Reference no: EM131402761

Assignment 1

THE SHAW GROUP, INC.*

This case includes data from The Shaw Group, Inc. annual report for the year ended August 31, 2010.

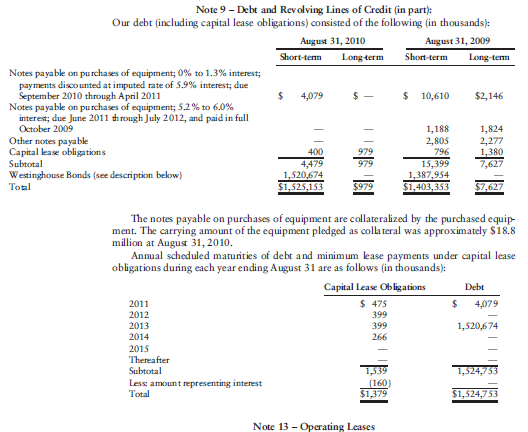

Assets acquired under capital leases, net of accumulated depreciation, were $1.6 million and $2.0 million at August 31, 2010, and 2009, respectively. If the assets acquired under capital leases transfer title at the end of the lease term or contain a bargain purchase option, the assts are amortized over their estimated useful lives; otherwise, the assets are amortized over the respective lease term. Depreciation expense of $59.8 million, $52.3 million, and $43.7 illion for the fiscal years ended August 31, 2010, 2009, and 2008, respectively, is included in cost of revenues and general and administrative expenses in the accompanying consolidated statements of operations.

At August 31, 2010, construction in progress consisted primarily of deposits on heavy equipment to be used on some of our power projects. At August 31, 2009, construction in progress consisted primarily of cost related to the construction of our module fabrication and assembly facility in Lake Charles, Louisiana.

In fiscal year 2009, we recorded an asset impairment charge of $5.5 million for a consolidated joint venture. The impairment charge reduced the property, plant, and equipment to its salvage value.

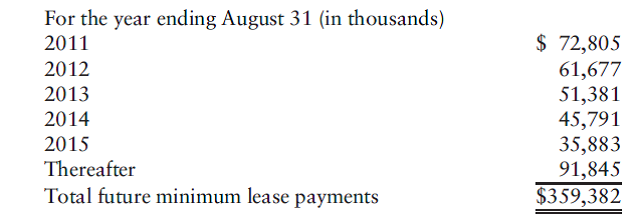

We lease certain office buildings, fabrication and warehouse facilities, machinery, and equipment under various lease arrangements. Leases that do not qualify as capital leases are classified as operating leases and the related lease payments are expensed on a straight-line basis over the lease term, including, as applicable, any free-rent period during which we have the right to use the asset. For leases with renewal options where the renewal is reasonably assured, the lease term, including the renewal period, is used to determine the appropriate lease classification and to compute periodic rental expense.

Certain of our operating lease agreements are non-cancelable and expire at various times and require various minimum rentals. The non-cancelable operating leases with initial noncancelable periods in excess of twelve months that were in effect as of August 31, 2010, require us to make the following estimated future payments:

Future minimum lease payments as of August 31, 2010 have not been reduced by minimum non-cancelable sublease rentals aggregating approximately $0.8 million.

In 2002, we entered into a 10-year non-cancelable operating lease for our Corporate Headquarters building in Baton Rouge, Louisiana. In connection with this lease, we purchased an option for $12.2 million for the right to acquire additional office space and undeveloped land for approximately $150 million. The option expires the earlier of January 2012, or upon renewal of the existing Corporate Headquarters lease. The cost of the option is included in other assets. The book value of the option is assessed for impairment annually based on appraisals of the additional office space and undeveloped land subject to the option. If we renew the lease rather than exercise the option, the option value will be expensed over the term of the new Corporate Headquarters building lease.

We also enter into lease agreements for equipment needed to fulfill the requirements of specific jobs. Any payments owed or committed under these lease arrangements as of August 31, 2010, are not included as part of total minimum lease payments shown above.

The total rental expense for the fiscal years ended August 31, 2010, 2009, and 2008 was approximately $178.8 million, $178.1 million, and $170.6 million, respectively. Deferred rent payable (current and long-term) aggregated $32.0 million and $30.3 million at August 31, 2010 and 2009, respectively.

