Reference no: EM13198601

Physical prices vs. Financial Settlements for natural gas.

In Lesson 6, you looked-up some cash prices at various hubs in the US using the link for Natural Gas Intelligence. Using those same cash hubs, compare the most recent prices to the NYMEX Settlement price for natural gas for June, 2014.

Use the CME website to find the most recent Settlement price. Calculate the difference as follows: Cash price minus NYMEX.

These results represent what is known as the "actual Basis" relationship between the NYMEX Henry Hub contract delivery point for natural gas in south Louisiana and other physical delivery points in the US.

The natural gas is processed due to it contains many impurities and water. There are some specifications natural gas delivered by or on behalf of Shipper to Natural at any Receipt Point, and natural gas delivered by Natural to or for the account of Shipper at any Delivery Point, shall be of pipeline quality such as below.

- % of O2: The parties should make various efforts to reduce the oxygen level in the gas. The oxygen level should not exceed to ten parts per million (10 ppm) by volume of uncombined oxygen.

- Water Vapor:The gas shall be free of water and hydrocarbons in liquid form at the temperature and pressure at which the gas is delivered. In addition, the gas shallnot contain any hydrocarbons which might condense to free liquids in the pipeline under normal pipeline conditions and shall in no event contain water vapor in excess of seven (7) pounds per one million (1,000,000) cubic feet.

- H2S:The total sulfur content, including mercaptans and hydrogen sulfide, shall not exceed one-half (1/2) grain per one hundred (100) cubic feet of gas.

- % of Nitrogen: The gas shall have a combined composition of total inert gases (principally nitrogen and carbon dioxide) of not more than four (4) mole percent.

Hydrocarbon dew point: Natural will include in such posting the anticipated duration of the limitation. Points with an actual flow of 100 Dth/d or less will be exempt from the limitation in any such posting. Natural will provide as much prior notice of any such limitation as reasonably practicable and will attempt to provide this prior notice in the posting at least ten (10) Days before the beginning of the month in which the limitation is to be effective. If prior notice by posting at least ten (10) Days before the beginning of the month is not practicable, Natural will explain the reason in the posting why it was unable to give such prior notice.

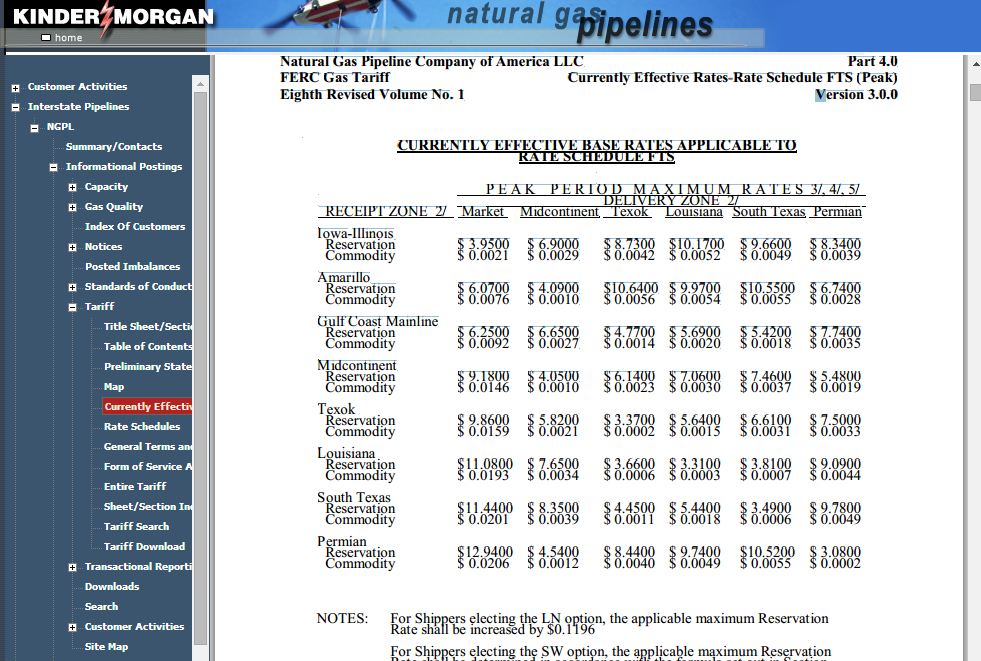

Calculation of daily natural gas pipeline transportation rates per MMBtu

From Midcontinent to Market

| Monthly reservation Fees |

9.18 |

|

13.72 |

|

|

|

|

| Days |

30.4 |

|

|

|

|

|

|

| Daily rate |

|

|

|

| per MMBtu |

0.302 |

|

|

|

|

|

|

| Commodity |

0.0146 |

|

|

|

|

|

|

| Total rate |

$ 0.317 |

|

|

|

Fundamental changes in human nature-relationship

: Leon Kass believes that allowing human cloning and genetic engineering will lead to "fundamental (and likely irreversible) changes in human nature, basic human relationships, and what it means to be a human being.

|

|

Personalities and our cognitive styles

: Implicit in Turkle's argument is the idea that we choose technologies that reflect our personalities and our cognitive styles. Discuss how you have used technology in your life to reflect your style. Do any of your technologies reflect your personali..

|

|

Apply to developmental theory

: Compare and contrast the philosophies of John Locke and Charles Darwin as they apply to developmental theory?

|

|

Effective progressive than theodore rossevelt

: What were the most important of Wilsons progressive reforms? Was Wilson actually a more effective progressive than Theodore Rossevelt?

|

|

Physical prices vs financial settlements for natural gas

: Natural will include in such posting the anticipated duration of the limitation. Points with an actual flow of 100 Dth/d or less will be exempt from the limitation in any such posting - Use the CME website to find the most recent Settlement price. ..

|

|

Find the price at which the firm sells the product

: Suppose that a firm maximizes its total profits and has a marginal cost (MC) of production of $8 and the price elasticity of demand for the product it sells is -3. Find the price at which the firm sells the product.

|

|

Discussion brainard and bennis

: Discussion Brainard, Bennis, and Farrell What problems is Brainard facing in designing a compensation system? Does it make sense that they should tie compensation to performance? What kinds of contributions should get the biggest rewards?

|

|

Define deterrent or distraction

: Deterrent or Distraction? Does the Patriot Act affectively deal with the threats of homegrown terrorism

|

|

By how much the demand for cigarettes will change

: Suppose that the price elasticity of demand for cigarettes is.46 in the short run and 1.89 in the long run, the income elasticity of demand for cigarettes is .50, the cross price elasticity of demand between cigarettes and alcohol is -.70.

|