Motives for takeover

There are many motives as to why an acquirer wants to take over the target firm. The reasons vary from undervaluation of the target firm to the synergy benefits. The motives for the takeover are discussed here on. The basic rationale for the takeover of any target firm is the undervaluation of the target firm. The firms who are acquiring the other firm undervalue the target firm. The target firms that are undervalued by the financial markets can be targeted for acquisition. This can be done by only those who can recognize the mispricing. The acquirer gains the difference between the value and the purchase price. This is the surplus for the acquiring firm. (Ashwath Damodaran)

This motive includes three basic things. Firstly, the acquirer should have the ability to find out the undervalued firm by the access to that information that is not available in the market or by any other analytical tools. Secondly, the acquirer should have the required funds that are necessary for the takeover of the target firm. The easier access to the capital will depend upon the access of the acquirer on the capital markets and the past history of the acquirer. Thirdly, there is a need of a proper skill set by the acquirer in order to execute the deal. (Specific motives for acquisition)

The other motive for the takeover is the reason of diversification. The acquirer wants to diversify from its present line of business. This may be due to fact that the acquirer wants to stabilize its earnings and reduce its risk in the times of uncertain economic conditions. Diversification helps in reducing the investor exposure to the risks that are basically firm-specific. By the process of buying the firms in the other businesses areas i.e. by diversifying, the acquiring firms can bring the stability in the earnings and also reduction in the risks a firm can face by not diversifying.

The most important motive for the takeover is the reason of synergic benefits. Synergy is the additional benefit or the additional value that can be generated when two firm operate together than as a standalone. There are two types of synergies that can be created: one is financial synergy and the other one is the operating synergy. Operating synergy is in the form of high growth or in the form of lower costs. However, the financial synergy comes in the form of either tax savings or increased capacity of debt or cash slack. The sources of operating synergies involve four major factors like: the economies of scale that may arise from the acquisition that makes the combined firm to be more cost efficient and more profitable, the increased pricing power which is resulted from reduction in the competitors and increase in the market share which in turn should result in greater margins and increase in operating income, the Combination of various functional area related strengths which would be in the form of strong marketing skills and great product line, and finally, the greater chance of growth in the existing markets. The sources of financial synergy are cash slack and increased debt capacity.

The other motives behind takeover include poor management of the target firm and the self interest of the managerial positions. There is one more motive that can exist behind a takeover and that is hubris. This motive includes the managerial inefficiency in evaluating the target firm even when there is no synergy that can occur from the deal. (Aswath Damodaran)

The main motive behind the Cadbury- Kraft deal was the benefit from the synergy. The firms expected that there will be a synergy that can be created from the deal. A positive synergy was the main motive behind the deal. Cadbury was at the first position in the U.S market for chocolates but was the world's second largest in the area of confectionary and Kraft was at the first position in the U.K market for foods but was the world's second largest only after Nestle.(Cadbury - Kraft Deal)

Valuation methods of an acquisition

There are a number of methods for valuing an acquisition deal. The most common and the most basic method is the discounted cash flow. This is the best to compare with a number of alternative methods. In short, this is the best method to evaluate any acquisition offer. Not only this, by using various methods, a company with no historical record can be valued as data that is required for DCF technique is not available in such companies.

The first method to discuss is the valuation based on market price of the share. In this case, the numbers of outstanding shares of the company are multiplied by the current market price and then a control premium is added to it and this price is offered to the target company. This is suitable for those target companies that are publicly traded in the market. However, for a privately held company, the acquirer can ask the target company to go for an initial public offering and thus the set price can be used as a source of valuation.

