare the cost of all the goods and services produced in an economy.

c. Providing a portable and durable item of value readily accepted by others as payments for goods and services.

d. Serving as a store of value over time.

e. Answers (a), (b), (c) and (d) are all true.

28. A method for measuring the size of the government is to compute the ratio of the sum of local, state and federal government spending to GDP. When this ratio is computed for different countries, which of the following statements is true?

a. The U.S. has a relatively high ratio of all government spending to GDP compared to other well developed countries.

b. This ratio for the U.S. has historically been around 30 percent of GDP.

c. The ratio is higher in other developed countries than in the U.S., but the U.S. is the only developed country that does not provide health care coverage: this decision obviously lowers the ratio for the U.S.

d. Answers (a) and (c) are both true statements.

e. Answers (b) and (c) are both true statements.

29. During the Great Recession the government could have engaged in fiscal policy as a way to counter the economic effects of the recession. But, for fiscal policy to be effective it must

a. Reflect agreement by Congress and the President as to the appropriate policy.

b. Be enacted by Congress and the President swiftly: delays due to prolonged discussion mean delays in the impact of the policy.

c. Be a policy that affects the economy quickly: delays in the economic impact of the fiscal policy will lessen the ability of the fiscal policy to effectively address the underlying deficiency of demand.

d. Answers (a), (b) and (c) are all true statements.

e. Answers (a) and (c) are true statements.

30. All of the following could cause a recession EXCEPT

a. A sharp decrease in the stock market.

b. A sharp rise in the value of property.

c. A significant increase in the price of petroleum.

d. A decrease in the money supply instituted by the central bank.

e. A drop in the price of a commodity in an economy that produces little else beside the commodity.

31. GDP does not include

a. Any work that people do but where there is no pay for that work.

b. The impact of production on the environment.

c. The money you pay your housekeeper and that he reports on his taxes each year.

d. Answers (a), (b) and (c) are all true statements.

e. Answers (a) and (b) are true statements.

32. Suppose we want to compare the economic production of two countries. Which is the best measure of the following choices if this is our goal?

a. Nominal GDP for the same time period for the two countries.

b. Real GDP for the same time period for the two countries.

c. Nominal GDP per capita for the same time period for the two countries.

d. Real GDP per capita for the same time period for the two countries.

33. If your country has a large percentage of people engaged in farming it is likely that

a. The farmers will receive large subsidies from the government that are financed by the relatively smaller percentage of people not engaged in farming.

b. The farmers will sell their products at prices that are lower than the market prices for these goods which in essence results in a subsidy to the relatively smaller percentage of people not engaged in farming.

c. Government policy may result in a subsidy to farmers or it may result in a subsidy to the part of the population that is not engaged in farming.

d. The smaller group (the non-farmers) will subsidize the larger group (the farmers).

e. Answers (a) and (d) are both true statements.

34. Wheelan points out that selling a brownstone for $250,000 when it is worth $500,000 is highly unlikely and yet people often assume that the stock market presents the same kind of opportunity to "get rich quick". To support his argument he writes about

a. The "hot stock tip" that we read about in a business publication: it is unlikely that you are the only person aware of the tip and as buyers rush to buy the stock, the price of the stock should increase.

b. How the price of a stock at any given time is the price where the number of buyers of that stock is equal to the number of sellers of that stock.

c. If analysts are excited about a stock this is similar to real estate agents providing you information about the real estate market. Neither of these cases should suggest that you will earn an above-average return on your investment.

d. Answers (a), (b) and (c) are all illustrations he uses to make his point.

e. Answers (a) and (b) are illustrations he uses to make his point.

35. Government can help financial markets work better by insuring

a. That fraud is minimized in these markets.

b. That financial markets are transparent in their activities.

c. And enforcing a regulatory framework for these markets.

d. Answers (a), (b) and (c) are all true statements.

