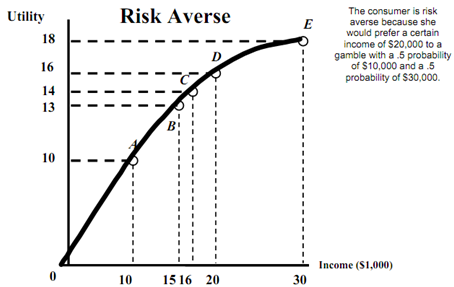

Risk Averse:

- A person who prefers certain given income to risky income with same expected value.

- A person is careful risk averse if they have a diminishing marginal utility of income

- The use of insurance demonstrates the risk aversive behavior.

* Risk Averse: A Scenario

- A person have a $20,000 job with 100% probability and receive utility level of 16.

- The person could have a job with the .5 possibility of earning $30,000 and a .5 possibility of earning $10,000.

* Expected Income =

(0.5)($30,000) + (0.5) ($10,000) = $20,000

* Expected income from both the jobs is same -- risk averse may choose present job

* The expected utility from new job is found:

- E(u) = (1/2)u ($10,000) + (1/2)u($30,000)

- E(u) = (0.5)(10) + (0.5)(18) = 14

- E(u) of Job 1 is 16 which is greater than the E(u) of Job 2 which is 14.

* This individual would keep their current job as it provides them with more utility than the risky job.

* They are called as risk averse persons.