Reference no: EM13889787

1. Suppose that the current (simple annual) yields on 3-month U.S. (RA) and U.K. T-bills (Rb) are 16 percent and 8 percent, respectively, and that the dollar value of the pound is expected to rise 1 percent during the next three months.

(a) How might the British and American T-bill and foreign exchange markets adjust to this situation? Present and discuss an equilibrium consistent with the concept of interest rate parity (IRP) and discuss the processes by which this equilibrium might be achieved. Should you buy U.S. or U.K. bills? At what U.S. T-bill yield would you be indifferent between U.K. and U.S. T-bills given the expected changes in the exchange rate?

(b) Governments frequently buy and sell foreign exchange for the purpose of smoothing fluctuations in exchange rates. Discuss the purposes for these interventions since 1971 and describe how these actions might interfere with the efficient allocation of resources by causing forward exchange rates to be biased predictors of spot rates.

Hints: IRP Condition: (1 + Ra) = (1 + Rb)(1 + Ee) = (1 + Rb)(1 + F/S)

where Ra = 3-month U.S. T-bill yield,

• _Rb = 3-month U.K. T-bill yield,

Ee = expected proportional change in the dollar value of the British pound, ƒ _.

F = forward exchange rate ($/ƒ _),

S = spot exchange rate ($/ƒ _).

2. Describe the objectives involved in the management of a bank's overall liquidity position and the costs to the bank of poor liquidity management. In your discussion, identify the major sources of demand on a bank's liquidity position, including reserve requirements, and the major sources of funds to meet liquidity needs. As part of your discussion, consider how the predictable fluctuations in loan demand and deposit flows can cause changing liquidity needs and how a bank might anticipate such changes.

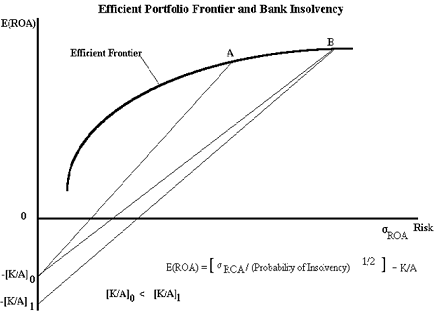

3. As a financial institutions and markets analyst for MoreGaine Securities, Inc., a highly reputable financial institutions' securities underwriter, you must prepare an analysis of the financial condition of a broad range of financial institutions of various sizes, localities, and product lines. Using the "probability of insolvency" model discussed in class where E(ROA) is the expected value of after-tax earnings on assets, σ2 is the variance of ROA, and K/A is the firm's equity capital plus contingency and loan loss reserves to total assets, discuss, based upon your economic assumptions, what financial ratios you might use to assess the level and expected future course, over the next few years, of each of these indicators of financial soundness. As a preliminary to this discussion, clearly state your assumptions about general economic growth and cyclical movements, interest rates (level and term structure), and potential developments in individual industries and regional economies (e.g., agriculture, energy, Asian Markets). Primarily, discuss how the federal regulatory agencies' capital adequacy policy, in the form of risk-based capital adequacy standards and Prompt Corrective Action, might affect financial institution soundness, costs of moral hazard and portfolio choices.

NOTE: the maximum probability of insolvency = σ2/[E(ROA) + K/A]2

4. Public policy toward financial institutions, and depositories in particular, has attempted to promote competition within a framework of regulation intended to ensure the financial integrity of the institutions.

a. Detail the fundamental reasons for financial regulation as discussed in class and in the text. As part of this discussion, provide an analysis of the potential conflicts between a policy of promoting competition and a policy of reducing the chance of financial institution failure. In this context what are the dangers of the too-big-to-let-fail policy in promoting financial intermediary efficiency, productivity and competition as more large FIs are formed through mergers and consolidation. Consider whether the problem of moral hazard facing regulators and the federal deposit insurance funds is more or less of a problem under this policy.

b. Give an example of a recent regulatory reform or change in federal or state laws that are intended to promote competition among financial intermediaries and how they are to do so. Within your discussion, provide an analysis of how market forces, such as rising interest rates, inflation, and financial innovation, have stimulated the development of new financial instruments and new institutional arrangements and intensified competition among financial institutions.

c. Several dominant movements in determining the structure of U.S. banking have been the spread of branch banking, the growth of bank holding companies and interstate banking which permits the geographic expansion of banking services and the ability of banking organizations to offer new and diversified product lines. In the 1970s, nonbank financial firms, such as insurance companies and stock brokers, began competing with depository institutions. Does this revitalized competition, recently characterized by the innovation of by specialized banking firms and the potential for expanded product lines, cause present prudential regulation (e.g., capital adequacy standards, examinations or asset composition constraints) and federal deposit insurance to be outmoded? In your answer, discuss the role and administration of prudential regulation when major depository institutions may be highly diversified financial service companies providing life and casualty insurance sales and underwriting, corporate securities underwriting, household and business depository services, sophisticated EFT and telecommunications services as well as traditional lending to business.