36. Financial instruments (like stocks, bonds, mutual funds, etc.) are based on meeting four simple needs:

a. The need to raise capital; the need to store and protect the value of existing capital; the need to insure against risk; and the need to bet on short-term price movements.

b. The need to raise prices; the need to store and protect the value of existing capital; the need to insure against predictable problems; and the need to bet on long-term price movements.

c. The need to raise capital; the need to raise prices; the need to insure against risk; and the need to bet on short-term price movements.

d. The need to raise prices; the need to insure against risk; the need to protect the value of existing capital; and the need to eliminate short-term price movements.

37. Joe is trying to decide between spending $10 on a movie ticket to see a movie on Friday night or to spend $10 on a concert ticket on Friday night. Both events would take three hours for Joe to attend. In either case, Joe will have to get a replacement at his job serving ice cream where he is paid $8 an hour. The opportunity cost for Joe of attending the movie is

a. $24

b. $34

38. Consider a market for a particular good in a small economy where the domestic equilibrium price for the good if the economy is a closed economy is greater than the world price for the good. If this economy opens to trade

a. Domestic consumers would benefit while domestic producers would be hurt.

b. Domestic consumers would be hurt while domestic producers would benefit.

39. A small economy opens its markets to trade. In the market for one good the government of the small economy decides to implement a tariff on the good. To have any effect on this market, the tariff must be

a. Greater than the world price for the good and the world price of the good must be greater than the equilibrium price in this market if the market was closed to trade.

b. Greater than the world price for the good and the world price of the good must be less than the equilibrium price in this market if the market was closed to trade.

40. The world price of a good is less than the closed economy price of that same good. Implementation of an effective quota will

a. Increase producer surplus.

b. Decrease producer surplus.

41. The world price of a good is greater than the closed economy price of that same good. Opening this market to trade will

a. Increase consumer surplus.

b. Decrease consumer surplus.

42. Irving, a stockbroker, sells $10,000 worth of stock to George during 2009. He charges George a commission of $200 when he makes this transaction. GDP for 2009

a. Will include both the $10,000 worth of stock as well as the $200 commission.

b. Will include only the $200 commission.

43. First Nation's nominal GDP for 2009 was 20% greater than its nominal GDP for 2008. First Nation's real GDP for 2009 was 16% greater than its real GDP for 2008. From this information we can conclude that

a. First Nation's GDP deflator in 2009 rose relative to First Nation's GDP deflator in 2008.

b. First Nation's GDP deflator in 2009 fell relative to First Nation's GDP deflator in 2008.

44. Which of the following statements is TRUE?

a. In calculating real GDP the quantity measures are held constant.

b. In calculating the CPI, the choice of base year will yield different index numbers, but will not affect the rate of inflation between different years.

45. Suppose real GDP in 2000 is $100,000 and that real GDP in 2001 grows by 20% from the level in 2000. Furthermore, suppose the population in 2000 is 1000 and the population in 2001 is 1100. Which of the following is TRUE?

a. Since the population is growing at a slower rate than the rate of growth for real GDP, we know this adversely affects the standard of living.

b. The economy is in a recession.

c. Real GDP per capita in 2001 has increased relative to 2000.

d. The economy is in an expansion.

46. GDP

a. Can be measured using the expenditure approach or the factor payment approach.

b. Includes any transaction made within the geographic borders of a country during a specific time period.

c. Per capita in real terms decreases if the rate of population growth is less than the rate of growth in aggregate production.

d. Understates the value of volunteer production while overstating the value of household production.

