Reference no: EM13764917

1. The spending multiplier is equal to:

A) MPC / MPS.

B) 1 / (1 - MPS).

C) MPC + MPS.

D) 1 / (1 - MPC).

2. If the marginal propensity to consume is 0.75 and the federal government increases spending by $100 billion, the income expenditure model would predict that real GDP will increase by:

A) $100 billion.

B) $750 billion.

C) $400 billion.

D) $300 billion.

3. The money demand curve is:

A) downward-sloping because the opportunity cost of holding money is inversely related to the interest rate.

B) downward-sloping because the opportunity cost of holding money rises as the interest rate rises.

C) downward-sloping because the opportunity cost of holding money rises as the interest rate falls.

D) upward-sloping because the opportunity cost of holding money rises with the interest rate.

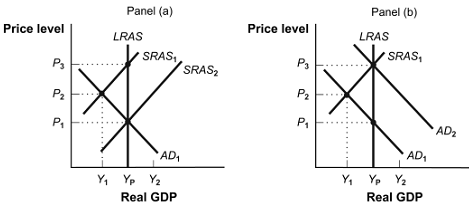

Figure: Policy Alternatives

4. If the economy is in equilibrium at Y1 in panel (a) and the government increases government spending, the result will likely be

A) an increase in unemployment.

B) a decrease in interest rates.

C) inflation.

D) deflation.

5. (Figure: Policy Alternatives) If the economy is in equilibrium at Y1 in panel (a) and the government does not intervene, the result will likely be

A) a shift of AD1 to the left.

B) a shift of SRAS1 to SRAS2.

C) a shift of LRAS to the left.

D) no change in AD or SRAS.

6. If the economy is in equilibrium at Y1 in panel (a) and the government decides to intervene, it would most likely

A) increase taxes.

B) decrease the money supply.

C) increase government spending.

D) decrease government spending.

7. In the long run, an increase in AD will result in:

A) no changes in the aggregate price level.

B) no changes in the aggregate output level.

C) increases in both the aggregate price level and the aggregate output level.

D) increases in the aggregate price level but no changes in the aggregate output level.

8. Starting from its potential output, an economy's government increases spending. In the long run, this economy:

A) will produce at an output level that is greater than its potential output.

B) will produce at its potential output.

C) will produce at an output level that is below its potential output.

D) will produce at its potential output level, but at a lower aggregate price level.

9. In the long run, the aggregate price level falls. This could result from:

A) a leftward shift in AD.

B) a rightward shift in AD.

C) a rightward shift in short run AS.

D) more spending by consumers.

10. A movement along the short-run AS curve occurs, holding everything else constant, when there is a:

A) change in commodity prices.

B) supply shock.

C) change in the aggregate price level.

D) productivity change.

11. If an economy is operating at a real GDP level that is below its potential real GDP, one will find:

A) relatively high unemployment levels.

B) nominal wages moving upwards as the economy moves from the short run to the long run.

C) the SRAS curve shifting left as the economy corrects itself from the short run to the long run.

D) no change in price levels.

12. When unemployment is high, then in the short run:

A) nominal wages will be flexible to downward trends.

B) nominal wages will be inflexible in a downward direction.

C) nominal wages will not be affected by the unemployment effects.

D) nominal wage contracts will be changed quickly.

13. If the tax rate is 0.1 and the MPC is 0.5:

A) the multiplier is equal to 2.

B) the multiplier is equal to 1.8.

C) the multiplier is equal to 2.1.

D) the multiplier is equal to 1.

14. A government encounters a recessionary gap and uses expansionary fiscal policy to correct the problem. It may:

A) find the policy ineffective, especially if a budget deficit is present, since crowding out may occur.

B) find the policy ineffective if it has to borrow in order to increase government spending.

C) cause its budget balance to move toward a surplus.

D) decrease the level of public debt in the short run.

15. When government spending results in persistent deficits that necessitate borrowing, thereby leading to a reduction in private investment, it is referred to as:

A) implicit liabilities.

B) transfer payments.

C) crowding out.

D) automatic stabilizers.

Scenario: Fiscal Policy

Consider the economy of Arcadia. The households of Arcadia spend 75% of their income. There are no taxes and no foreign trade. The currency of Arcadia is called the arc. The level of potential output in Arcadia is 600 billion arcs.

16. (Scenario: Fiscal Policy) Refer to the information provided in the scenario. The government spending multiplier in Arcadia is equal to:

A) 5.

B) three-fourths.

