Reference no: EM131409590

Consider the Consumption-Income data given in Table 5.1 and provided on the Springer web site as CONSUMP.DAT. Estimate a Consumption-Income regression in logs that allows for a six year lag on income as follows:

(a) Use the linear arithmetic lag given in equation (6.2). Show that this result can also be obtained as an Almon lag first-degree polynomial with a far end point constraint.

(b) Use an Almon lag second-degree polynomial, described in equation (6.4), imposing the near end point constraint.

(c) Use an Almon lag second-degree polynomial imposing the far end point constraint.

(d) Use an Almon lag second-degree polynomial imposing both end point constraints.

(e) Using Chow's F-statistic, test the arithmetic lag restrictions given in part (a).

(f) Using Chow's F-statistic, test the Almon lag restrictions implied by the model in part (b).

(g) Repeat part (f) for the restrictions imposed in parts (c) and (d).

|

Write and balance the molecular equation

: Write and balance the molecular equation and then give ionic and net ionic equations for the neutralization reaction between Ba(OH)2(aq) and HF(aq). Assume the salt formed in this neutralization reaction is insoluble.

|

|

Develop an application review matrix

: Develop an application review matrix that may help support the installation of a software application at a health care organization.Discuss legislative and regulatory rule changes that may affect the need to implement electronic health applicatio..

|

|

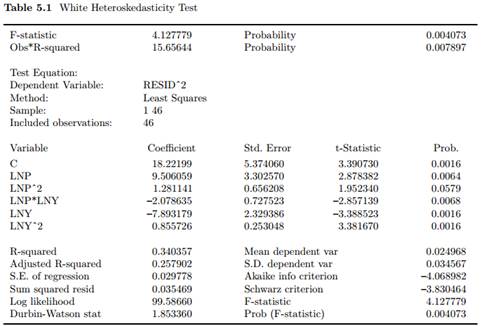

What are some of signals for presence of multicollinearity

: One of the indicators that multicollinearity is present is when a variable that is known to be an important predictor ends up having a partial regression coefficient that is not significant. What are some of the other signals for the presence of ..

|

|

Generate a plot of absorbance

: Using the calculation you performed in your Pre-Lab in Microsoft Excel, generate a plot of absorbance @ your chosen wavelength (the wavelength that provides the best data for your purposes) vs. [indicator].

|

|

Test the arithmetic lag restrictions given

: Use the linear arithmetic lag given in equation (6.2). Show that this result can also be obtained as an Almon lag first-degree polynomial with a far end point constraint.

|

|

Explain the key principles of data security

: Recommend at least three (3) specific tasks that could be performed to improve the quality of datasets, using the Software.Development Life Cycle (SDLC) methodology. Include a thorough description of each activity per each phase.

|

|

Identify all of risks that are associated with your project

: For this assignment, you will use what you identified as your approach in this Discussion Board to identify and assess all of the risks that are associated with your project.

|

|

Would multicollinearity tend to be a problem

: In linear regression models, for what types of uses or applications would multicollinearity tend to be a problem? Are there any applications or uses for which multicollinearity would not be a problem?

|

|

Problem regarding the electron configuration

: A S atom has an electron configuration of 2.8.6. What is the electron configuration of an S2- ion?

|