Reference no: EM131143768

Write the answer of question given below related to the topic "Interest Rates"

5-1. Your bank is offering you an account that will pay 20% interest in total for a two-year deposit. Determine the equivalent discount rate for a period length of

a. Six months.

b. One year.

c. One month.5-2. Which do you prefer: a bank account that pays 5% per year (EAR) for three years or

a. An account that pays 2 12 % every six months for three years?

b. An account that pays 7 12 % every 18 months for three years?

c. An account that pays 12 % per month for three years?

5-3. Many academic institutions offer a sabbatical policy. Every seven years a professor is given a year free of teaching and other administrative responsibilities at full pay. For a professor earning $70,000 per year who works for a total of 42 years, what is the present value of the amount she will earn while on sabbatical if the interest rate is 6% (EAR)?

5-4. You have found three investment choices for a one-year deposit: 10% APR compounded monthly, 10% APR compounded annually, and 9% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.)

5-5. You are considering moving your money to new bank offering a one-year CD that pays an 8% APR with monthly compounding. Your current bank's manager offers to match the rate you have been offered. The account at your current bank would pay interest every six months. How much interest will you need to earn every six months to match the CD?

5-6. Your bank account pays interest with an EAR of 5%. What is the APR quote for this account based on semiannual compounding? What is the APR with monthly compounding?

5-7. Suppose the interest rate is 8% APR with monthly compounding. What is the present value of an annuity that pays $100 every six months for five years?

5-8. You can earn $50 in interest on a $1000 deposit for eight months. If the EAR is the same regardless of the length of the investment, how much interest will you earn on a $1000 deposit for

a. 6 months.

b. 1 year.

c. 1 12 years.

5-9. Suppose you invest $100 in a bank account, and five years later it has grown to $134.39.

a. What APR did you receive, if the interest was compounded semiannually?

b. What APR did you receive if the interest was compounded monthly?

5-10. Your son has been accepted into college. This college guarantees that your son's tuition will not increase for the four years he attends college. The first $10,000 tuition payment is due in six months. After that, the same payment is due every six months until you have made a total of eight payments. The college offers a bank account that allows you to withdraw money every six months and has a fixed APR of 4% (semiannual) guaranteed to remain the same over the next four years. How much money must you deposit today if you intend to make no further deposits and would like to make all the tuition payments from this account, leaving the account empty when the last payment is made?

5-11. You make monthly payments on your mortgage. It has a quoted APR of 5% (monthly compounding). What percentage of the outstanding principal do you pay in interest each month?

5-12. Capital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need to borrow $8000 to purchase your dream Harley Davidson, what will your monthly payment be?

5-13. Oppenheimer Bank is offering a 30-year mortgage with an EAR of 5 3 8 %. . If you plan to borrow $150,000, what will your monthly payment be?

5-14. You have decided to refinance your mortgage. You plan to borrow whatever is outstanding on your current mortgage. The current monthly payment is $2356 and you have made every payment on time. The original term of the mortgage was 30 years, and the mortgage is exactly four years and eight months old. You have just made your monthly payment. The mortgage interest rate is 63⁄8% (APR). How much do you owe on the mortgage today

5-15. You have just sold your house for $1,000,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $800,000. The mortgage is currently exactly 181⁄2 years old, and you have just made a payment. If the interest rate on the mortgage is 5.25% (APR), how much cash will you have from the sale once you pay off the mortgage?

5-16. You have just purchased a home and taken out a $500,000 mortgage. The mortgage has a 30- year term with monthly payments and an APR of 6%.

a. How much will you pay in interest, and how much will you pay in principal, during the first year?

b. How much will you pay in interest, and how much will you pay in principal, during the 20th year (i.e., between 19 and 20 years from now)?

5-17. Your mortgage has 25 years left, and has an APR of 7.625% with monthly payments of $1449.

a. What is the outstanding balance?

b. Suppose you cannot make the mortgage payment and you are in danger of losing your house to foreclosure. The bank has offered to renegotiate your loan. The bank expects to get $150,000 for the house if it forecloses. They will lower your payment as long as they will receive at least this amount (in present value terms). If current 25-year mortgage interest rates have dropped to 5% (APR), what is the lowest monthly payment you could make for the remaining life of your loan that would be attractive to the bank?

