Reference no: EM131137076

Q1. Demand for a new prescription drug is given by the equation QD = 100-P, while supply is given by Qs = 3P.

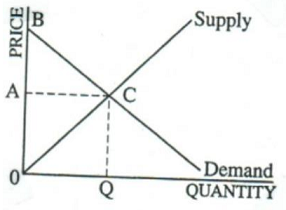

a) Solve for the equilibrium price and quantity.

b) Graph your results.

c) The U.S government, in order to increase access to the drug, imposes a price ceiling of $20. Is there a shortage or surplus? How big?

d) Does the price ceiling have the intended effect of the increasing the number of people that obtain the prescription drug?

Q2. Suppose market demand for movie tickets (in millions per year) is given by the equation QD = 19 - 2P, while tickets are supplied according to the market supply equation Qs = P - 2.

a. Solve for the equilibrium price and quantity.

b. Graph your results.

c. Suppose the government imposes an excise tax on movie tickets of $2 each. An excise tax is a per unit tax on suppliers. In the graph in Q2 b, show the changes in the equilibrium price and quantity. Show the areas corresponding to total taxes collected, taxes paid by consumers, and taxes paid by producers.

d. Solve algebraically for:

i) The after-tax equilibrium price.

ii) The net price received by sellers

iii) Total taxes collected by government

iv) Taxes paid by the customers

vii) Taxes paid by producers.

e. Calculate the consumer surplus before tax

f. Calculate the consumer surplus after tax?

g. Is society better off with or without the tax (from the standpoint of your response to e and f above)?

h. Why?

i. Calculate the deadweight loss?

j. If the demand curve were steeper (but went through the equilibrium point you found in part a), would consumers pay a higher or lower share of the total taxes collected?

k. Why?

l. If the supply curve were steeper (but went through the equilibrium point you found in part a) but the demand curve unchanged, would consumers pay a higher or lower share of the total taxes collected?

m. Why?

Q3. Beer in Huntington sells for $2 a bottle, or in other words supply is completely elastic. The demand for beer (in millions of bottles) is given by: Qd = 10 - 2P

a. Find the equilibrium price and quantity.

b. On Halloween weekend, the city of Huntington enacts a beer tax of $1 per bottle (paid by retailers) to attempt to get people to drink less.

Find the new equilibrium price and quantity and graph demand as well as both supply curves.

Does the tax achieve what it was supposed to do?

c. The beer tax expires before Christmas, and on Christmas Eve, Huntington has as much beer in town as is usually consumed. Unfortunately, Santa's elves get into the beer and consume 2 million bottles, and sellers respond by getting as much per bottle as they can.

Find the new equilibrium price and quantity.

Can you explain what is going on here given your answer to C above?

Q4. Bottles of wine (in tens of thousands) in Huntington are supplied and demanded according to the following:

Qd = 100 - 4P

Qs = 10 + 5P

a. Find the equilibrium price and quantity.

b. The Wine Snob Commission enacts a law that says any bottle of wine cheaper than $5 a bottle is illegal to buy or sell due to its poor quality.

What terminology can we use to describe this law?

Find and graph the new equilibrium price and quantity and describe the effect of the law.

The Wine Lovers Association retaliates and manages to get a law passed that only allows wine to be sold for no more than $8 a bottle in the hope that more people will become Wine Lovers like themselves as the lower price.

Find and graph the new equilibrium price and quantity, and find a term to describe this new law (or explain what is happening here.)

Will more people become Wine Lovers?

Q5. Suppose that the supply of low-skilled labor is given by:

Ls = 10W

where W is the wage (dollars per hour) and Ls is the quantity of low-skilled labor (in millions of persons employed each year). The demand for low-skilled labor is given by:

LD = 80 - 10W

a. What will be the equilibrium wage rate and employment level?

b. Graph the supply and demand curves and show the equilibrium.

c. What is the point elasticity of supply in equilibrium?

Now, suppose that the government sets a minimum wage of $5 per hour.

d. How many people will be employed at that wage? Show the ceiling and the new equilibrium on your graph (preferably in a different color).

e. How many people want to be employed at this wage?

f. What is the arc elasticity over the demand curve for the two points on the demand curve?

g. Will there be any dead-weight loss? If so, calculate the size of the loss.

Q6.

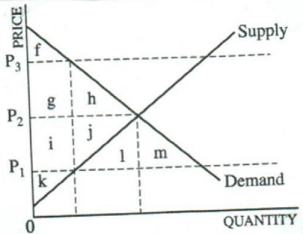

The graph above shows the market for a good that is subject to a per-unit tax. The letters on the graph represent the enclosed areas. Producer surplus after the tax is

a) G

b) F

c) F+J

d) H+I

e) H+I+J+K

Q7.

