Reference no: EM131225568

Part A

Bogart Ltd has determined the number of widgets it will need during the next five years as follows:

| 2011 |

50000 |

| 2012 |

50000 |

| 2013 |

52000 |

| 2014 |

55000 |

| 2015 |

55000 |

The equipment used to manufacture the widgets must be replaced and management is considering the purchase of a replacement machine. The new machine will cost $945,000 and 2% discount is available if it is purchased within the next 10 days. There will be a 2 per cent discount is available if payment is made within 10 days. The company usually takes all purchase discounts.

Freight and installation costs would total $22,900 and the machine would be ready for use on 1 January 2011. The machine has a five-year useful life and the company employs a straight line method in depreciating its assets. For tax purposes it can be depreciated over three years and after five years it is expected to have a scrap value of $12,000.

Purchase of the machine would provide a 25% reduction in both direct labour and variable overhead. Also there would be a one-off permanent decrease in working capital requirements of $2,500. The existing equipment can be sold now for $1500 and is fully depreciated.

The Production Manager has suggested that rather than replace the equipment, the widgets could be purchased rather than made. If the widgets were purchased, the old equipment would remain in place. The widgets can be purchased at a price of $27 each. Bogart's current manufacturing cost is as follows:

Direct Materials $8.00

Direct Labour $10.00

Variable Overhead $6.00

Fixed Overhead

Supervision $2.00

Facillities $5.00

General $4.00 $11.00

$ 35.00

Total Maufacturing cost $35.00

Per Unit

Bogart employs a plant-wide fixed overhead rate for its operations and if the widgets were purchased outside, fixed overhead of $45 000, would be eliminated.

Bogart currently pays tax at 40% and applies an after-tax discount rate of 12%.

Required

a) Calculate the net present value of the estimated after-tax cash flows

b) Recommend which of these two options to pursue.

Part B

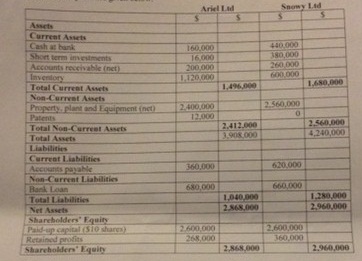

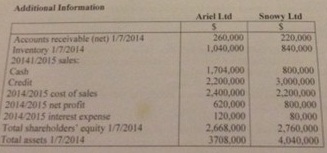

The Balance Sheets and other selected information for the year ended 30 June, 2015 for Ariel Ltd and Snowy Ltd are given below:

Additional Information

Required: Prepare a common size comparative balance sheet for each of the companies.

b) Prepare all relevant financial statement ratios for each company.

c) Which company do you think has a better liquid position? Why?

d) Which company is using leverage more effectively to increase the rate of return to ordinary shareholders? Please explain your answer.

e) What additional information would you have found useful to allow you to undertake a full analysis? Why?

Part C

Trotsky started production on 1 April with the following sales forecast:

| Sales |

Units |

| May |

550 |

| June |

610 |

| July |

730 |

| Aug |

875 |

| Sep |

900 |

| Oct |

900 |

| Nov |

900 |

| Dec |

800 |

| Jan |

700 |

Selling price per unit is $110 and all sales will be made on one month's credit. Sufficient finished goods inventory at the end of the previous month should be enough to cover current monthly sales.

Purchases of raw materials will be such that there should be sufficient raw materials inventory available at the end of each month precisely to meet the following month's planned production. This planned policy will operate from the end of April. purchases of raw materials will be on one month's credit.

The cost of raw materials is $45 per unit of finished product. The dp Non-production overheads are planned to be $12,000 per month of which $1,000 will be depreciation. Various fixed assets costing $275,000 will be bought and paid for during April. Except where specified otherwise, assume that all payments take place in the same month as the cost is incurred.

The business will raise $350,000 in cash from a share issue in April.

You are required to draw up for the six months ending 30 September.

a) finished inventory budget, showing just physical quantities;

b)a raw materials inventory budget, showing both physical quantities and financial values;

c) a trade creditors budget; trade debtors budget; a cash budget

Part D

FLOCCINAUCINIHILIPILIFICATION - Does it matter in Accounting?

|

Accounts receivable account represented

: The Redwood Company determined that its balance in its Accounts Receivable account represented 23% of total assets and that cost of goods sold represented 38% of total revenue. These findings are the result of

|

|

Calculate total variable labor cost for the coming year

: Using High-Low to Calculate Predicted Total Variable Cost and Total Cost for a Time Period that Differs from the Data Period Pizza Vesuvio makes specialty pizzas. Data for the past eight months were collected: Calculate total variable labor cost for ..

|

|

What is the bottom line net income for the company

: In its latest set of financials, a company presents the following information regarding its income statement: Assuming these 6 items are the only income statement entries provided by the company, what is the bottom line net income for the company?

|

|

Research the website of one multinational company in detail

: BOIITMG306 International Management Assignment - Group Research and Presentation. Students are required to research the website of one multinational company in detail. Research information must include the growth, the strategic planning, organisati..

|

|

Prepare a common size comparative balance sheet

: Prepare a common size comparative balance sheet for each of the companies - Prepare all relevant financial statement ratios for each company and which company do you think has a better liquid position? Why?

|

|

Derive the expression for the loop gain

: The small-signal parameters of the transistors in the circuit in Figure are hFE and VA = ∞. - Derive the expression for the loop gain.

|

|

Jack and jill total stockholders equity

: Jack and Jill Corporation's year-end 2009 balance sheet lists current assets of $259,000, fixed assets of $809,000, current liabilities of $186,000, and long-term debt of $291,000. What is Jack and Jill's total stockholders' equity?

|

|

Develop a microsoft access database based upon the er-model

: Develop a Microsoft Access database based upon the below Entity Relationship Model. Be sure to include tables, fields, keys, relationships, and data in your database. Your final submission will be a Microsoft Access database.

|

|

What is nicole total stockholders equity

: Nicole Corporation's year-end 2009 balance sheet lists current assets of $756,000, fixed assets of $606,000, current liabilities of $539,000, and long-term debt of $694,000. What is Nicole's total stockholders' equity?

|