Reference no: EM13350

Your business tax client, Mimi Charpentier, operates a successful sole proprietorship which sells cupcakes to retail customers at three locations in Las Vegas. Mimi's Cupcakes does not carry any inventories, because of the nature of its products. Mimi owns the three small buildings in which the shops exist. One of the stores is slightly larger than the others; it is Mimi's original location, and it still is the site of the kitchen and the loading dock where the Cupcakes trucks daily pick up and deliver merchandise and supplies.

The work force of each store is the equivalent of 2.5 employees; the employees are paid reasonably well, and the low-pressure atmosphere of the typical work day results in a very low turnover rate. Mimi's offers only one fringe benefit to the employees - it encourages the employees to use Health Savings Accounts for their medical costs, and Mimi's reimburses the employee for the out-of-pocket deductible amounts, to a $1,000 maximum per employee per calendar year.

Mimi's attorney, Gloria Willis, has urged her to incorporate the business, primarily because of the limited shareholder liability associated with corporate status, and to facilitate a business succession plan for the operation. After several years of discussions, Mimi has agreed to go ahead with this idea. She will take a sixty percent ownership interest in the common stock of the new entity; twenty percent interests will be made available to Mimi's daughter Nancy, and to Joan Price, the chief operating officer of the business, who is not related to the other two shareholders.

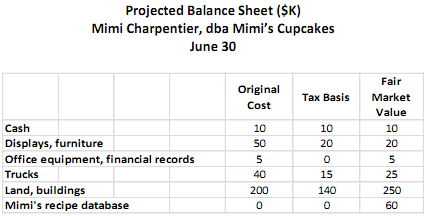

Mimi certainly will ask you to cover the issue of which assets to contribute to the new corporation, with the explanations that Duvall could not provide. Concentrate on those issues for this meeting, offering at least two alternative plans for the asset transfers.

At the meeting, Nancy will look to you for information on issues of asset basis, as well as any effects that the incorporation might have on sales/use and self-employment tax obligations. Ignore any exposure to the corporate or individual alternative minimum tax, though.

Prepare a tax research memo to the file that addresses the issues you feel are most relevant to Mimi's various issures.