Reference no: EM131421078

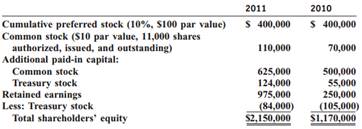

Tracey Corporation reports the following in its December 31, 2011, financial report:

The total balance in treasury stock on December 31, 2010, represents the acquisition of 1,500 shares of common stock on March 3, 2009.

REQUIRED:

a. Compute the number of shares of common stock issued during 2011.

b. Compute the average market price of the common shares issued during 2011.

c. Assume that Tracey Corporation earned net income of $2 million during 2011. Compute the amount of dividends that were declared during 2011.

d. If Tracey Corporation did not declare or pay any dividends during 2010, and again assuming a net income during 2011 of $2 million, compute the amount declared as dividends to common stockholders during 2011.

e. Prepare the entry that would have been necessary on March 3, 2009, to record the purchase of the treasury stock.

f. Assume that all shares of treasury stock reissued during 2011 were reissued at the same time and at the same price. Prepare the entry to record the reissuance of the treasury stock.

g. At what per-share price was the treasury stock reissued?

|

Which is a feature of a high-performing organization

: Which of the following is a feature of a high-performing organization? An organization's return on investment is calculated by dividing. One way of pursuing a differentiation strategy is by.

|

|

Determine the specific segment of the market

: Determine the specific segment of the market that your organization's strategy or strategies will target. Recommend whether pre-service, point-of-service, or after-service activities would be the most effective in approach in marketing your strateg..

|

|

Definitions and theoretical models of addiction

: Addiction, whether to chemicals or behaviors, is part of a broad continuum (Doweiko, 2015). At one end of the continuum is total abstinence or the non-problematic use of chemicals or patterns of behavior. The moderately problematic use of chemical..

|

|

Identify and explain anticipated challenges

: Identify and explain anticipated challenges and at least three common reasons why overseas assignments might fail. Propose solutions for each of the reasons you identified

|

|

At what per-share price was the treasury stock reissued

: Assume that all shares of treasury stock reissued during 2011 were reissued at the same time and at the same price. Prepare the entry to record the reissuance of the treasury stock.

|

|

How many participants will you have in your sample

: What is the problem being addressed by your research study?State the refined research question and hypothesis (null and alternative).What are your independent and dependent variables? What are their operational definitions?Who will be included in you..

|

|

Describe the risks associated with excess body fat

: Write a response of at least 350 words that explains the associated health problems of the obesity epidemic and eating disorders. Address the following: Describe the risks associated with excess body fat

|

|

Why should the market value of disney’s stock rise

: The Wall Street Journal once reported that the stock split was "a psychological boost and an indication that management has confidence in their performance and that the stock price can be sustained." Explain how this explanation could account for ..

|

|

How did your perspective on compensation develop

: Employees often perceive their compensation in different ways -- as a return in exchange for their labors, as an entitlement, as a reward, etc. In what way do you perceive compensation and how did your perspective on compensation develop?

|