Reference no: EM131247328

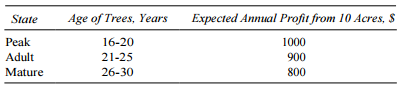

The following investment decision is being considered by Citrus Farms. For $7000 the company can acquire ownership of 10 acres of 15-year-old orange trees and a 15-year lease on the land. The productive life of an orange tree is divided into stages as follows:

a) What is the present value of each alternative? Since the land and anything on it will belong to the lessor in 15 years, assume that once the trees are harvested the land will not be replanted by Citrus.

b) As an alternative to this investment, Citrus can use the $7,000 to buy a new orange-sorting machine. The machine would reduce sorting expenses by $1300 a year for 15 years. Which investment would you make? Why? Assume that all other investment opportunities for the next 15 years will earn the cost of capital.

c) In the tenth year Citrus discovers that everyone else with 25-year-old trees has sold them. As a consequence the price the firm can get for the trees is only $8000. Since so many trees have been sold for decoration, small orange crops are expected for the next 5 years. As a result the price of oranges will be higher. Your acreage will yield $1200 a year. The selling price of your trees in another 5 years is expected to be still depressed to $6000. What should you do?

d) Given the situation in (c), what was the NPV of your actual investment over the 15-year period?

e) What would the NPV be if the trees had been sold in year 10 for $8000?

|

What is the effects of counseling on the children of parents

: Identify at least one example for each of the following topics that you plan to use for your research proposal due on : What is the effects of counseling on the children of parents who have a substance abuse issue?

|

|

Types of stores and other distribution channels

: Give 400 words specifically on the Distribution (where sold, types of stores and other distribution channels [including any use of e-commerce], extent of availability, etc of the Apple iPhone.

|

|

Explain critical thinking

: Provide an example from your personal experience of critical thinking applied to a business decision.Discuss the importance and benefits of using critical thinking.Relate the importance and benefits of critical thinking to the example provided.Dis..

|

|

Competitive aggressiveness and risk taking

: Entrepreneurship has characteristics such as autonomy, innovativeness, proactiveness, competitive aggressiveness, and risk taking. How do these fit in a typical corporation?

|

|

What is the present value of each alternative

: What is the present value of each alternative? Since the land and anything on it will belong to the lessor in 15 years, assume that once the trees are harvested the land will not be replanted by Citrus.

|

|

What fluid velocity will be required in the model

: A model of this pipeline is to be designed using a 2-in.-diameter pipe and water at 60°F as the working fluid. To maintain Reynolds number similarity between these two systems, what fluid velocity will be required in the model?

|

|

Process impact the outcome of the event

: Think about the last event you had to plan for either at work or in your personal life. Did you have a process? How did having or not having a process impact the outcome of the event?

|

|

How the pressure p will change when fluid velocity double

: Make use of dimensional analysis to determine how the pressure, p, will change when the fluid velocity, V, is doubled.

|

|

What are the sources of monopoly power

: What are the sources of monopoly power

|