Reference no: EM1373729

Submit a file that has all the answers for the questions and an Excel file that has only the data and regression outputs. For the Excel file, make sure you give the name for each spread sheet such as data, straight- line, quadratic and cubic. Do not forget to put the group number and the names of the participants on the project in the Word document.

The project below is Question 9 on page 287, chapter 7. I deleted certain questions. Make sure you read pp. 258-260 with the special attention to Figure (the three different specifications of the total cost function) and pp. 295-305 from your textbook.

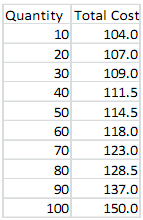

You have been presented with the following cost data and asked to fit a statistical cost function:

1. Fit three possible statistical cost functions to the data. Use straight- line, quadratic, and cubic formulas.

2. Discuss the statistical results you obtained in question 1. Include in your discussion R2, the coefficients, and the statistical significance of the coefficients. For the statistical significance test, use the p-test rather than the t-test. If you decide to use the t-test, you first have to find the degrees of freedom and then find the appropriate critical t-value in Table A.4 on page 583.

3. If the data represent 10 months of production for one plant of a specific company, would you consider this to be a short-run analysis?

4. How would your answer to question 3 change if you were told that the data represent 10 different plants during a particular month of the year?

Textbook required - Paul G. Keat and Philip K.Y. Young, Managerial Economics,7th ed., Pearson Prentice Hall

|

What do you tell her about the income tax consequences

: What do you tell her about the income tax consequences and are there ways to change the basic structure so that it is more advantageous from an income tax point of view?

|

|

Exercising the application of a mandatory retirement age

: Discuss the logic of a company setting and exercising the application of a mandatory retirement age and determine the pros and cons of the mandatory retirement practice from the perspective of the organization, economy, individual, or Nation?

|

|

High employment deficit

: The high employment deficit is estimated at $100 billion. Suppose that the ecomony is operating below full employment and that it will not overheat during year,

|

|

Discussion on behavior of profit maximizing firms

: The number of repairs manufactured by a computer repair shop depends on the number of employees as given follows:

|

|

Fit possible statistical cost functions to the data

: Fit three possible statistical cost functions to the data. Use straight- line, quadratic, and cubic formulas and discuss statistical results. Include in your discussion R2, the coefficients, and the statistical significance of the coefficients.

|

|

Explain the appropriate discretionary fiscal policy

: The economy has seen unemployment rate raise from 6% to 9.5%, the inflation rate decrease from 2.8% to 1.2%, and there has been a 24% decline in consumer spending and a 45% decline in investment spending in the same time period.

|

|

Compute the marginal revenue product

: Assume the following payoff matrix in which the numbers indicate the profits in millions of dollars for a duopoly based either on a high price or a low price strategy.

|

|

Can investment tax credits decrease employment

: Many states give companies with an investment tax credit that effectively decrease the value of capital. In theory these credits are designed to stimulate new investment and thus create jobs.

|

|

Describe the consequences of government overspending

: When watching at our economy, you will determine that government expanding is very important to our overall output of our economy.

|