Required

a. For August 31, 2010:

1. What was the gross amount for property and equipment?

2. What was the net amount for property and equipment?

3. What was the gross amount for assets acquired under capital leases?

4. What was the net amount for assets acquired under capital leases?

5. How material are assets acquired under capital leases in relation to total property and equipment?

b. How material are capital lease obligations in relation to total debt and revolving lines of credit at August 31, 2010?

c. Operating leases:

1. What was the total future minimum lease payments as of August 31, 2010?

2. Using two-thirds of future minimum lease payments representing principal, what would be the estimate for principal at August 31, 2010?

3. How material are operating leases in relation to capital leases?

SAFEWAY INC. AND SUBSIDIARIES*

Notes to Consolidated Financial Statements (In Part)

Note K: Employee Benefit Plans and Collective Bargaining Agreements (In part)

Pension Plans

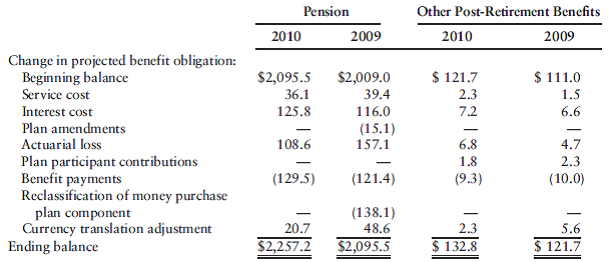

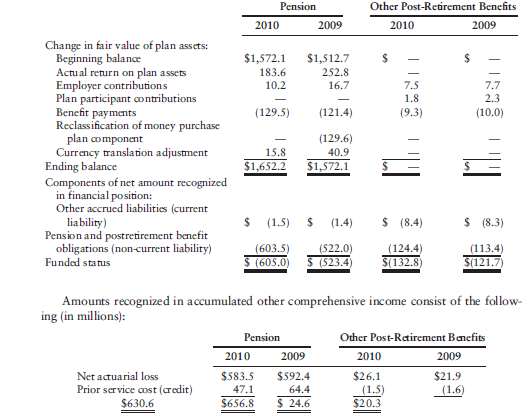

The Company maintains defined benefit, non-contributory retirement plans for substantially all of its employees not participating in multi-employer pension plans. Safeway recognizes the funded status of its retirement plans on its consolidated balance sheet.

Other Post-Retirement Benefits

In addition to the Company's pension plans, the Company sponsors plans that provide postretirement medical and life insurance benefits to certain employees. Retirees share a portion of the cost of the postretirement medical plans. Safeway pays all the costs of the life insurance plans. The Company also sponsors a Retirement Restoration Plan that provides death benefits and supplemental income payments for senior executives after retirement. All of these Other Post-Retirement Benefit Plans are unfunded.

The following table provides a reconciliation of the changes in the retirement plans' benefit obligation and fair value of assets over the two-year period ended January 1, 2011 and a statement of the funded status as of year-end 2010 and year-end 2009. Activity for 2009 includes the removal of the Canadian money purchase plan which had been previously presented within the table but has since been determined to be a defined contribution plan (in millions):

Safeway expects approximately $62.2 million of the net actuarial pension loss and $15.9 million of the prior service cost to be recognized as a component of net periodic benefit cost in 2011.

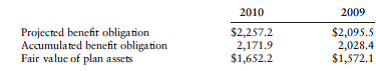

Information for Safeway's pension plans, all of which have an accumulated benefit obligation in excess of plan assets as of year-end 2010 and 2009, is shown below (in millions):

Required

a. 1. Determine the projected benefit obligation at the end of 2010 and 2009 (pension and other post-retirement benefits).

2. Determine the fair value of plan assets at the end of 2010 and 2009 (pension and other post-retirement benefits).

3. Determine the funded status at the end of 2010 and 2009 (pension and other postretirement benefits).

4. Why is the funded status of the other post-retirement benefits equal to the projected benefit obligation?

5. Do all of the pension plans have an accumulated benefit obligation in excess of plan assets?

b. Comment on the trend in projected benefit obligation and the funded status (pension and other post-retirement benefits).