5-18. You have an outstanding student loan with required payments of $500 per month for the next four years. The interest rate on the loan is 9% APR (monthly). You are considering making an extra payment of $100 today (that is, you will pay an extra $100 that you are not required to pay). If you are required to continue to make payments of $500 per month until the loan is paid off, what is the amount of your final payment? What effective rate of return (expressed as an APR with monthly compounding) have you earned on the $100?

5-19. Consider again the setting of Problem 18. Now that you realize your best investment is to prepay your student loan, you decide to prepay as much as you can each month. Looking at your budget, you can afford to pay an extra $250 per month in addition to your required monthly payments of $500, or $750 in total each month. How long will it take you to pay off the loan?

5-20. Oppenheimer Bank is offering a 30-year mortgage with an APR of 5.25%. With this mortgage your monthly payments would be $2000 per month. In addition, Oppenheimer Bank offers you the following deal: Instead of making the monthly payment of $2000 every month, you can make half the payment every two weeks (so that you will make 52 ⁄ 2 = 26 payments per year). With this plan, how long will it take to pay off the mortgage of $150,000 if the EAR of the loan is unchanged?

5-21. Your friend tells you he has a very simple trick for shortening the time it takes to repay your mortgage by one-third: Use your holiday bonus to make an extra payment on January 1 of each year (that is, pay your monthly payment due on that day twice). If you take out your mortgage on July 1, so your first monthly payment is due August 1, and you make an extra payment every January 1, how long will it take to pay off the mortgage? Assume that the mortgage has an original term of 30 years and an APR of 12%.

5-22. You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2000 rebate, or (b) pay a $5000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 2 1 2 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15% APR (monthly). Which payment option is best for you?

5-23. The mortgage on your house is five years old. It required monthly payments of $1402, had an original term of 30 years, and had an interest rate of 10% (APR). In the intervening five years, interest rates have fallen and so you have decided to refinance-that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 30-year term, requires monthly payments, and has an interest rate of 6 5⁄8% (APR).

a. What monthly repayments will be required with the new loan?

b. If you still want to pay off the mortgage in 25 years, what monthly payment should you make after you refinance?

c. Suppose you are willing to continue making monthly payments of $1402. How long will it take you to pay off the mortgage after refinancing?

d. Suppose you are willing to continue making monthly payments of $1402, and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the refinancing?

5-24. You have credit card debt of $25,000 that has an APR (monthly compounding) of 15%. Each month you pay the minimum monthly payment only. You are required to pay only the outstanding interest. You have received an offer in the mail for an otherwise identical credit card with an APR of 12%. After considering all your alternatives, you decide to switch cards, roll over the outstanding balance on the old card into the new card, and borrow additional money as well. How much can you borrow today on the new card without changing the minimum monthly payment you will be required to pay?

5-25. In 1975, interest rates were 7.85% and the rate of inflation was 12.3% in the United States. What was the real interest rate in 1975? How would the purchasing power of your savings have changed over the year?

5-26. If the rate of inflation is 5%, what nominal interest rate is necessary for you to earn a 3% real interest rate on your investment?

5-27. Can the nominal interest rate available to an investor be significantly negative? (Hint: Consider the interest rate earned from saving cash "under the mattress.") Can the real interest rate be negative? Explain.

5-28. Consider a project that requires an initial investment of $100,000 and will produce a single cash flow of $150,000 in five years.

a. What is the NPV of this project if the five-year interest rate is 5% (EAR)?

b. What is the NPV of this project if the five-year interest rate is 10% (EAR)?

c. What is the highest five-year interest rate such that this project is still profitable?

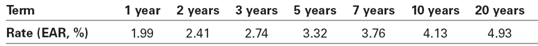

5-29. Suppose the term structure of risk-free interest rates is as shown below:

a. Calculate the present value of an investment that pays $1000 in two years and $2000 in five years for certain.

b. Calculate the present value of receiving $500 per year, with certainty, at the end of the next five years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average of the rate in year 3 and year 5.)

c. Calculate the present value of receiving $2300 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint : Use a spreadsheet.)