C) 4.

D) 3.

17. (Scenario: Fiscal Policy) Refer to the information provided in the scenario. If actual output is 500 billion arcs, what should the government do to restore the economy to potential output?

A) increase taxes by 25 billion arcs

B) decrease taxes by 25 billion arcs

C) increase government spending by 25 billion arcs

D) decrease government spending by 25 billion arcs

18. (Scenario: Fiscal Policy) Refer to the information provided in the scenario. Suppose that actual output is 700 billion arcs, and the government of Arcadia decides to tax its citizens. To bring the economy to potential output, the government should:

A) increase taxes by 33.33 billion arcs.

B) decrease taxes by 33.33 billion arcs.

C) keep taxes at zero.

D) decrease both taxes and government spending by 0.33 billion arcs.

19. When a bank borrows from the Federal Reserve, it pays the:

A) required reserve ratio.

B) discount rate.

C) federal funds rate.

D) prime rate.

20. The federal funds rate is the rate:

A) a private borrower would pay a bank for a loan.

B) one bank would pay another bank for a loan.

C) a bank would pay the Federal Reserve for a loan.

D) the Federal Reserve would pay to borrow money from government.

21. The functions of money are:

A) expander of economic activity, medium of exchange, and store of value.

B) medium of exchange, store of value, and factor of production.

C) store of value, medium of exchange, and determinant of investment.

D) store of value, unit of account, and medium of exchange.

22. If the Federal Reserve wants to discourage banks from borrowing directly from the Federal Reserve and thus

decrease the monetary base, it would likely:

A) increase the discount rate.

B) increase the federal funds rate.

C) increase the reserve requirement.

D) sell U.S. Treasury bills in an open market operation.

23. If the Federal Reserve wants to increase the monetary base, it might:

A) engage in an open market purchase of Treasury bills.

B) increase the discount rate.

C) increase the reserve ratio.

D) decrease personal income taxes.

24. Open-market operations occur when the Federal Reserve:

A) buys U.S. Treasury bills from the federal government.

B) buys or sells foreign currency.

C) buys or sells existing U.S. Treasury bills.

D) sells U.S. Treasury bills to the federal government.

25. If an economy is operating at an aggregate output level which is greater than its potential output level, the Federal Reserve may:

A) conduct an open market sale.

B) conduct an open market purchase.

C) lower the federal funds rate target.

D) decrease government spending.

26. If an economy is in long-run equilibrium at its potential output level, this also means:

A) the money market is in equilibrium.

B) money demand is greater than money supply.

C) money supply is greater than money demand.

D) there is excess money in the money market.

27. If the Federal Reserve conducts an open market purchase, holding everything else constant:

A) there will be an increase in the aggregate price level in the long run.

B) there will be an increase in the aggregate output level in the long run.

C) there will be a decrease in unemployment in the long run.

D) there will be no effects on output, unemployment, or the price level in the long run.

28. If the AD curve shifts to the right, in the short run there will be:

A) an increase in aggregate output and an increase in the price level.

B) an increase in aggregate output and a decrease in the price level.

C) a decrease in aggregate output and a decrease in the price level.

D) a decrease in aggregate output and an increase in the price level.

29. If an economy is operating at an output level below its potential output level, holding everything else constant, one would expect:

A) nominal wages to rise.

B) nominal wages to stay the same.

C) nominal wages to fall.

D) price levels to increase.

30. The aggregate demand curve is negatively sloped in part because of the impact of interest rates on:

A) potential output.

B) net exports.

C) consumption and investment.

D) government purchases.

1. Suppose that the money market in Madagascar is initially in equilibrium and the central bank decides to decrease the money supply.

a. Use a diagram to illustrate and explain what will happen to the interest rate in the short run.

b. What will happen to the interest rate in the long run?

2. An economy is in long-run macroeconomic equilibrium with an unemployment rate of 5% when the government passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram.

3. Does monetary neutrality occur in the short-run?

4. Suppose that real GDP is $1,500 and potential GDP is $1,200, while the marginal propensity to consume is 0.8. If the government is going to engage in government spending and imposes no taxes, what specific fiscal policy action should policy makers take?

5. Suppose the economy is in short-run equilibrium. Use the AD-AS model to predict short-run changes to real GDP and the aggregate price level if the stock of physical capital is relatively small and falling. Explain your reasoning.

Assume the MPC is .80 and policy makers have targeted real GDP to increase by $200 billion. By how much must taxes be reduced to achieve this goal?