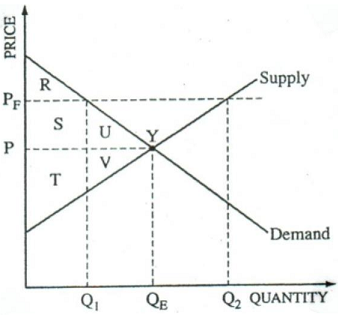

The diagram above shows the demand and supply curves for a good, and the market is currently in equilibrium. Letters R through V represent the enclosed areas, respectively. If the government imposes a minimum price for the good equal to PF, which of the following will occur.

a) Consumer surplus will fall by R

b) Consumer surplus will fall by S + U

c) Producer surplus will rise by S

d) Producer surplus will fall by T + V

e) Deadweight loss will be S + U

Q8.

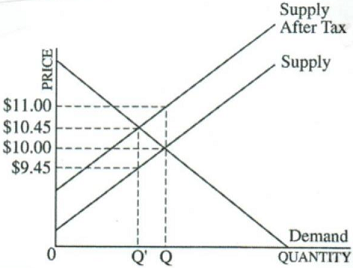

According to the above diagram, what is the dollar amount of the unit tax?

a) $0.00

b) $0.45

c) $0.55

d) $1.00

e) $1.45

Q9.

When the market is in equilibrium, the total economic surplus in the above figure is equal to the area

a) f + k

b) f + g + i + k

c) g + h + i + j

d) f + g + h + i + j + k

e) f + g + h + i + j + k+ l + m

Q10. If a price ceiling is set at P1 in the above figure, which if the following areas represent the resulting consumer surplus, produce surplus, and deadweight loss?

|

|

Consumer surplus

|

Producer surplus

|

Deadweight loss

|

|

a)

|

f

|

k

|

L

|

|

b)

|

f + g + h

|

k + l

|

h + j

|

|

c)

|

f + g + h

|

i + j + k

|

l + m

|

|

d)

|

f + g + i

|

k

|

h + j

|

|

e)

|

F + g + i

|

h + j

|

l + m

|

Q11. Rick is interested in purchasing a used car that the owner is advertising for sale at $800. After negotiating with the owner, Rick is able to buy the used for $700. If Rick is willing to pay $1,000 for the used car, his consumer surplus is

a) $0

b) $100

c) $200

d) $300

e) $1000

Q12. If the government imposes a tax on the production of cars, which of the following will occur in the market for cars?

a) There will be a movement to the right along the supply curve

b) There will be a movement to the right along the demand curve

c) The supply curve will shift to the right

d) The supply curve will shift to the left

e) The demand curve will shift to the right

Q13. Which of the following best illustrates the concept of consumer surplus?

a) A thirsty athlete pays $0.85 for a cold drink when she would have gladly paid $1.50 for a drink.

b) An individual who is willing to accept a job at $7.50 per hour is offered $7.00 per hour

c) An individual pays the sale price of $15.00 for the same shirt that the individual refused to purchase earlier at $18.00

d) An individual finds that the price of artichokes, a food she dislikes, has been reduced by 50 percent

e) A Wood-carver has a marginal cost of $5.00 for a unit of output, but sells that unit at $6.00

Q14. In the diagram below, consumer surplus is the area

a) ABC

b) 0AC

c) 0CQ

d) 0ACQ

e) 0BCQ

Q15. If Whitney purchased a soccer ball for $40 when she was willing to pay $50 for the soccer ball, her consumer surplus would be

a) $0

b) $10

c) $40

d) $50

e) $90

Q16. After the government imposed a $0.20 per gallon tax on gasoline, the price of gasoline increased from $1.00 to $1. 15. Which of the following statements is true?

a) Consumers will bear the entire burden of the tax, since producers can pass the tax along to consumers

b) Consumers and producers will share the tax burden equally

c) Consumers will bear most, but not all, of the tax burden

d) Producers will bear the entire burden of the tax, since the tax was levied on producers, not consumers

e) There is no burden of the tax, since gasoline is a normal good.

Q17.

|

Number of scoops of ice-cream

|

Price per scoop Susan is willing to pay

|

|

1

|

$5

|

|

2

|

$4

|

|

3

|

$3

|

|

4

|

$2

|

|

5

|

$12

|

The table above shows Susan's demand schedule for ice cream. If the price of a scoop of ice cream is $2.50, how much consumer surplus does Susan receive from purchasing 3 scoops of ice-cream?

a) $0.50

b) $1.50

c) $2.50

d) $4.00

e) $4.50