Assignment 2

Discuss fully the following cases. Be sure to include responses to all questions asked in the case, answered in the same order that they are found within the case:

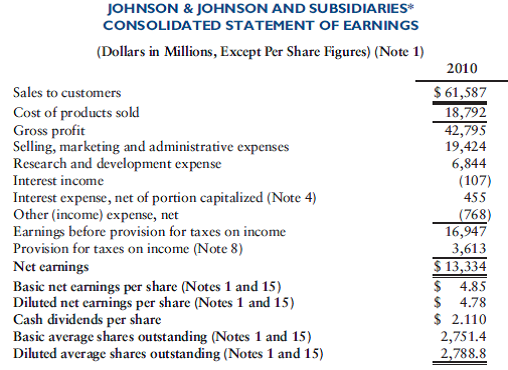

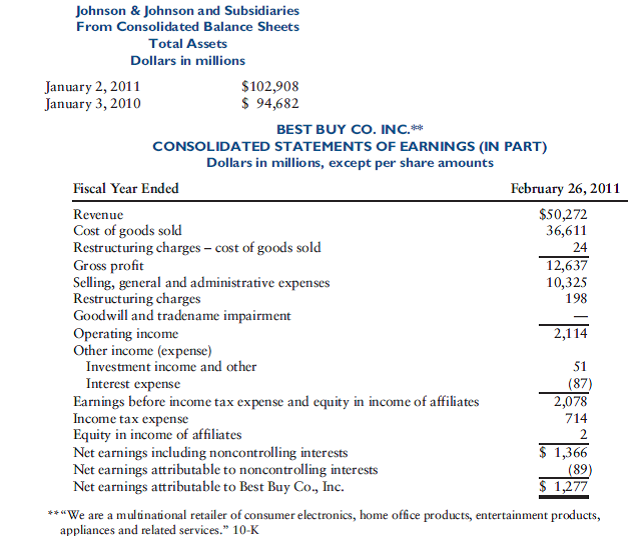

With this case, a comparison is made between two firms in different industries using net profit margin, total asset turnover, and return on assets.

Best Buy Co. Inc.

From Consolidated Balance Sheets

Total Assets

Dollars in Millions

February 26, 2011 $17,849

February 27, 2010 $18,302

Required

a. Compute the following ratios for Johnson & Johnson:

1. Net profit margin

2. Total asset turnover

3. Return on assets

b. Compute the following ratios for Best Buy Co.:

1. Net profit margin

2. Total asset turnover

3. Return on assets

c. Comment on the effect of the industry on these ratios.

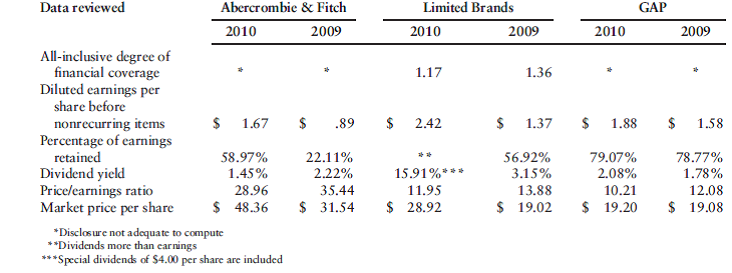

Abercrombie & Fitch Co.

(52-week fiscal year ended January 29, 2011; 52-week fiscal year ended January 30, 2010; 52-week fiscal year ended January 31, 2009)

"Abercrombie & Fitch Co ... is a specialty retailer that operates stores and directto- consumer operations." 10-K

Source: Abercrombie & Fitch 2010 10-K

2. Limited Brands, Inc.

(52-week fiscal year ended January 29, 2011; 52-week fiscal year ended January 30, 2010; 52-week fiscal year ended January 31, 2009)

"We operate in the highly competitive specialty retail business" 10-K

Source: Limited Brands 2010 10-K

3. Gap, Inc.

(52-week fiscal year ended January 29, 2011; 52-week fiscal year ended January 30, 2010; 52-week fiscal year ended January 31, 2009) "We are a global specialty retailer offering apparel, accessories, and personal care

products" 10-K

Source: Gap Inc 2010 10-K

Required

a. Comment on all data reviewed for each individual company.

b. Based on the above, which firm would you select?

Assignment 3

Discuss fully the following cases. Be sure to include responses to all questions asked in the case, answered in the same order that they are found within the case:

TRAVEL COMPANY

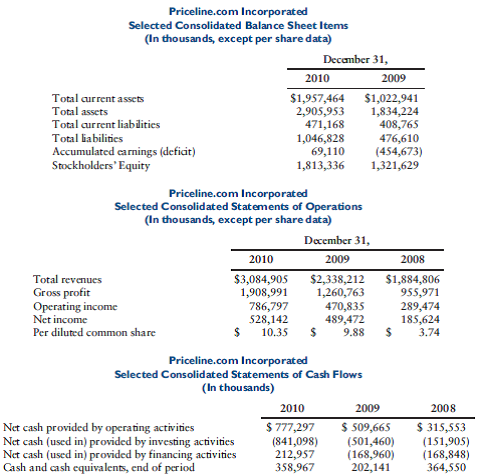

The data in this case come from the financial reports of Priceline.com.*

Required

a. 1. Compute the current ratio for 2010 and 2009. Comment.