47. The following are hypothetical data on the CPI and nominal wages for an economy.

|

Year

|

CPI

|

Nominal Wage

|

|

2000

|

100

|

$10

|

|

2001

|

110

|

$12

|

|

2002

|

115

|

$13

|

|

2003

|

135

|

$14

|

According to this table, the REAL WAGE in 2000 dollars was highest in 2002 at

a. $17.50

b. $14.95

c. $8.85

d. $11.30

48. Citizen Jane is assigned the task of computing Economy X's GDP for the current period. She is given the following data:

Tire production for the period $4 million

New car production for the period $20 million

Residential Sales of Pre-existing homes $20 million

Real Estate Brokerage Fees for the period $2 million

Furthermore, Jane knows that 25% of the tires manufactured in her economy are replacement tires for worn out tires. Assume there are no other transactions in this economy. Which of the following statements is TRUE?

a. GDP for Economy X in this period equals $26 million.

b. GDP for Economy X in this period equals $22 million.

c. GDP for Economy X in this period equals $43 million.

d. GDP for Economy X in this period equals $23 million.

The table below presents the statistics of Ireland in 2010. Use the information in the table to answer next two questions.

|

Consumption Expenditure

|

$500 million

|

Market value

of stock issued

|

$80 million

|

|

Expenditure on plant and equipment

|

$200 million

|

Market value

of bonds issued

|

$ 50 million

|

|

Inventories

|

$-380 million

|

Purchases of

foreign bonds

|

$40 million

|

|

Government expenditure

|

$80 million

|

Wages

|

$300 million

|

|

Government tax revenue

|

$30 million

|

Profit

|

$80 million

|

|

Government transfers

|

$20 million

|

Interest

|

$ ??????????

|

|

Exports

|

$195 million

|

Rent

|

$75 million

|

|

Imports

|

$75 million

|

|

|

49. It can be said about the information in the table that:

a. That Ireland's GDP is $ 620 million..

b. That Ireland's GDP is $ 520 million.

c. That Ireland's GDP is $ 900 million.

d. That Ireland's GDP is $ 420 million.

50. In 2000 Country A's real GDP per person was $20,000 per person, while country B's real GDP per person was $10,000 per person. For this problem assume that population in both countries is constant over time and does not change. Assume that the growth rate of real GDP in Country A is a constant 5% a year while the growth rate of real GDP in Country B is a constant 10% a year. Using the rule of 70, in what year will the real GDP per person of both countries be the same?

a. 2021

b. 2014

c. 2028

d. 2007

51. Which of the following will notshift the aggregate demand curve?

a. A change in monetary policy.

b. A decrease in the wealth in society.

c. A rising optimism in the performance of the economy.

d. A change in oil prices.

52. Country X is at its long run equilibrium. Its government decides to increase its spending. At the same time country X experiences a positive technological improvement. In the framework of the Aggregate Demand and Aggregate Supply model:

a. Prices and production increase in the short run and prices at the new short run equilibrium are greater than prices at the new long run equilibrium.

b. Prices are indeterminate in the short run while production increases in the short run. In the long run production increases but we do not know if prices in the long run are greater than, less than or equal to their initial level.

c. Prices and production increase in the short run and prices at the new short run equilibrium are greater than prices at the new long run equilibrium.

d. Prices and production increase in the short run and production at the new long run equilibrium is greater than production at the new short run equilibrium.

Use the figure below of an aggregate economy to answer the next question.

53. The above diagram shows the long run aggregate supply curve (LRAS), the short run aggregate supply curve (SRAS), and the aggregate demand (AD) for an economy. The economy is not currently at the long-run equilibrium, Y*. Which of the following statements is true?

a. In the long run, if there is no fiscal or monetary policy intervention in this economy, aggregate production will increase and the aggregate price level will decrease.

b. Implementation of fiscal policy in the form of lower taxes will in the short run increase aggregate production and decrease the aggregate price level.

c. Implementation of fiscal policy in the form of increased government expenditure will in the short run have no effect on aggregate production but will cause the aggregate price level to increase.

d. In the long run, if there is no fiscal or monetary policy intervention in this economy, long run aggregate production will stabilize at a level lower than Y*.

54. The equilibrium price in the market for butter in Italy is $ 40 per ton. The government decides to impose a price floor of $ 45 per ton and guarantees to buy any excess supply generated by this policy. As a result of this policy:

a. The quantity exchanged in the market will not change.

b. The quantity exchanged in the market will increase.

