Reference no: EM131048068

FINANCIAL THEORY & FINANCIAL MARKETS ASSIGNMENT-

Question:

Assume you are working for a bulge-bracket investment firm and you have been just approached by a wealthy client. The client, Mr. John, has a significant savings of $10 million as of 31st March 2016.

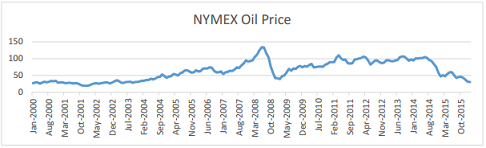

Mr. John is closely following the crude oil prices and would like to make money from the volatility of the oil prices. Specifically, he thinks that a steep fall of crude oil prices in the recent years may have opened investment opportunities. However, Mr. John is not sure which financial market within Australia is likely to give him the best return without taking huge risk

Mr. John would like to consult your team on your views, analysis and suggestion on whether he should invest in money market, bond market or equity market and for how long. As a team, you need to draft a report and make appropriate recommendations to Mr. John, i.e., whether you expect money market, bond market, or equity market to outperform. You also need to provide your indicative investment horizon period.

The marks will be given on the following points:

1. How convincing is your report

2. Academic rigour (past academic research and findings)

3. Why did oil prices drop so much recently?

4. How oil prices impact the financial markets?

5. Analysis of money, bond and equity market (pros and cons in each financial market, historical returns etc.)

6. Empirical analysis, arguments and supporting evidence (I do not expect financial valuation modelling or complex calculations)

7. Linking your findings with theoretical background

8. Readability of the report (should be professional, easy to read and attractive- remember the client is going to read the report)

9. Proper referencing (Harvard style)

The report should consist of following sections:

1. Executive summary ( approx. 100 words )

2. Introduction ( approx. 250 words )

3. Literature Review ( approx. 500 words )

4. Data ( approx. 250 words )

5. Analysis & Discussion ( approx. 600 words )

6. Conclusion ( approx. 300 words )

7. References

8. Appendix (if any)