5-30. Using the term structure in Problem 29, what is the present value of an investment that pays $100 at the end of each of years 1, 2, and 3? If you wanted to value this investment correctly using the annuity formula, which discount rate should you use?

5-31. What is the shape of the yield curve given the term structure in Problem 29? What expectations are investors likely to have about future interest rates?

5-32. Suppose the current one-year interest rate is 6%. One year from now, you believe the economy will start to slow and the one-year interest rate will fall to 5%. In two years, you expect the economy to be in the midst of a recession, causing the Federal Reserve to cut interest rates drastically and the one-year interest rate to fall to 2%. The one-year interest rate will then rise to 3% the following year, and continue to rise by 1% per year until it returns to 6%, where it will remain from then on.

a. If you were certain regarding these future interest rate changes, what two-year interest rate would be consistent with these expectations?

b. What current term structure of interest rates, for terms of 1 to 10 years, would be consistent with these expectations?

c. Plot the yield curve in this case. How does the one-year interest rate compare to the 10-year interest rate?5-33. Figure 5.4 shows that Wal-Mart's five-year borrowing rate is 3.1% and GE Capital's is 10%. Which would you prefer? $500 from Wal-Mart paid today or a promise that the firm will pay you $700 in five years? Which would you choose if GE Capital offered you the same alternatives?

5-34. Your best taxable investment opportunity has an EAR of 4%. You best tax-free investment opportunity has an EAR of 3%. If your tax rate is 30%, which opportunity provides the higher after-tax interest rate?

5-35. Your uncle Fred just purchased a new boat. He brags to you about the low 7% interest rate (APR, monthly compounding) he obtained from the dealer. The rate is even lower than the rate he could have obtained on his home equity loan (8% APR, monthly compounding). If his tax rate is 25% and the interest on the home equity loan is tax deductible, which loan is truly cheaper?

5-36. You are enrolling in an MBA program. To pay your tuition, you can either take out a standard student loan (so the interest payments are not tax deductible) with an EAR of 5 1 2 % or you can use a tax-deductible home equity loan with an APR (monthly) of 6%. You anticipate being in a very low tax bracket, so your tax rate will be only 15%. Which loan should you use?

5-37. Your best friend consults you for investment advice. You learn that his tax rate is 35%, and he has the following current investments and debts:

¦ A car loan with an outstanding balance of $5000 and a 4.8% APR (monthly compounding)

¦ Credit cards with an outstanding balance of $10,000 and a 14.9% APR (monthly compounding)

¦ A regular savings account with a $30,000 balance, paying a 5.50% EAR

¦ A money market savings account with a $100,000 balance, paying a 5.25% APR (daily compounding)

¦ A tax-deductible home equity loan with an outstanding balance of $25,000 and a 5.0%

APR (monthly compounding)

a. Which savings account pays a higher after-tax interest rate?

b. Should your friend use his savings to pay off any of his outstanding debts? Explain.

5-38. Suppose you have outstanding debt with an 8% interest rate that can be repaid anytime, and the interest rate on U.S. Treasuries is only 5%. You plan to repay your debt using any cash that you don't invest elsewhere. Until your debt is repaid, what cost of capital should you use when evaluating a new risk-free investment opportunity? Why?

5-39. In the summer of 2008, at Heathrow Airport in London, Bestofthebest (BB), a private company, offered a lottery to win a Ferrari or 90,000 British pounds, equivalent at the time to about $180,000. Both the Ferrari and the money, in 100 pound notes, were on display. If the U.K. interest rate was 5% per year, and the dollar interest rate was 2% per year (EARs), how much did it cost the company in dollars each month to keep the cash on display? That is, what was the opportunity cost of keeping it on display rather than in a bank account? (Ignore taxes.)

5-40. You firm is considering the purchase of a new office phone system. You can either pay $32,000 now, or $1000 per month for 36 months.

a. Suppose your firm currently borrows at a rate of 6% per year (APR with monthly compounding). Which payment plan is more attractive?

b. Suppose your firm currently borrows at a rate of 18% per year (APR with monthly compounding). Which payment plan would be more attractive in this case?