Reference no: EM13991896

Organisation Theory Essay.

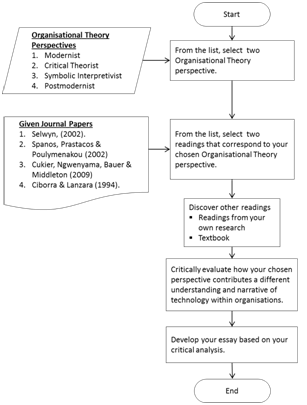

Four Organizational Theory perspectives, namely Modernist, Critical theorist, Symbolic Interpretivist and Postmodernist, produce different narratives about technology.

Choose two Organizational Theory perspectives. Based on your selected perspectives, identify and draw out the two readings out of the given list that match your chosen perspectives.

Critically analyze the two readings and evaluate how their ontological and epistemological positions result in a different understanding and narrative of technology within organizations.

1. The four readings are given in Section 8.3.

2. Select two from the four Organisational Theory Perspectives.

3. Critically evaluate how your two chosen perspectives contribute a different understanding and narrative of technology within organisations.

4. Use readings from your own research and the textbook to form substantive arguments

In addition to the textbook and lecture materials, the four provided readings are as follows:

1. Selwyn, N. (2002). ‘E-stablishing'an inclusive society? Technology, social exclusion and UK government policy making. Journal of Social Policy, 31(01), 1-20.

2. Spanos, Y. E., Prastacos, G. P., &Poulymenakou, A. (2002). The relationship between information and communication technologies adoption and management. Information & Management, 39(8), 659-675.

3. Cukier, W., Ngwenyama, O., Bauer, R., & Middleton, C. (2009). A critical analysis of media discourse on information technology: preliminary results of a proposed method for critical discourse analysis. Information Systems Journal, 19(2), 175-196.

4. Ciborra, C. U., &Lanzara, G. F. (1994). Formative contexts and information technology: Understanding the dynamics of innovation in organizations.Accounting, management and information technologies, 4(2), 61-86.

|

Problem regarding the effects of the december

: On November 24, he purchases an additional 350 shares for $6,300. Ed sells the original 500 shares for $10,000 on December 14. What are the effects of the December 14 sale? Explain.

|

|

Describe project execution challenges inherent in working

: Describe four project execution challenges inherent in working within dynamic, uncertain environments. Invent three motivational tools that project leaders can use during the execution phase of the project life cycle.

|

|

Design and draw a circuit using the cascade system

: Design and draw a circuit using the cascade system to operate two cylinders (A and B) which, on the operation of a start valve, produces the sequence A - B + B - A+. The cylinders should park in the positions B - A + when the start switch is in th..

|

|

Effects of the sales on darlene taxable income

: What are the effects of the sales on Darlene's taxable income in each year? Explain.

|

|

Critically analyze the given two readings

: Critically analyze the two readings and evaluate how their ontological and epistemological positions result in a different understanding and narrative of technology within organizations.

|

|

Explaining the tax effects of the sale

: Howard Company is 100% owned by Rona. During the current year, Howard sells some land to Rona for $50,000 that had cost Howard $80,000 and that had a fair market value of $100,000. Write a letter to Rona explaining the tax effects of the sale.

|

|

Determine the density of the liquid

: Graphing either m versus d or d versus m gives a straight line. In the graph shown above, we chose to plot don the vertical axis and m on the horizontal axis. From the equation for the line of best fit given, determine the density ρ of the liquid.

|

|

Population growth in less industrialized countries

: There are vast stores of organic matter in the soils of northern coniferous forests and tundra around the world. Suggest an explanation for why scientists who study global warming are closely monitoring these stores.

|

|

What wavelength of light is being used

: A grating that has 3600 slits per cm produces a third-order fringe at a 22o angle. What wavelength of light is being used? Express your answer to two significant figures and include the appropriate units.

|