55. Olives are used to make olive oil. Suppose that there has been an improvement in the technology of producing olives. How would that affect the market for vegetable oil?

a. Demand for vegetable oil will shift to the left.

b. Supply for vegetable oil will shift to the right.

c. Demand for vegetable oil will shift to the right.

d. Nothing will change in the market for vegetable oil.

Answer the next two questions using the information below:

Assume in a SMALL OPEN economy the domestic market demand curve is QD = 600 - 2P and the domestic market supply curve is QS = 4P. Suppose the world price is $50.

56. Which of the following is true:

a. The country will export 300 units.

b. The country will export 3000 units.

c. The country will import 3000 units.

d. The country will import 300 units.

57. What will be the Deadweight Loss in this economy if a tariff is imposed that raises the price to $75?

a. $ 3,750

b. $ 2,700

c. $ 1,875

d. $ 950

58. When we consider the opportunity cost of going to college, it includes

a. Both tuition and the value of the student's time.

b. Tuition but not the value of the student's time, which is not a monetary cost.

c. The value of the student's time but not tuition, which is a monetary cost.

d. Neither tuition nor the value of the student's time, since obtaining a college degree makes one's income higher in the future.

Answer the next two questions using the information below:

Consider a market for leather jackets. The demand and supply for them are:

Demand: P = 400 - 2Q

Supply: P = 100 + Q

59. What is the market equilibrium price and quantity for leather jackets?

a. P=100, Q=200

b. P=200, Q=100

c. P=100, Q=100

d. P=200, Q=200

60. Imagine that the world enters a new Ice Age and the new demand curve for leather jackets becomes P = 500 - Q. By how much will consumer surplus change after the shift in demand?

a. $ 0

b. $ 10,000

c. $ 20,000

d. $ 30,000

61. The vineyard Oldies can produce 100 bottles of jam and 0 bottles of wine or 10 bottles of wine and 0 bottles of jam in a typical work week. The vineyard Goodies, on the other hand, can produce 90 bottles of jam and 0 bottles of wine or 10 bottles of wine and 0 bottles of jam in a typical work week. Suppose that the PPFs of the Oldies and the Goodies are both linear. If the Oldies and the Goodies trade with each other according to their comparative advantage

a. The Oldies will sell wine and the Goodies will sell jam.

b. The price of one bottle of wine will be lower than 9 bottles of jam.

c. The price of 9 bottles of jam will be lower than 1 bottle of wine.

d. The price of one bottle of wine will be higher than 10 bottles of jam.

62. In 2000 Country A's real GDP per person was $20,000 per person, while country B's real GDP per person was $10,000 per person. For this problem assume that population in both countries is constant over time and does not change. Assume that the growth rate of real GDP in Country A is a constant 5% a year while the growth rate of real GDP in Country B is a constant 10% a year. Using the rule of 70, in what year will the real GDP per person of both countries be the same?

a. 2021

b. 2014

c. 2028

d. 2007

63. A price index like the CPI, which uses a fixed basket of goods from one year to the next, will tend to overstate inflation because

a. consumers will usually reduce their consumption of goods when they become relatively cheaper.

b. consumers will tend to substitute away from goods that become more expensive.

64. The type of unemployment caused by changes in the business cycle is natural unemployment.

a. true

b. false

65. Rob is considered unemployed if he

a. has looked for a job in the last four weeks but has not found a job.

b. has worked at least 1 hour but not more than 15 hours as a paid employee last week.

c. does not have a job and stopped looking for a job at least two months ago.

d. has a part-time job but would like a full-time job.

66. A farm began the year with 1,000 pounds of milk in inventory, produced 10,000 pounds of milk during the year and ended the year with 1,100 pounds of milk in inventory. The 100 pounds added to his inventory will be classified as

a. consumption expenditures.

b. investment.

c. net exports of goods and services.

d. capital inflow.