The second method that can be used is the valuation based on the revenue multiples for bringing the target firm at a comparable position with the other comparable firms. The most common multiple used in such cases is the EBITDA multiple. The buyer can use this multiple along with other comparable factors to derive an approximate price that is to be paid for a target company. As an example, if a target has sales of $120 million, and the market capitalization for several public companies in the same revenue range is 1.5 times the revenue, then the acquirer can value the target at $180 million. This method is most useful for a company that experiences fast growth or there are very few net margins. However, the revenue multiple method is only concerned with the income statement of the companies and it all together ignores the profitability factor. It is better to use both the revenue multiple and the EBITDA multiple in the valuation of the target company. If the revenue multiple gives a very high valuation and the EBITDA multiple gives valuation on the lower side, then it is possible that there are financially weak customers to whom the credit is being extended. The revenue multiples are the best valuation technique majorly for high-growth companies. These companies are usually diverting their resources into their growth.

However, it is possible that these multiples can mislead the valuations. When there are acquisitions within the same industry, the one with the best financial data and with the least underlying problems is the choice for the acquisition targets.

The other methods include valuations based on the enterprise value which is calculated as the sum of market value of equity as well as the market value of debt. A way is by valuing a company by way of using comparable transactions.

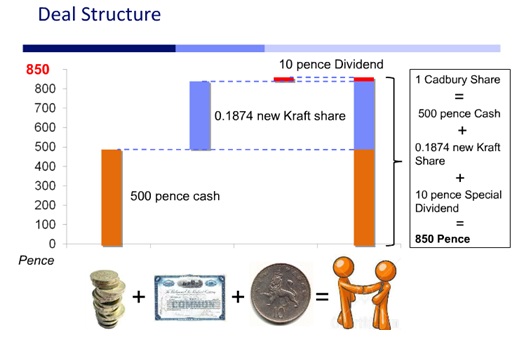

In the case of Cadbury - Kraft deal, the valuation was done on the basis of the comparable approach method. Both the companies belonged to the same industry. The Cadbury shareholders had received 500 pence in the form of cash and 0.1874 new Kraft share for each existing Cadbury share. For each Cadbury American Depository Share, shareholders had received 2,000 pence in the form of cash and 0.7496 new Kraft share for each existing Cadbury share. Thus, the total offer was 840 pence for a Cadbury share and 3,360 pence for a Cadbury ADS, based on the Kraft share price of $29.58 (January 15 closing price) and an exchange rate of 1.63 dollars to the pound. (Reuters)

Additionally, Cadbury shareholders had also received 10 pence for a share in the form of a special dividend. The total value of the Cadbury stood at approximately 11.9 billion pounds. In the case of the multiple approaches, the offer that was extended was at a multiple which was 13.0 times Cadbury's underlying 2009 EBITDA. The final offer did not require any approval from the Kraft shareholders. This deal was approved by the Cadbury finally. (Kraft Foods)

Valuation problems

Though, there are various methods of valuing a deal. But, there are various problems that are associated with the valuation. The acquisition valuations are very complex as it involves valuing a synergy and valuing control. Some of the issues that are associated with valuation techniques are as follows: when should the synergy be considered and when would the method of payment enter and at which stage. The most important issue is if there is a synergy in an acquisition process then how the synergy to be valued. How can the value of control be measured and how can its value be estimated.

The valuation of synergy can be done in the following way. The main motive behind an acquisition is the synergy benefits. The synergy in an acquisition is represented by the following formula:

V(AB) > V(A) + V(B)

where

V (AB) = Value of a firm created by combining A and B

V (A) = Value of firm A,operating independently

V (B) = Value of firm B,operating independently

The existence of synergy implies that the combined firm will be more profitable or grow at an increased rate after the merger than the firms that are operating individually. A stronger test that can be performed to check the synergy is by evaluating whether the merged firms have improved their profitability performance relative to the competitors in the same industry, after takeover has taken place. (Ashwath Damodaran)

In the Cadbury-Kraft deal, earlier the valuation price was set at 745 pence at which the Cadbury found itself undervalued. Later on, when the dear was finalized in 2010, the price was set at 850 pence almost an 11 percent increase in the price. So, the value is difficult to analyze. These are the problems that the deal faced when valuation was undertaken. (Reuters)

