THEORY OF REVEALED PREFERENCE:

If consumer's taste and preferences do not change, then observation of her market behaviour or, actual act of choice between the commodity sets reveals her preference. The above statement is the basis of the revealed preference theory.

We will show that although revealed preference theory have no concept of utility function like indifference curve approach, it still preserves all the main results of the consumer behaviour theory. Just like in the indifference curve approach, substitution effect is negative in this theory and also consumer is free from money illusion i.e., the demand will remain unchanged if prices of all goods and money income change proportionately. Under this theory, the slope of the ordinary demand curve can take any algebrical sign, which is also consistent with the indifference curve approach.

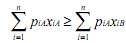

Given a price income substitution, if a consumer buys a collection of goods A, rather than an available collection B, and if B is not more expensive than A, then A has been revealed preferred to B. Let pA = (p1A, p2A,..., pnA) be the set of prices at which the individual buys collection A = (x1A, x2A,..., xnA) and spurns B = (x1B, x2B,..., xnB). Then A is revealed preferred to B, if it is at least as expensive as B at the prices pA at which A is purchased, i.e., if the following holds,

where right hand sum represents the cost of collection B at the prices pA at which in fact A was purchased.

where right hand sum represents the cost of collection B at the prices pA at which in fact A was purchased.

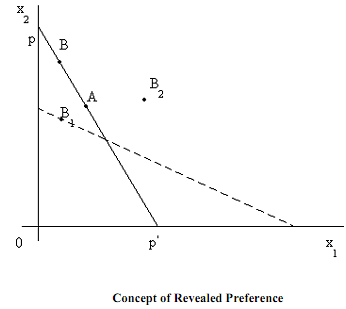

In a two-commodity framework, price and income are given by (p1, p2, M) and represented by price line pp'. Any other point on pp', such as B is just as expensive as A because they both are on the same budget line. Every point such as B1 below the price line represents smaller amounts of both commodities than do some points on pp'; such lower points are cheaper than A.

Therefore, because consumer bought A rather than any of these collections that were no more expensive, it follows that every point on or, below pp' is revealed inferior to A. Any point above pp' is more expensive than A. None of such points like B2, can be revealed inferior to A by consumer's purchase of A.