67. In year 2005, US consumers spent $10 billion, interest payments were $1.5 billion, the government purchased $3 billion, net exports amounted to $2 billion, and investment was $8 billion. Hence the US 2005 GDP was

a. $21.5 billion.

b. $24.5 billion.

c. $23 billion.

d. $19.5 billion.

68. The Labor Force of Ithaca in 1325 BC consisted of 1200 people. The unemployment rate before the recession of 1325 BC was 25%, during the recession 400 employees were fired and half of them became discouraged workers. What was the after-recession unemployment rate in Ithaca?

a. 33%

b. 40%

c. 50%

d. 60%;

69. The following table provides information about production in some specific economy. Use this information to answer the next question. For this question assume the market basket is defined as 10 oranges, 20 bananas, and 20 apples.

|

|

2008

|

2009

|

|

Price

|

Quantity

|

Price

|

Quantity

|

|

oranges

|

2

|

10

|

2

|

15

|

|

bananas

|

3

|

20

|

2

|

20

|

|

apples

|

1

|

20

|

3

|

10

|

Suppose 2008 is the base year. What is the value of the CPI in 2009?

a. 115

b. 90

c. 100

d. 120

70. The type of unemployment that occurs because of a recession is called

a. frictional unemployment.

b. seasonal unemployment.

c. natural unemployment.

d. cyclical unemployment.

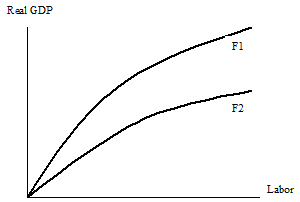

71. Observe the following figure in which the aggregate production function of United States shifts from F1 to F2:

Which of the following could cause such a shift in the aggregate production function?

a. A decrease in the workday from 8 to 7 hours.

b. A less intensive use of installed capacity (less use of capital).

c. An decrease in the price of oil assuming that the US is a net importer of oil.

d. A subsidy per worker hired in the software industry.

72. Binding minimum wages generally lead to

a. cyclical unemployment since not everyone can find a job at the minimum wage rate.

b. frictional unemployment since the binding minimum wage results in longer job searches.

c. strucutural unemployment since more people want to work than can find jobs at the minimum wage.

d. all of the above answersare correct.

73. Tom currently earns $100 a week at his job. Tom expects inflation to be 10% a year for the next two years. In order for Tom to maintain the same real purchasing power of his salary, how much will his nominal salary need to be two years from now?

a. $120 a week

b. $121 a week

74. True or False: It is possible to implement a quota or a tariff in a market so that the impact on the quantity of imports, and the effect on consumer surplus and producer surplus are equivalent. Even if the two trade policies are equivalent with regard to the effect on imports, the effect on consumer surplus, and the effect on producer surplus, the two policies (quota or tariff) will necessarily create a different amount of deadweight loss.

a. True

b. False

Use the following information to answer the next question.

The following information describes the PPF for Arcadia. Arcadia produces two goods, trucks and welding equipment. Assume that Arcadia's PPF is linear between any two adjacent combinations in the table.

|

Combination

|

Trucks

|

Units of Welding Equipment

|

|

A

|

100

|

0

|

|

B

|

90

|

20

|

|

C

|

75

|

40

|

|

D

|

35

|

80

|

|

E

|

0

|

100

|

75. Consider the PPF of Arcadia. Which of the following statements is TRUE?

I. The Law of Increasing Opportunity Cost does NOT hold for Arcadia since the production possibility frontier is composed of linear segments.

II. The Law of Increasing Opportunity Cost holds with respect for trucks but does NOT hold with respect to welding equipment.

III. The Law of Increasing Opportunity Cost holds with respect to welding equipment but does NOT hold with respect to trucks.

a. Statement I is true.

b. Statement II is true.

c. Statement III is true.

d. Statements I, II and III are all NOT true.