Kraft at first offered some 31 percent premium for the Cadbury. This Cadbury found it to be very much undervaluing. For over two months, the two companies have been publicly fighting over the bid that was offered. Cadbury wanted a great increase in the premium that was being offered by Kraft whereas Kraft was determined to keep the premium from increasing. Only some days before the deal was finalised, the management of Cadbury declared the deal as non-operational. By offering a higher premium of about 50 percent over the stock price that was initially offered and 60 percent consideration to be paid in cash, Kraft finally increased the value of the acquisition valuation for the Cadbury shareholders. This was consistent with the fact that managers who initially were offered a low premium are later on paid a higher premium. (Drexel)

Financing of an acquisition

There are various ways in which a firm can finance its acquisition deals. Some of the common methods are all cash deal, all stock deal or combination of both cash and stock. The firms that are undervalued will not prefer stock deal as their stocks are undervalued and they will incur a huge loss. Also, the firms that are over or appropriately valued will definitely go for a stock deal type of an acquisition as they will benefit massively from the deal. It is said that premium paid is higher in case of a stock deal than in the case of all cash deal. Cash deals can cause a tax liability whereas such liability is absent in case of a stock deal. (Ashawat Damodaran)

The Cadbury - kraft deal was a mixture of both cash and stock. It offered cash as well as stock offer to the Cadbury shareholders.

Brief about the Cadbury - Kraft deal

The following are the key events in the takeover of Kraft and Cadbury. On 28 August, 2009, the chairman of the Kraft met the Cadbury's chairman to have an overview about the stock-cash deal at a price of 755 pence. But, this price was rejected by the Cadbury's chairman. Then, on 7 September, 2009, the Kraft foods went for a public deal and offered a price of 745 pence but this too was rejected by the Cadbury. Nine days later, Warren Buffet warned Kraft foods not to increase the bid for Cadbury. On 23 September, 2009, the Cadbury chief executive named Todd Stitzer has reported at a Bank of America conference that he had seen few potential benefits from the Kraft deal and discussed various valuations with the investors of Cadbury. However, on 25 September, 2009, Cadbury's Stitzer said that he did not believe the offer of Kraft as it made no strategic as well financial meaning. On 30 September, 2009, the UK Takeover Panel warned Kraft that it has time till 5pm of Nov 9, 2009 to make an offer for Cadbury. Cadbury again rejects the bid notification. On 21 October, 2009, there was gloomy day for Kraft as Cadbury published its third-quarter report with the sales up by 7 percent. Thus, it raised the bid deal and the Kraft's share price did not react. On the contrary, on 3 November, 2009, Kraft's third-quarter had disappointed the investors with less than the expected revenue in the financial report and hence it cut the sales forecast for the year 2009. At this time, Kraft itself did not apply for the takeover deal. On 9 November, 2009, Kraft again had formalized its bid at the previous terms for Cadbury i.e. 717 pence. However, nine days, Cadbury did not receive an approval from anywhere. Gradually, on 23 November, 2009, Cadbury's share price peaked at 819.50 pence in view of the deal that was going on between Cadbury and Kraft. On 4 December, 2009, Kraft publishes its offer document to Cadbury shareholders. Through this, it started off a two-month fight for the British rules. Kraft further reduces the bid price to 713 pence. On 5 January, 2010, Kraft offers to the Cadbury with increased 60 pence cash but in return reduces the shares it was about to offer. On 12 January, 2010, Cadbury again rejects the bid on the valuation. Finally on 19 January, 2010, the deal was finalized and it was widely accepted by both the parties. (Cadbury - Kraft takeover timeline)

Conclusion

The deal was finally sealed in 2010 and the biggest hostile takeover took place in the era of recession. The deal was valued at $19 million approximately. Both, the parties gained for a stock-cash deal and hence were benefitted from the deal. This is the classic example of a hostile takeover of the biggest giants in the area of food and confectionary. The deal was financed both by stocks as well as cash.