Reference no: EM13710372

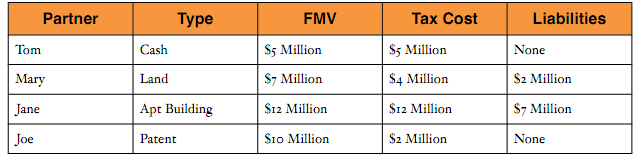

Tom, May, Jane and Joe form ZZ LLC at the beginning of 2012. ZZ LLC ?les as a tax partnership. Each individual contributes the following to the partnership:

Each partner's capital interest equals the net FMV contribution he or she contributed to the partnership. Note: in the above transfers, the partnership assumed the partner's liabilities on the item transferred into the partnership. For example, Mary contributed $7 Million FMV land; however, the partnership assumed $2 Million debt on the land. Thus, Mary's contribution equals $5 Million. The same idea applies to Jane's contribution.

Each partner share of pro?ts and losses equals: Tom - 20%; Mary - 20%; Jane - 20%; and Joe - 40%. Each partner shares liabilities according to the ratios in the previous sentence.

The partnership had the following transactions in 2012 (its ?rst year of operation:

1. Depreciated the building strait line over 30 years. The building represents 80% of the above allocation and land represents the remaining 20%. This apartment building was just completed - Jane has not previously operated it or taken any depreciation on it.

2. In 2012, the apartment building generated $1 Million cash revenues with $400,000 cash expenses [note: you need to also include depreciation as not included in the $400,000 expense ?gure].

3. The partnership made a yearly 2012 interest only payment on apartment debt on December 31, 2012, (rate equals 5%).

4. Joe's patent does not generate any amortization expense as he self created the patent. Thus, the partnership has no amortization as noted in Section 197(c)(2). However, the patent did create $1 Million in patent royalty revenue for the partnership. The partnership paid $50,000 in ordinary expenses relating to the patent.

5. The partnership used $3 Million cash to buy an additional patent. This patent does generate amortization expense using the Section 197(a) patent life. This patent was bought on July 1, 2012. The partnership had $100,000 in royalty revenue from this patent and $10,000 ordinary expense.

6. During the year, the partnership paid o? the $2 Million debt on the land. The partnership paid $2 Million to settle the debt plus $50,000 interest expense due.

7. The partnership later on in the year sold the land for $10 Million cash to an outside party. [Note: as covered in Section 704(c), the partnership allocates the ?rst gain on the sale of the partnership land to Mary's pre contribution gain (FMV less basis) with the remaining gain allocated according to pro?t ratios.]

8. The partnership distributed $2 Million cash total to the partners at year end based on their pro?t ratios.

Part a. Prepare a FMV Balance Sheet for the partnership on its formation at the beginning of 2012 (include each partner's capital account).

Part b. Prepare a Tax Basis Balance Sheet for the partnership on its formation at the beginning of 2012.

Part c. Prepare a schedule showing each partners' tax basis in the partnership (note each partner receives a share of partnership basis in liabilities) at the beginning of the 2012.

Part d. Prepare a 2012 taxable income statement table for the partnership for 2012.

Note: you exclude the land sale from this computation. Then below the taxable income partnership income statement include the land sale total gain and allocate this gain to the partners (you may not need a table for the land gain as you could just explain in some bullets if you wish).

Part e. Prepare a December 31, 2012 schedule showing the tax basis each partner has in his (her) partnership interest.

Note: You are to complete this assignment in Word only. You can just answer each section right after the part by placing a word table with computations. Thus, you place a word table on part a. and answer and then place a table in part b. and answer.

|

Refrigerant such that pressure inside tank remains constant

: A 4.56ft3 rigid tank contains saturated refrigerant-134a at 100 psia. Initially, 11% of the volume is occupied by liquid and the rest by vapor. A valve at the top of the tank is now opened, and vapor is allowed to escape slowly from the tank. Heat is..

|

|

Derive and draw the firms demand for labor

: Derive and draw the firm's demand for labor while the firm's product is sold in a competitive market at $15, and the wage rate is $60.

|

|

Gas turbine engine has a pressure ratio

: A gas turbine engine has a pressure ratio of 10, and the intake air is at 90 kPa and 280K. Both the compressor and turbine have an isentropic efficiency of 100% and a regenerator with an effectiveness of 0.8 is used. The highest temperature in the cy..

|

|

A slow leak developed in a tire

: A slow leak developed in a tire (assume constant volume), in which it takes 3 hr for the pressure to decrease from 30 psig to 25 psig. The air volume in the tire is 0.5 ft3, and the temperature remains constant at 60 oF. The mass flow rate of the air..

|

|

Prepare a tax basis balance sheet for the partnership

: Depreciated the building strait line over 30 years. The building represents 80% of the above allocation and land represents the remaining 20%. This apartment building was just completed - Jane has not previously operated it or taken any depreciati..

|

|

Present worth be better using the cash right

: A Car Costs 25,000 dollars. You can buy it for cash for 21000 (right now) or buy it over time with a down payment of 8000 dollars and pay the remaining 17000 over 72 months at 12% interest compounded monthly.

|

|

About balloon with camera launched in space

: Questions about balloon with camera launched in space... How can the angle with respect to north are measured. How can we make this system rotate physically while at high altitude? How can we measure the altitude of the system?

|

|

Determine the instantaneous heat transfer rate

: Consider a 1.25 cm diameter carbon steel (1% C, k = 40 W/m-K) sphere to be cooled from 500oC to 100oC by a cooling air flow at 25oC with convection coefficient of 110 W/m2-K.

|

|

Entered and the pressure of the steam in the supple line

: A 2-m^3 rigid insulated tank initially containing saturated water vapor at 1 MPa is connected through a valve to a supply line that carries steam at 400C. Now the valve is opened, and steam is allowed to flow slowly into the tank until the pressure i..

|