2. Compute the debt ratio for 2010 and 2009. Comment.

3. Total revenues - Prepare a horizontal common-size - use 2008 as the base. Comment.

4. Gross profit - Prepare a horizontal common-size - use 2008 as the base. Comment.

5. Net income - Prepare a horizontal common-size - use 2008 as the base. Comment.

6. Per diluted common share - Prepare a horizontal common-size - use 2008 as the base. Comment.

7. Net cash provided by operating activities - Prepare a horizontal common-size - use 2008 as the base. Comment.

b. Give an overall comment.

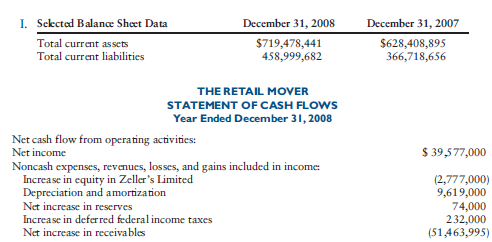

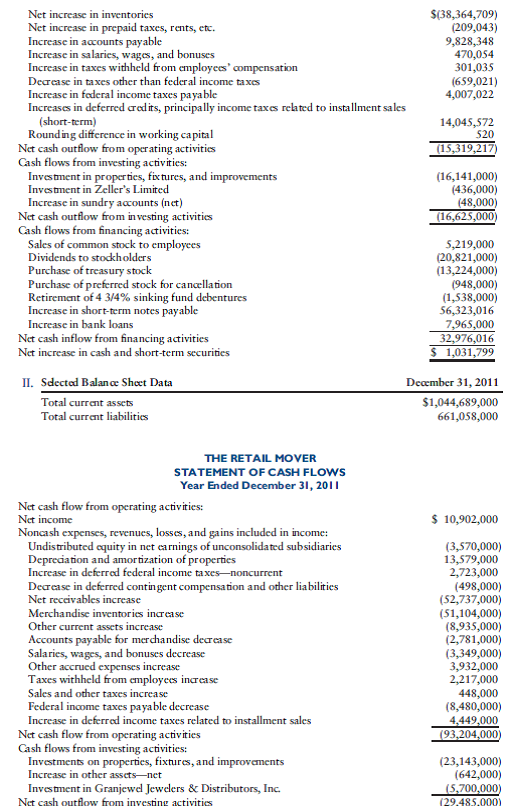

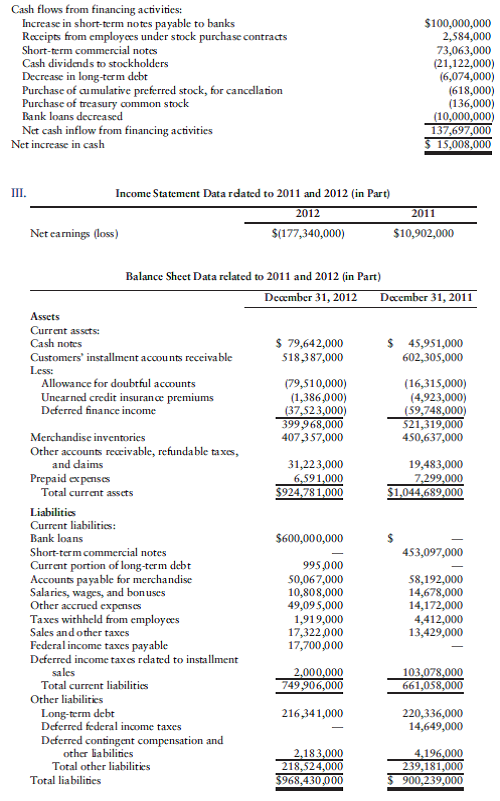

THE RETAIL MOVER

This case represents an actual retail company. The dates and format have been changed.

Required

a. Compute and comment on the following for 2007, 2008, and 2011:

1. Working capital

2. Current ratio

b. Comment on the difference between net income and net cash outflow from operating activities for the years ended December 31, 2008, and December 31, 2011.

c. This company reported a loss of $177,340,000 for 2012. Reviewing the balance sheet data, speculate on major reasons for this loss.

d. Considering (a), (b), and (c), comment on the wisdom of the short-term bank loan in 2012. (Consider the company's perspective and the bank's perspective.)